Mansi

@drmansipd

Trader in the US equity market. Here to learn. Beware imposter accounts. I NEVER send DMs. #PositiveVibesOnly 😇

ID: 2922549134

https://www.youtube.com/@drmansipd 08-12-2014 09:35:19

9,9K Tweet

15,15K Takipçi

73 Takip Edilen

"Don't just say you have read books. Show that through them you have learned to think better, to be a more discriminating and reflective person." - Epictetus Daily Stoic

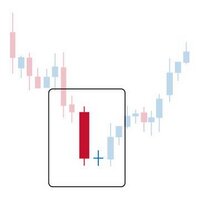

Also, short float 45.63% Thanks Drew McConnell for putting this on my radar!