Danielle DiMartino Booth

@dimartinobooth

CEO & Chief Strategist, QI Research LLC, Fmr Federal Reserve insider, Economist #FedUp amzn.to/2ifi2fF, dimartinobooth.substack.com

ID: 3280573716

http://www.qiresearch.com 15-07-2015 12:56:04

149,149K Tweet

315,315K Takipçi

499 Takip Edilen

Danielle DiMartino Booth Bloomberg Apollo Global Management, Inc. for anyone wondering how Apollo shorted the debt, there are some good comments here: x.com/LeylaKuni/stat…

In my latest interview I said Fed WOULD cut. In ONE Schwab interview I misspoke & was corrected. See Julia La Roche full interview to explain why Fed will HAVE to cut even if data released w/a lag showing weakening. Alternative data are UNEQUIVOCALLY weak. Have a great weekend!

Danielle DiMartino Booth Bloomberg Apollo Global Management, Inc. Hold on. The auditors creditor was the party shorting the loans?!?

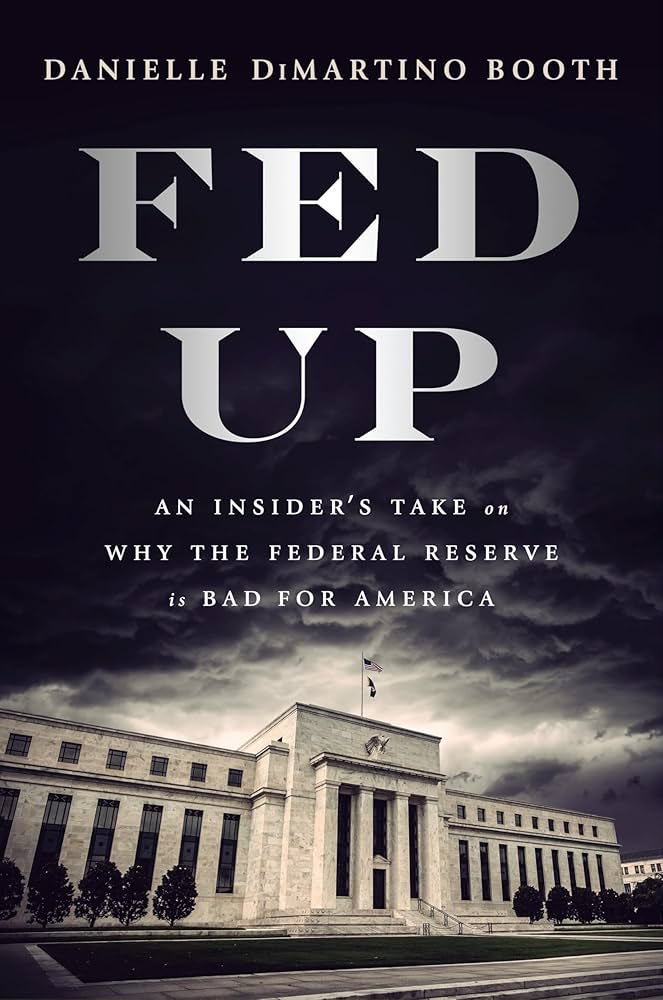

Almost done with Danielle DiMartino Booth’s book Fed Up. Highly recommend! Get a picture of how the issues from the ‘08 crisis were never really solved and the runway for why what we are facing today is much bigger and worse after learning the market’s plumbing and pulling today’s #’s

I loved this conversation with Danielle DiMartino Booth for today’s Brew Markets …. Will the govt shutdown & with it limited govt data force the Fed to (at last?) look at new sources of info? Irrational exuberance vs fairly highly valued equities. And is First Brands an Enron 2.0? Listen

Thank you David R Kotok for Camp Kotok & the chance to meet Danielle DiMartino Booth … fast forward to today and our conversation on Is This The Fed’s Watershed Moment? youtu.be/JIT113z8NKM?si…

We sat down with Danielle DiMartino Booth to discuss the Fed, the labor market, and whether we're in a stock market bubble. Watch: youtube.com/watch?v=JIT113…

Brew Markets Danielle DiMartino Booth Check out our conversation wherever you get pods! Love all feedback! Spotify: open.spotify.com/episode/4PRdfn… Apple: podcasts.apple.com/us/podcast/bre…

I’d be right after you Michael Taylor

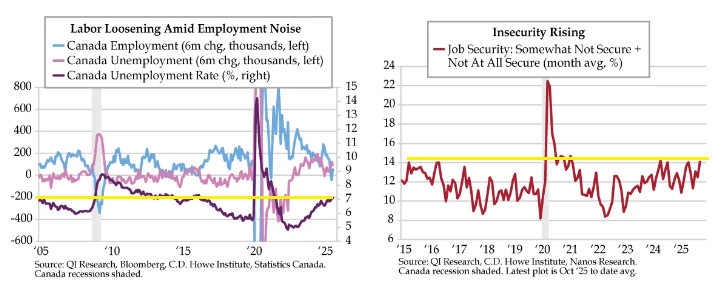

There are so many charts from Danielle DiMartino Booth pointing to rupture points, while at the same time there not being one single aspect in the economy that could be a trigger, that the only plausible explanation is that of a black swan event. Something unexpected is going to happen.

It's black & white as Jack Farley shows. I wonder what BankRegData will show when the dust settles on call sheets given cycle's raft of consumer loan modifications & J.P. Morgan upping its loan loss provisions by $810M mostly tied to card services amidst "softening job growth."

Good point BeerTheAnchor To distinguish btw loan loss provisions raised by $810M for cc losses, J.P. Morgan took $567M in net charge-offs due to "what appears to be borrower-related collateral irregularities in secured lending facilities," $170M of which was specific to Tricolor.