Diego Bohórquez

@diegoebm

Research Fellow @bancaditalia | PhD from @UPFBarcelona | International macro-finance and banking

ID: 1895599908

https://diegoboh.github.io 23-09-2013 00:46:38

131 Tweet

367 Takipçi

481 Takip Edilen

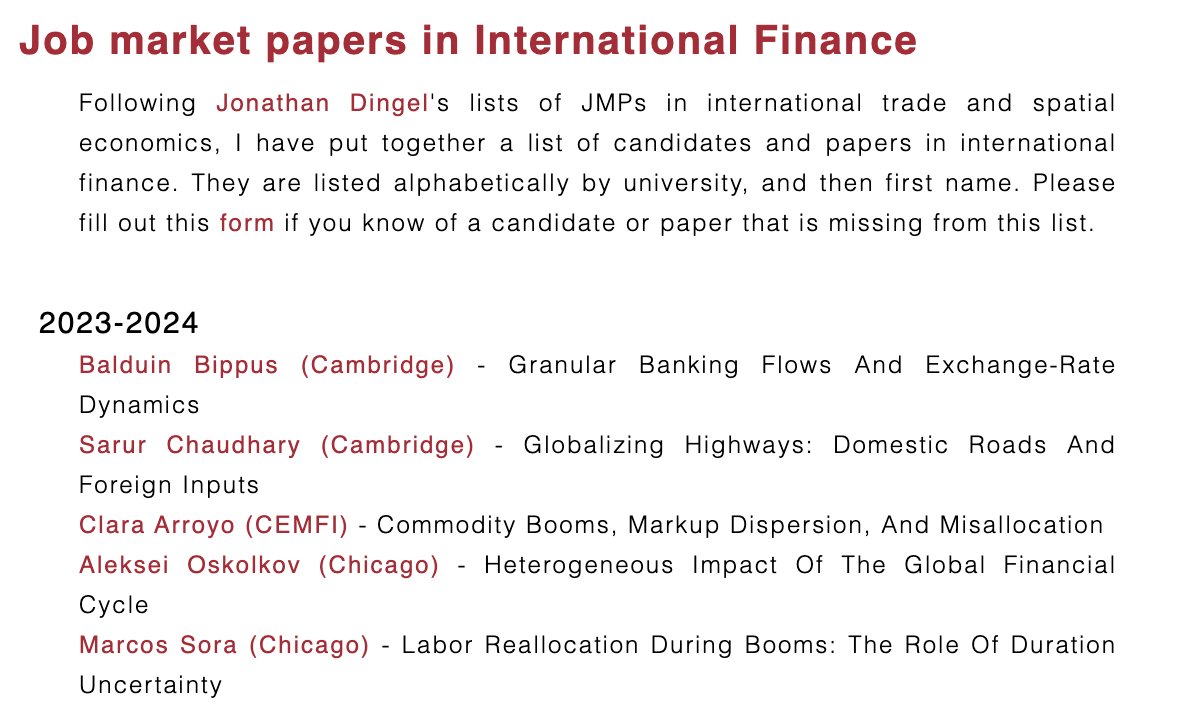

📢📢As in previous years, I have put together the list of JMCs in International Finance (inspired by Trade Diversion (Jonathan Dingel)'s list in International Trade). Check out the candidates on my website! chenzi-xu.com/misc.php 📢📢 #EconTwitter #JMCs

New: "Capital Controls and Firm Performance" by Eugenia Andreasen (Departamento de Economía | FEN U. de Chile), Sofía Bauducco (Central Bank of Chile Research) and Evangelina Dardati (FAE UDP). doi.org/10.1016/j.jint… 1/2

🚨Fully in person seminar🚨 Tomorrow Wednesday 6th at 11:30 am (GMT-3:00) we will have Humberto Martínez (Departamento de Economía | FEN U. de Chile) at the Banco Central de Chile presenting his work titled “Capital Controls on Outflows: New Evidence and a Theoretical Framework”.

New CEPR Discussion Paper - DP18943 #Capital Flows and #ExchangeRates: A Quantitative Assessment of the Dilemma Hypothesis Ambrogio Cesa-Bianchi Bank of England, Andrea P Ferrero 🇮🇹🇪🇺🇺🇦 University of Oxford, Shangshang Li University of Liverpool ow.ly/o4bt50R15FM #CEPR_IMF #economics

🚨 Call for Papers 🚨 We are also organizing in December at FEN U. de Chile the Dev Macroeconomics/ Int Trade workshop. Send us your paper and join us in Santiago!

Only a few days left to submit to this amazing workshop! This year's focus: secular trends and structural factors in international macro and finance 🔥 Keynote: Andrei Levchenko 🤩 Submit here 👉 bankofengland.co.uk/events/2024/ju… Aydan Dogan @lulucarpi Julia Schmidt Daniel Ostry

🚨New working paper🚨 "𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐅𝐢𝐫𝐦 𝐃𝐲𝐧𝐚𝐦𝐢𝐜𝐬 𝐰𝐢𝐭𝐡 𝐃𝐚𝐢𝐥𝐲 𝐃𝐚𝐭𝐚" with Davud Rostam-Afschar We study how firms respond to macro shocks during post-pandemic inflation. Paper: shorturl.at/fzzXr Talks: Università di Pavia Macro Forum & Verein für Socialpolitik

Hi #EconTwitter! Believe it or not, I’m on the Econ/Finance job market this year at Imperial Business School. My JMP studies the role of information in safe asset liquidity crises and is joint work with Robert Czech from the BoE. 🚨A quick summary thread🚨#EconJMP tinyurl.com/2uvhz8xp

TODAY CREI@30. We’re celebrating 30 years! CREi@30 conference with current and past researchers, students, visitors, staff, and friends! Centres CERCA

Deeply honored to receive a European Research Council (ERC) Consolidator grant! The MACROGROWTH project will shed light on how monetary and fiscal policies should be designed to ensure that new, and potentially disruptive, technologies deliver higher productivity and widespread welfare gains.