DeFi Mago

@defi_mago

DeFi Research | @Dune Data Wizard 🧙♂️. Turning On-Chain Chaos into Visual Alpha | Vibing with LST/LRT

ID: 1641371795889725442

https://dune.com/defimago 30-03-2023 09:28:49

1,1K Tweet

36,36K Followers

692 Following

Move fast, there’s a stablecoin farm pushing up to 245% APR right now. It's a straightforward loop strategy using sUSP (USDC pegged by Pareto (prev Idle)) on Euler Labs with their Multiply feature to boost up to 230.62% with the sUSP/USDC pair. 👉 Basically: stable pair, low

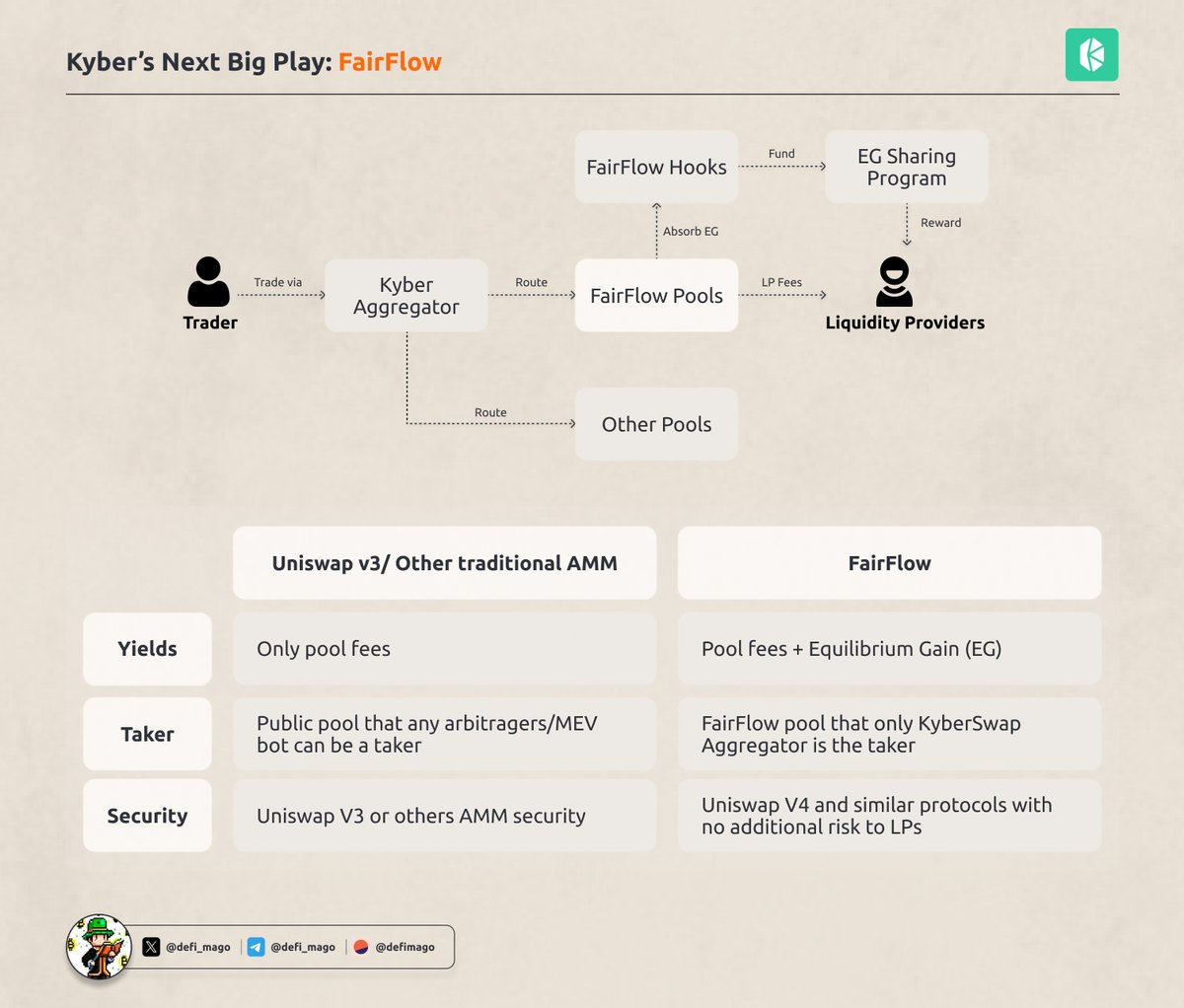

FairFlow by Kyber Network is redefining the game for LPs FairFlow (FF) is a swap hook that enhances liquidity pools, built on Uniswap V4 and similar protocols, it lets LPs earn that juicy arbitrage value that usually goes straight into arbitragers’s pocket. Instead of just

LPs just got a big APR boost! With FairFlow by Kyber Network , LPs not only earn fees, they also reclaim arbitrage profits through Equilibrium Gain (EG). Plus: Liquidity Mining rewards are live Aug 6 – Aug 12 for extra incentives on top. Can you really miss this? 👉 Fees + EG