Tej Shah

@tejshah_94

Fund Manager, Marcellus Investment Managers; Kings of Capital Portfolio

ID: 1338503598

https://marcellus.in/team/tej-shah/ 09-04-2013 07:06:13

187 Tweet

1,1K Followers

113 Following

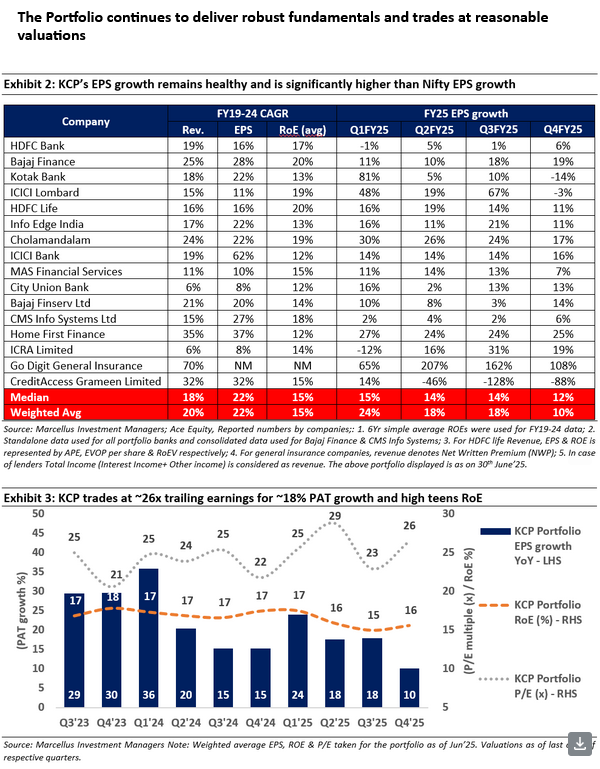

Watch the latest Marcellus Investment Managers Kings of Capital webinar on learning from history and update on portfolio fundamentals. bit.ly/3RmSbG4

The Prudent Path - The journey to 1 lac crore AUM! Prudent Corporate Advisory Services Ltd. is India's third-largest mutual fund distributor and has grown revenues and EPS by 29% and 46% respectively over FY19-24. During this period, Prudent has significantly outpaced mutual fund industry growth and has

As investors have started to realise that capital protection is the key to investing, the Kings of Capital portfolio has started to see meaningful outperformance! Join us for Marcellus Investment Managers KCP webinar on 11th March at 5PM: lnkd.in/dVMyx9PK

Clarification from Marcellus Investment Managers, client monies have had zero impact and business continues as usual!