Sanjay R Singh

@sanjayrajsingh

Macroeconomist @sffed and @UCDavisEcon. RT's ≠ endorsements

ID: 55208509

http://ssingh.ucdavis.edu 09-07-2009 11:25:13

3,3K Tweet

1,1K Followers

884 Following

Two major macro trends since 1980: - Rising markups - Declining business dynamism By now, it’s accepted that market power killed dynamism. Ryan Decker and I find that the industry data tells a completely different story. Conventional wisdom => 🗑️? 🧵 on our updated paper

𝙈𝙖𝙧𝙠𝙚𝙩 𝙈𝙖𝙘𝙧𝙤𝙨𝙩𝙧𝙪𝙘𝙩𝙪𝙧𝙚… in this essay with Valentin Valentin Haddad we highlight common threads in exciting work that takes a down-to-earth view of financial markets: let’s focus on figuring out 𝘸𝘩𝘰 is doing 𝘸𝘩𝘢𝘵 and 𝘸𝘩𝘺. Curious to hear comments.

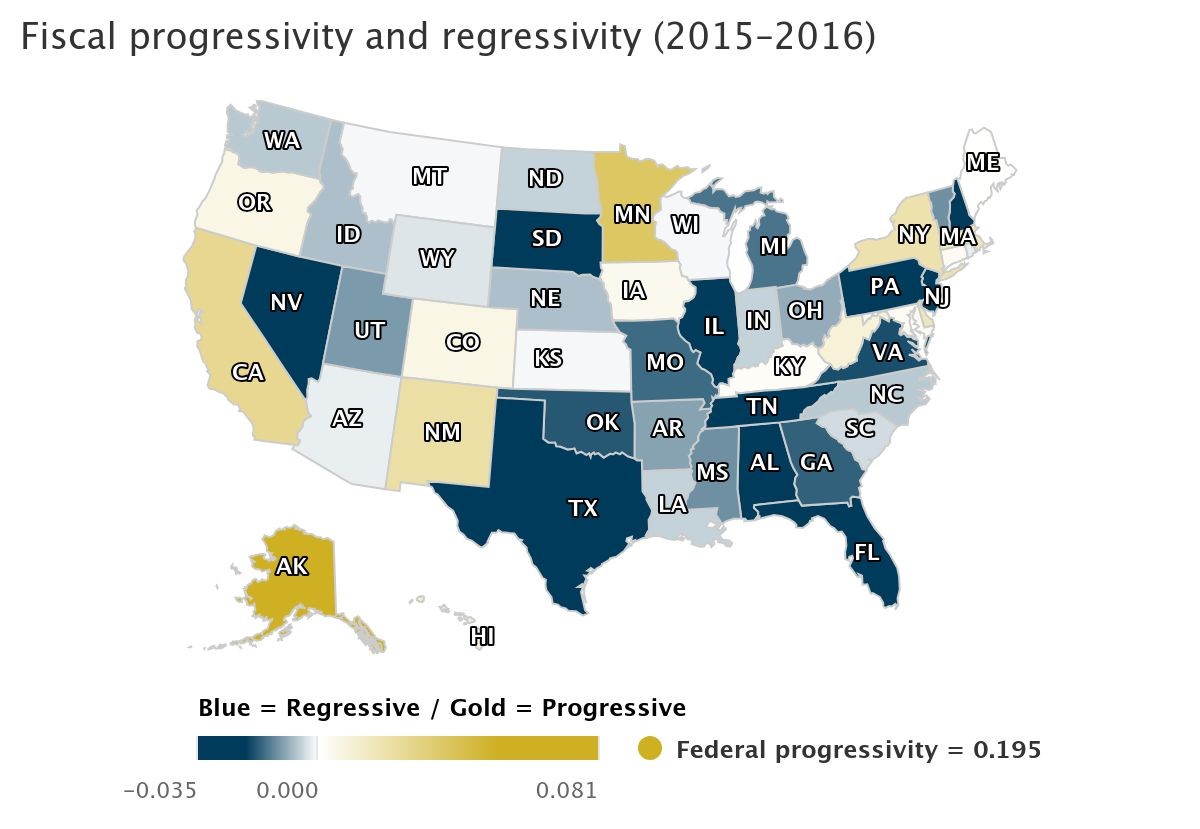

States that depend on property & sales taxes typically tax poorer households at higher rates, even after transfers. Opposite goes for states that rely on income taxes. Explore the map & many insights from our recent staff report by Jonathan Heathcote and co-authors:

New paper with Paul Beaudry (UBC Economics) and Paolo Cavallino (Bank for International Settlements). In it, we argue that monetary policy may be driving secular trends in real interest rates because very persistent rate changes have only weak effects on activity [1/7]

![Tim Willems (@timwillems85) on Twitter photo New paper with Paul Beaudry (<a href="/ubcVSE/">UBC Economics</a>) and Paolo Cavallino (<a href="/BIS_org/">Bank for International Settlements</a>). In it, we argue that monetary policy may be driving secular trends in real interest rates because very persistent rate changes have only weak effects on activity [1/7] New paper with Paul Beaudry (<a href="/ubcVSE/">UBC Economics</a>) and Paolo Cavallino (<a href="/BIS_org/">Bank for International Settlements</a>). In it, we argue that monetary policy may be driving secular trends in real interest rates because very persistent rate changes have only weak effects on activity [1/7]](https://pbs.twimg.com/media/GkUSBIgXQAAzCCp.png)

Our new Economic Letter provides new evidence of monetary policy perceptions by the public, using both surveys and financial market data. Huge thanks to my coauthors Carolin Pflueger and Adi Sunderam.

Good snow and even better papers @ Second Annual Jackson Hole IFM Workshop with Oleg Itskhoki Sebnem Kalemli-Ozcan Hanno Lustig fabrizio perri Sanjay R Singh Ariel Burstein George Alessandria

This quote from David Beckworth is perfect to motivate a new wave of research on the macroeconomics of the medium run.

📢 Workshop on 𝗘𝘅𝗽𝗲𝗰𝘁𝗮𝘁𝗶𝗼𝗻𝘀 𝗮𝗻𝗱 𝗕𝗲𝗵𝗮𝘃𝗶𝗼𝗿𝗮𝗹 𝗠𝗮𝗰𝗿𝗼 at the Federal Reserve Bank of San Francisco 🌁 San Francisco, October 27, 2025 🚨 Keynote speaker: Yuriy Gorodnichenko 📆 Submission deadline: July 31, 2025 ➡️ Full CfP: treinelt.github.io/files/CfP_Expe… Yeji Sung Sanjay R Singh