Practical Venture Capital

@practicalvc

Q: How do you make $1B in VC?🤔 A: Start with $2B.🤣

PracticalVC.com is a Silicon Valley VC secondary fund.

partners: @DaveMcClure @AmanVerjee @StephVentured

ID: 945815902112555008

http://PracticalVC.com 27-12-2017 00:37:38

244 Tweet

2,2K Followers

877 Following

data-driven comparison of "experienced" vs. "emerging" VC/PE fund managers by Jaap Vriesendorp Marktlink.com cc Practical Venture Capital #venturecapital #openLP #VC #FoF #investing medium.com/@jjjvriesendor…

"3 types of emerging managers to look for w/ higher probability of outsized returns": 1) The Super Connector (deal flow) 2) The Hyper Specialist (domain expert) 3) The VC Disruptor (new strategy) medium.com/@jjjvriesendor… by Jaap Vriesendorp Marktlink.com

PitchBook: VC investment in the US fell 30% YoY to $170.6B in 2023, lowest since 2019, and declined 35% YoY to $345.7B globally, lowest since 2017 (Sarah G McBride / Bloomberg) bloomberg.com/news/articles/… 📫 Subscribe: techmeme.com/newsletter?fro… techmeme.com/240104/p3#a240…

💡 Did you know that Dave McClure, has one of the best track records in venture, delivering BOTH a 60X and 40X fund? On today’s episode 10X Capital Podcast, Dave discusses that, how he founded 500 Startups and his new venture Practical Venture Capital, in addition to: 1️⃣ The Economics

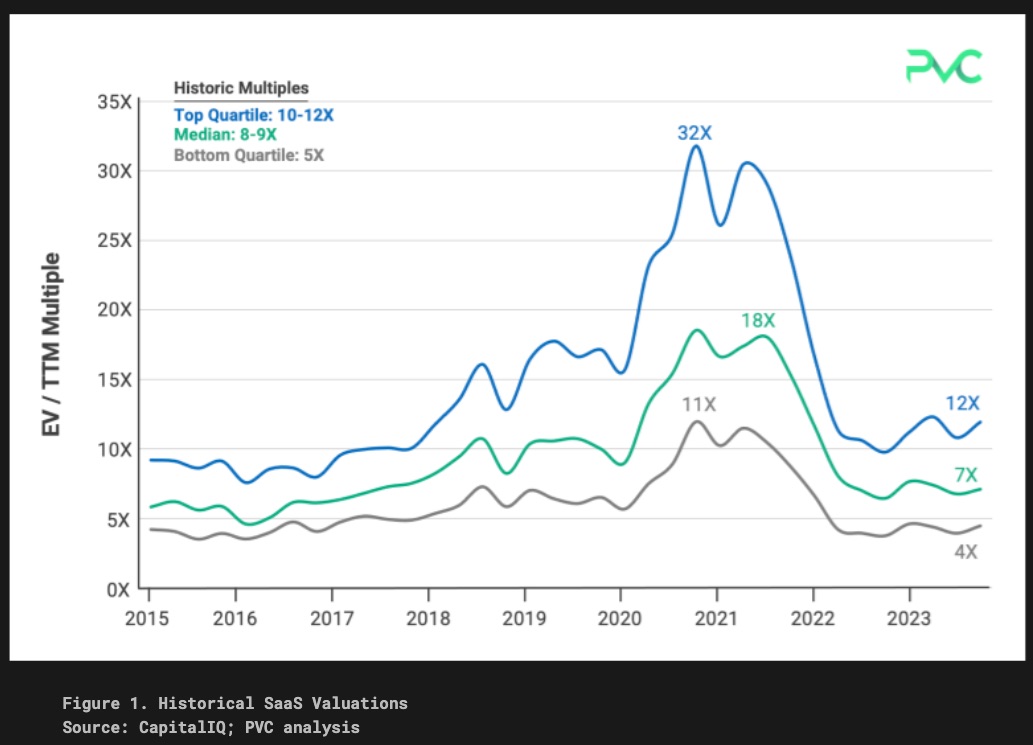

the Practical Venture Capital #Saas Index for Q1/24 is out: practicalvc.com/pvc-saas-index… highlights: * median SaaS rev multiples were 7.1x in Q1/24 * these numbers are similar/typical to 2017-18 * still historically cheap (below 5- and 10-yr avg) * rev multiple "bottom" was 6.3X in Q4/22 * Saas

. @jason and @practicalvc's Dave McClure discusses the dynamics, strategies, and outcomes of vc investments: -- the 'Spray and Pray' approach -- mastering portfolio management -- the evolution of the accelerator landscape, including @YCombinator's pivotal role

great convo Scott Kupor Dan Primack re: VC LP liquidity dynamics (aka TVPI vs. DPI) -- hwvr you guys might be overlooking how critical this is for smaller, non-institutional LPs (HNWI + FOs). (this isn't really @A16Z LPs, but it's def the LP base for a majority of microVCs) /1

The Q2/24 Practical Venture Capital #Saas Index report (by Aman Verjee): - median 6.3X EV/LTM rev multiple - top/bottom quartile 10.5X/4.1X - median historical avg ~10X - Q1 earnings super weak - median Q1 rev growth 18% YoY (prev >30% YoY, 2020-22) - >50% Q2 rev guidance below consensus

thx David ☕ Superclusters for interview on our microVC fund secondary strategy Practical Venture Capital youtu.be/Lr4iBAumuxk topics: - VC secondary fundamentals: liquidity and DPI for VC funds - company vs. fund secondary - LP secondary vs. GP secondary - VC power-law distribution +

The Practical Venture Capital Q4/24 #Saas Index rpt: practicalvc.com/pvc-saas-index… by Aman Verjee - #PVCSaasIndex now @ 7.7X rev, up from 6.1X in Q2 - still below but close to 5-10 yr avg of ~8X - lower #s reflect slower Saas growth rates - lower interest rates + election = bull market since Sept

.Practical Venture Capital is now raising PVC-3 #TheHalftimeFund, our third #VC #secondary fund. PVC-3 is a #506c general solicitation fund open to #QualifiedPurchasers and Level 10 #SuperVillains. Info on our new fund + #SkipTheJCurve strategy: linkedin.com/posts/davemccl…

the Practical Venture Capital Q1/25 #SaaS Index is out, and it ain’t pretty: practicalvc.com/pvc-saas-index… - median 5.7X Saas rev multiple is historical low for past decade - “Liberation Day” #tariffs crushed the market and still weigh heavily - Saas Index value down >30% since Feb; no gains in

VCs and LPs looking at #secondary market for #liquidity as #IPO exit options appears limited in 2025 newcomer.co/i/163178657/vc… by Eric Newcomer cc Industry Ventures Hans Swildens Practical Venture Capital

"It was the best of times, it was the worst of times..." Down Round #IPO is the New Black linkedin.com/posts/aman-ver… by Aman Verjee Practical Venture Capital #BadNews: every VC-backed IPO in past yr has been a "down round". 📉 #GoodNews: last 11 VC-backed IPOs up 83% on avg since listing. 📈