Pavan

@pavankat

Bottom-up thoughts and observations on AI x Crypto. Co-founder @yomigamesgg. Try @manamidotai. BTC '2013, ETH '2016, DEFI '2019. Prev @ConsenSys

ID: 16842296

https://pavan.vc 18-10-2008 19:22:30

1,1K Tweet

1,1K Followers

592 Following

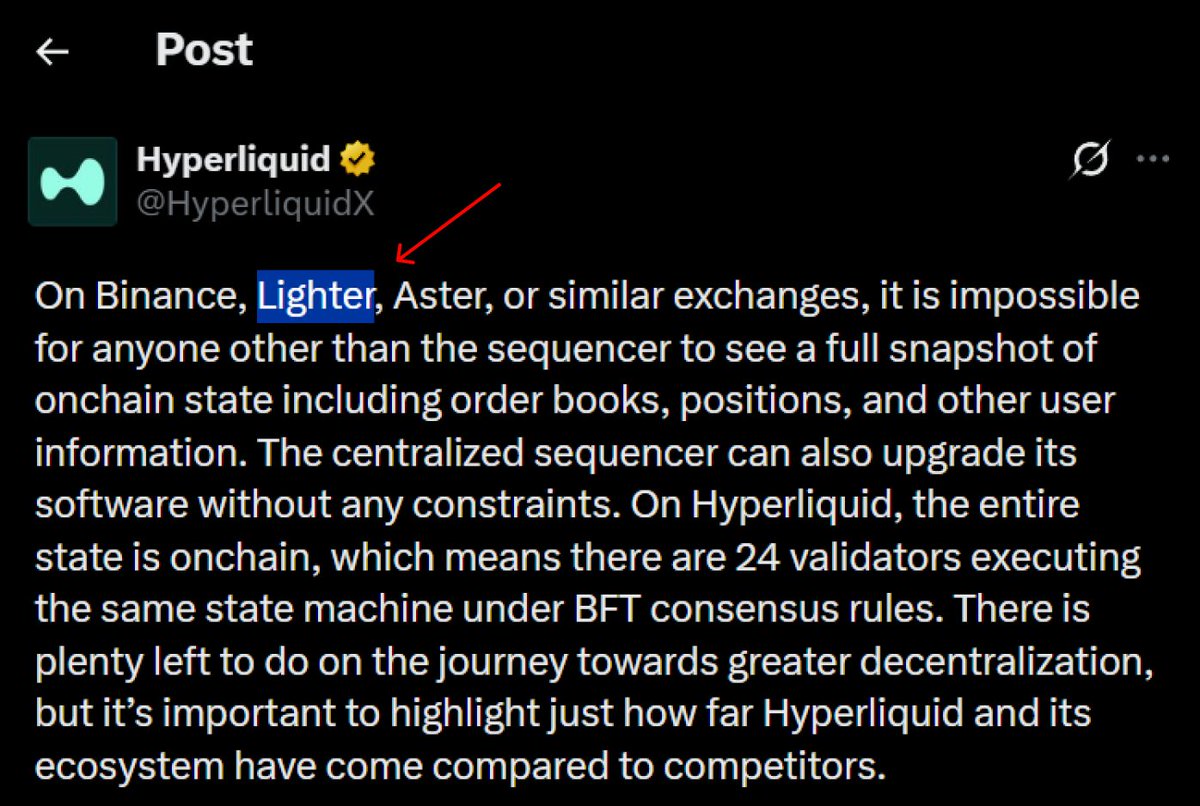

Vladimir Novakovski They're infinitely smarter than you considering all Lighter does is implement what Hyperliquid already had 6 months later They're also not wrong, unless you can specifically say what is wrong other than labeling everything as FUD Sorry this isn't Quora

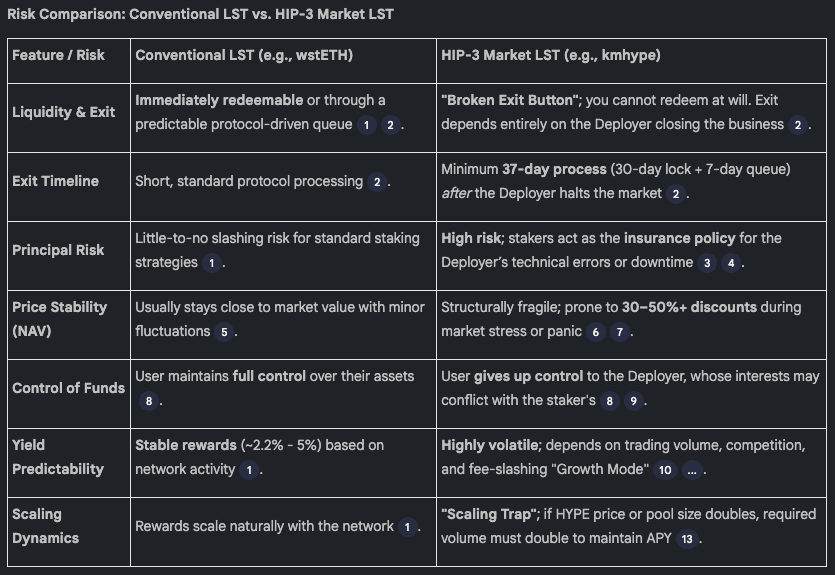

Why a 15% APR on HIP-3 staking is simply not enough. I’ve seen the comments: "How can these yields be so high? Not even $LUNA had those ones." People are missing the fundamental link between risk and reward. If you are holding a Hyperliquid Exchange LST, you aren't just