Tasie

@papi_snr

Crypto enthusiast | Bitcoin + @stacks. 🟧

ID: 924783185061466112

29-10-2017 23:41:07

10,10K Tweet

3,3K Followers

3,3K Following

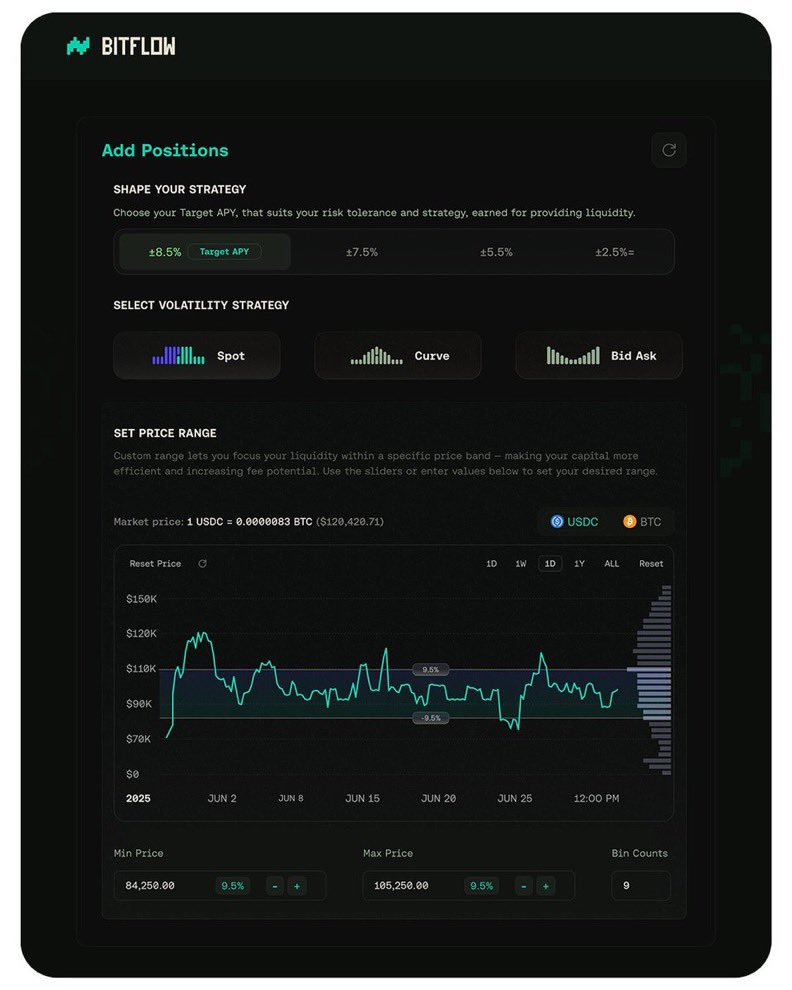

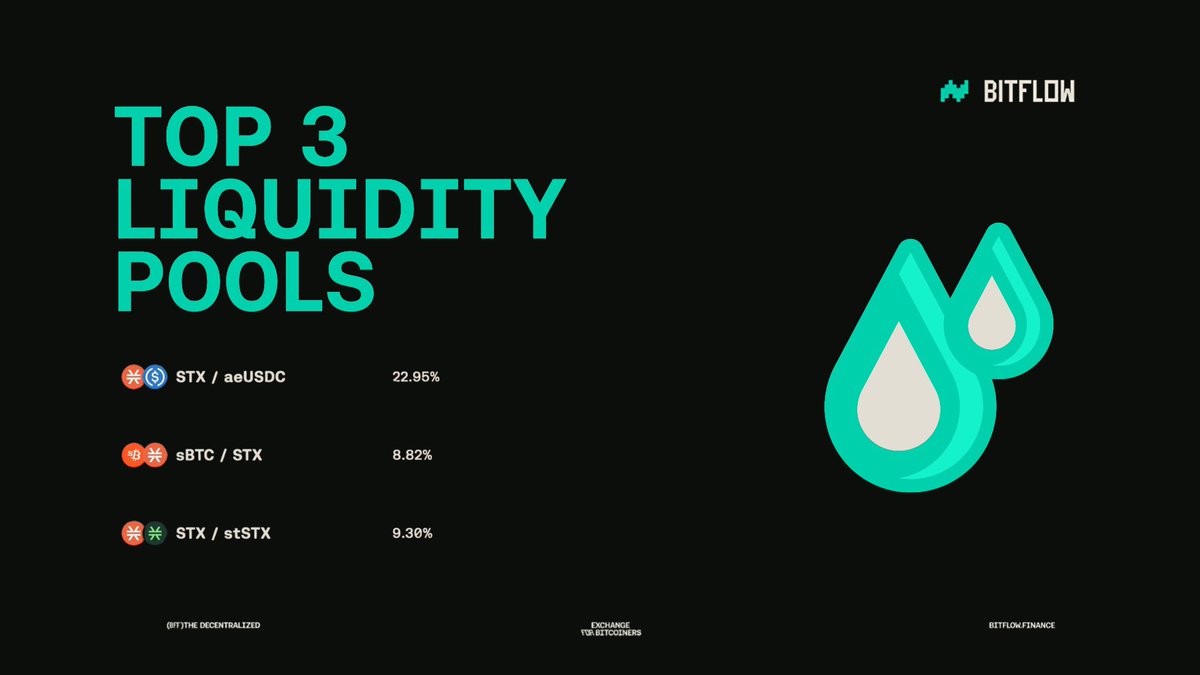

I’ve shared so much about Bitcoin DeFi strategies lately. STX market behaviour for a few weeks now has been swinging in tight ranges, leaving some holders waiting for consistent bullish candles. However, others are already making good percentages within the stacks.btc ecosystem.

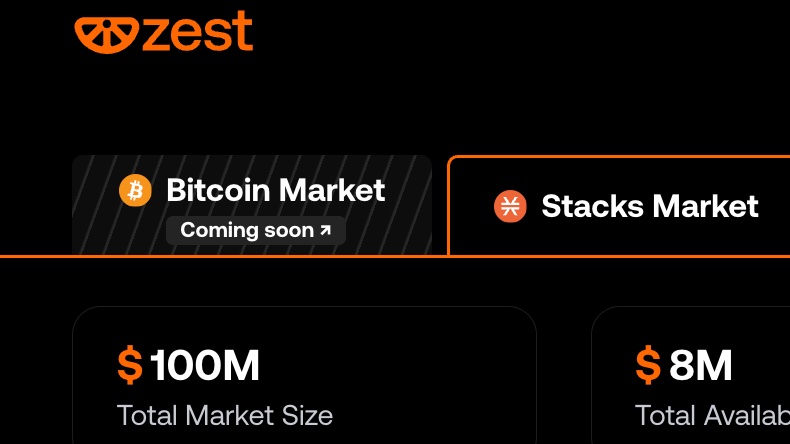

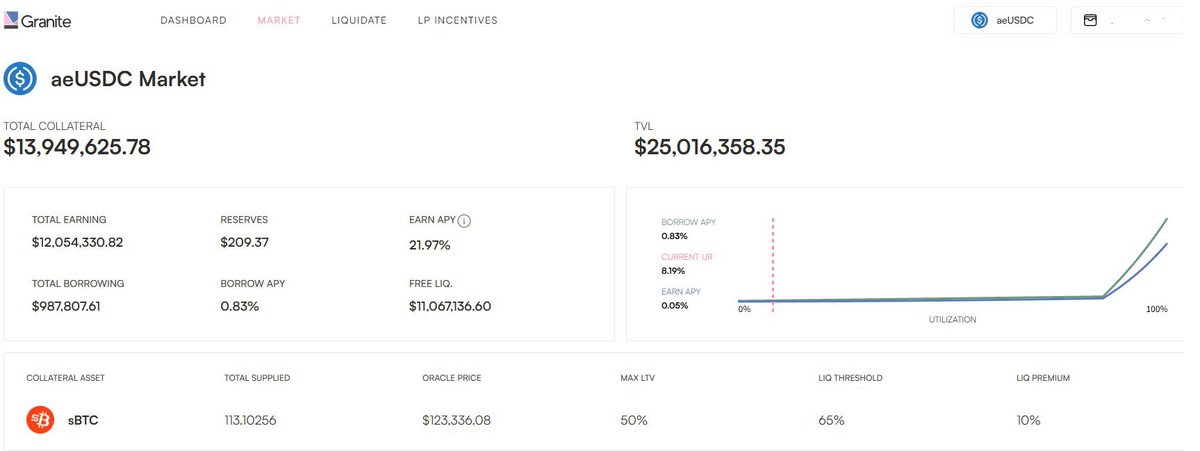

I’ve been keeping an eye on the trends and stats on @stacks. A few days ago, Granite - Never sell your bitcoin’s aeUSDC market reached a TVL of $25M. Granite also had over 113 sBTC supplied as collateral. It’s really impressive to see more people locking up their BTC for stablecoins they can use

Stacks content creators are the cornerstone of our community 🧡 Huge shoutout to Stacks OG Algorithm.btc for consistently delivering quality posts on the ecosystem. From project updates to feature deep-dives, Algo always has you covered. (1/5).

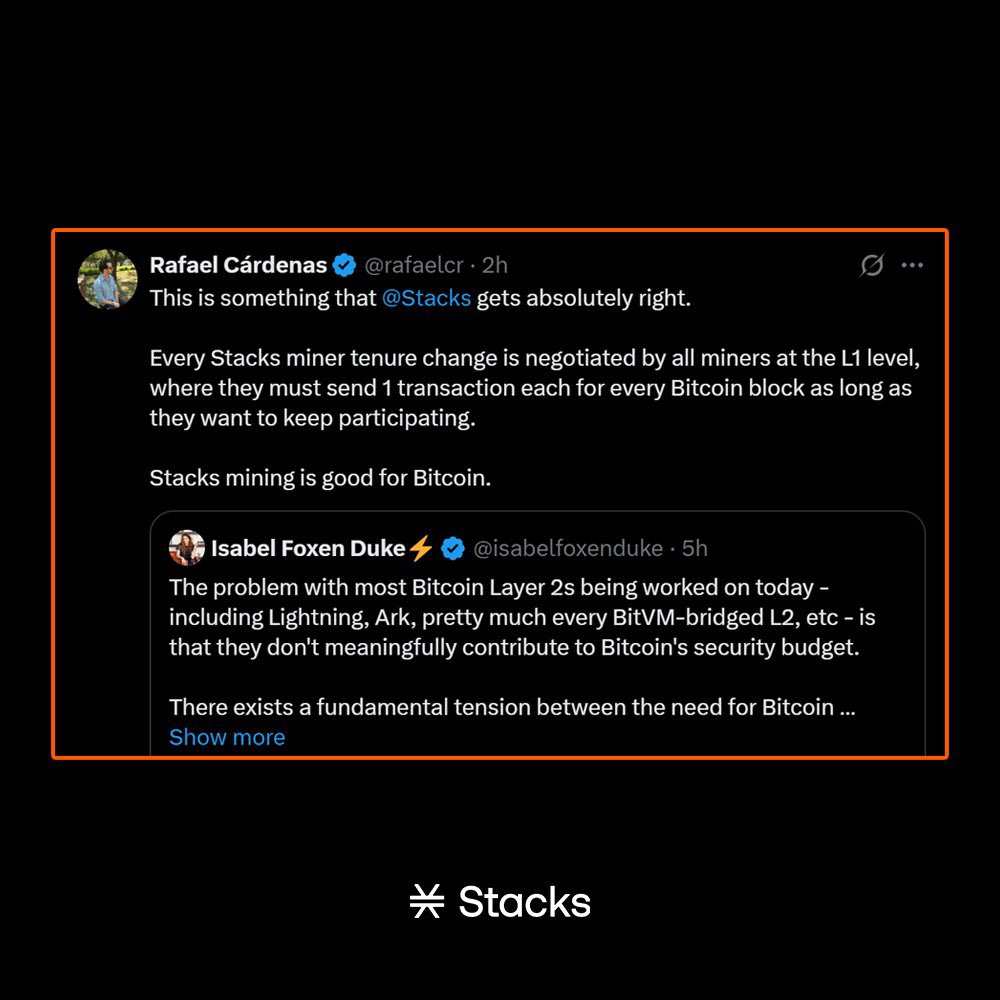

What's happening on stacks.btc? Here is everything you need to know from the last few weeks. 🧵 ⬇️

One thing I think makes Stacking DAO very unique is its UX. I have interacted with so many powerful apps across chains, but most of them are either too complex or plain boring. That’s a major turnoff. StackingDao makes interactions like native stacking and liquid stacking feel