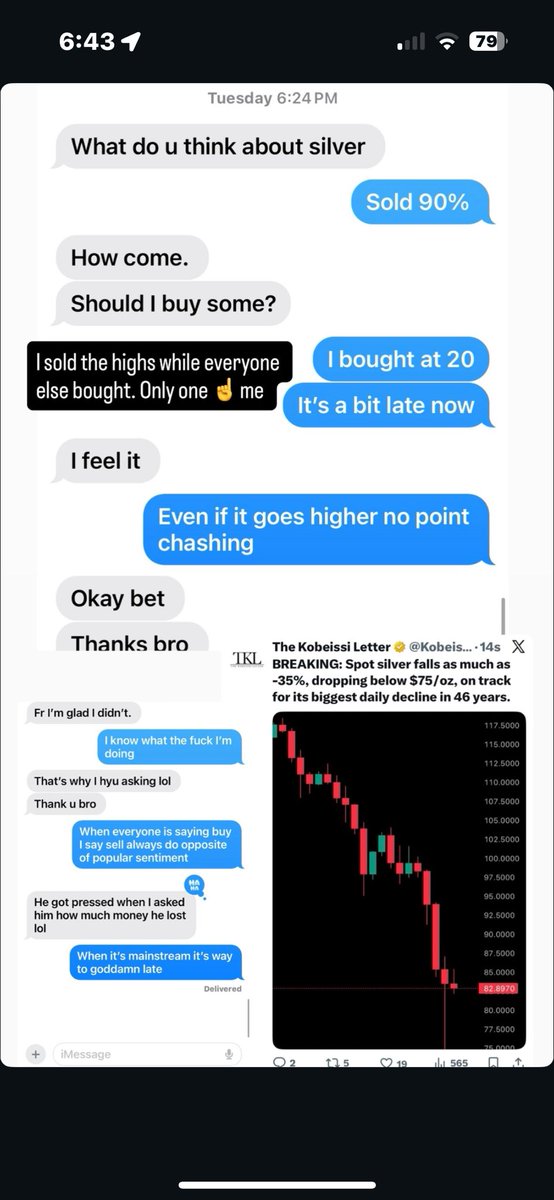

Michael Henri St.Clair

@mikaelstclair

Elevate your trading @ St. Claire's Investment Club!🌟 Get exclusive insights & connect with a dynamic community. 🎯 Sign up for a FREE month with code INVEST!

ID: 1157008359985307648

https://whop.com/stclairsinvestmentclub 01-08-2019 19:21:03

1,1K Tweet

1,1K Followers

1,1K Following