Marc Chaikin

@marcchaikin

Stock market expert, Founder & CEO, Chaikin Analytics @chaikinanalytic - an award winning stock idea platform powered by the Chaikin Power Gauge Rating

ID: 142351603

http://www.chaikinanalytics.com 10-05-2010 17:12:22

3,3K Tweet

15,15K Followers

34 Following

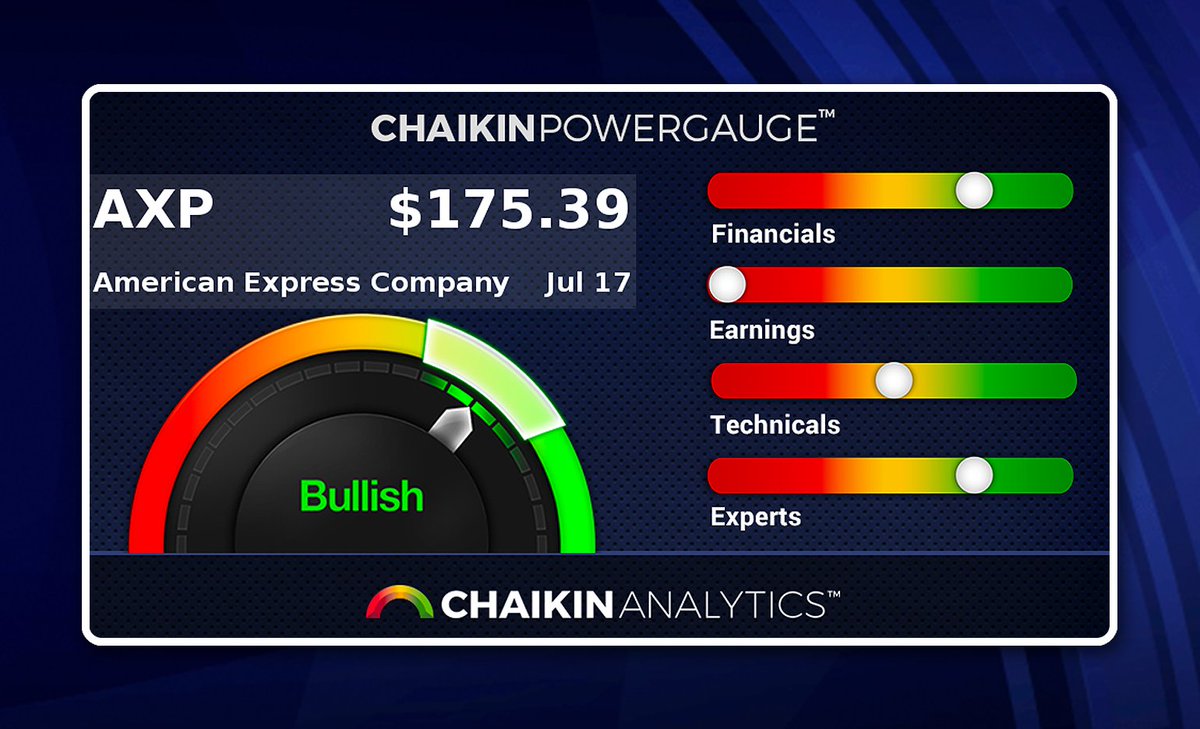

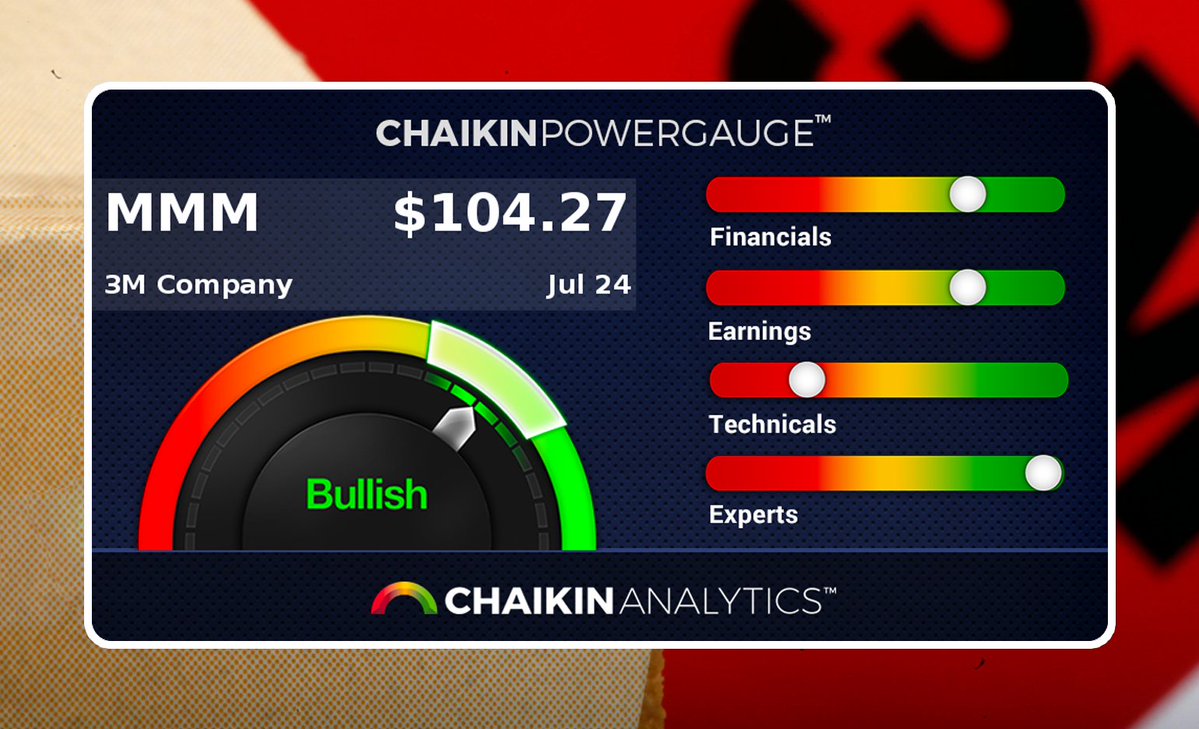

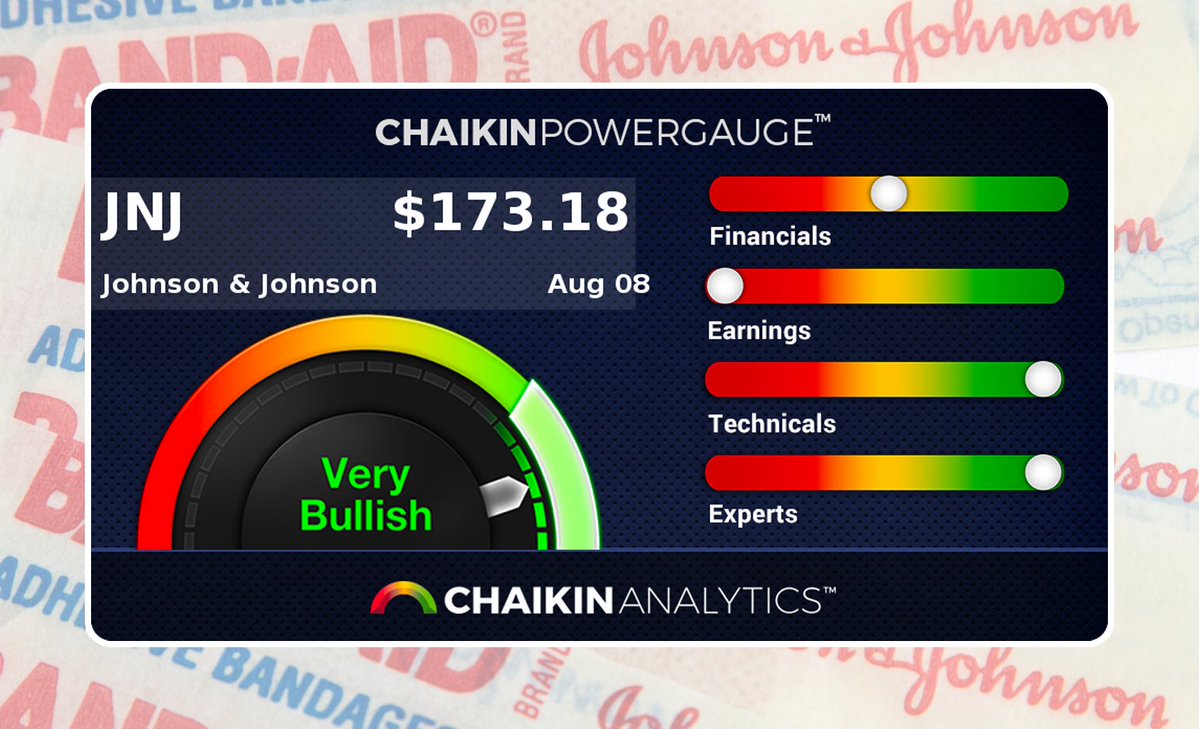

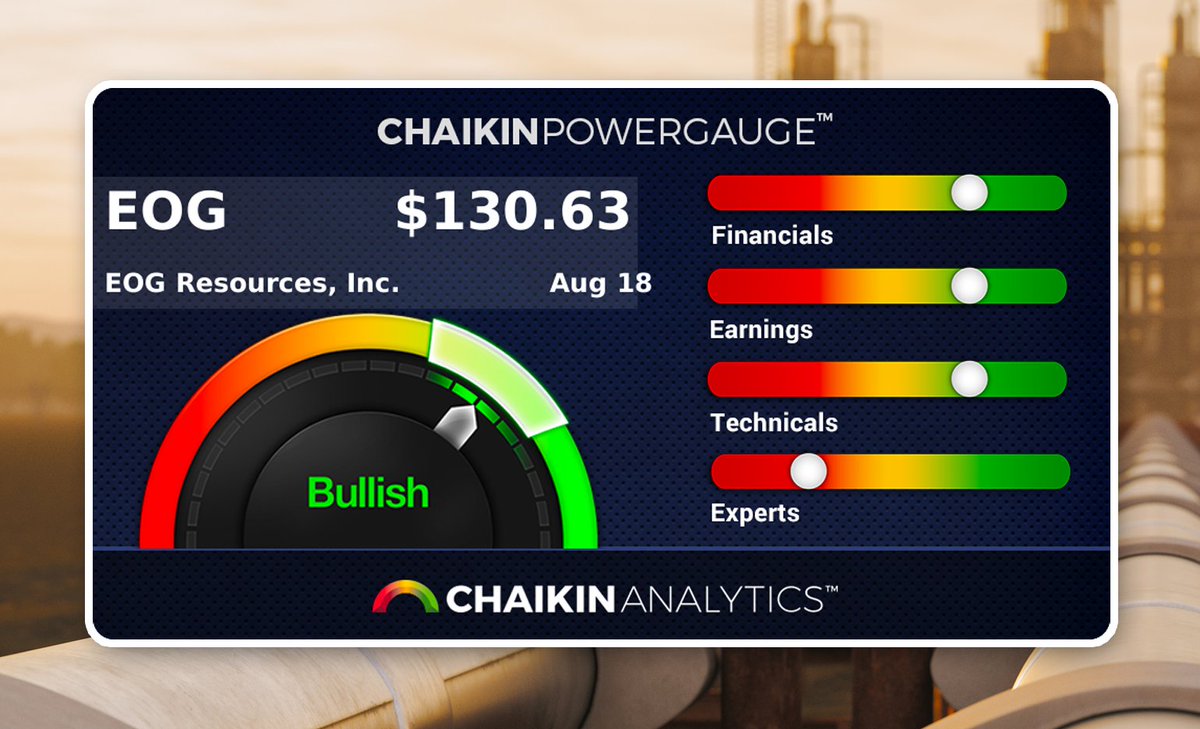

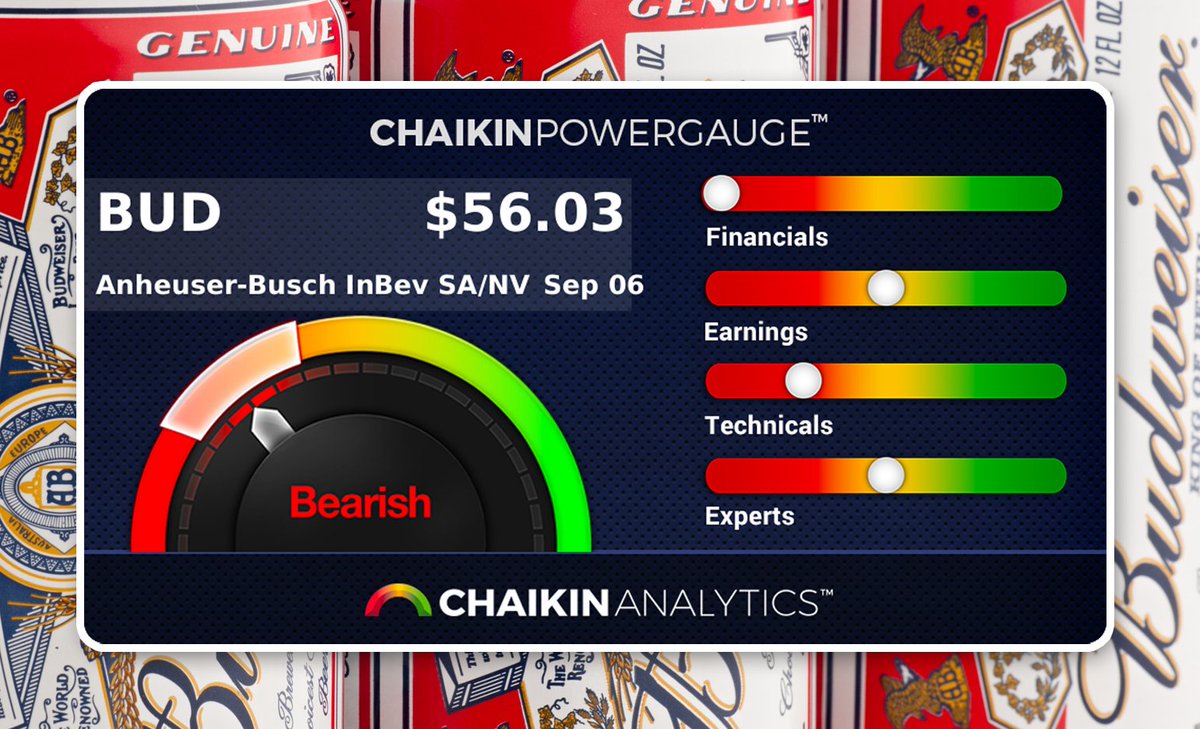

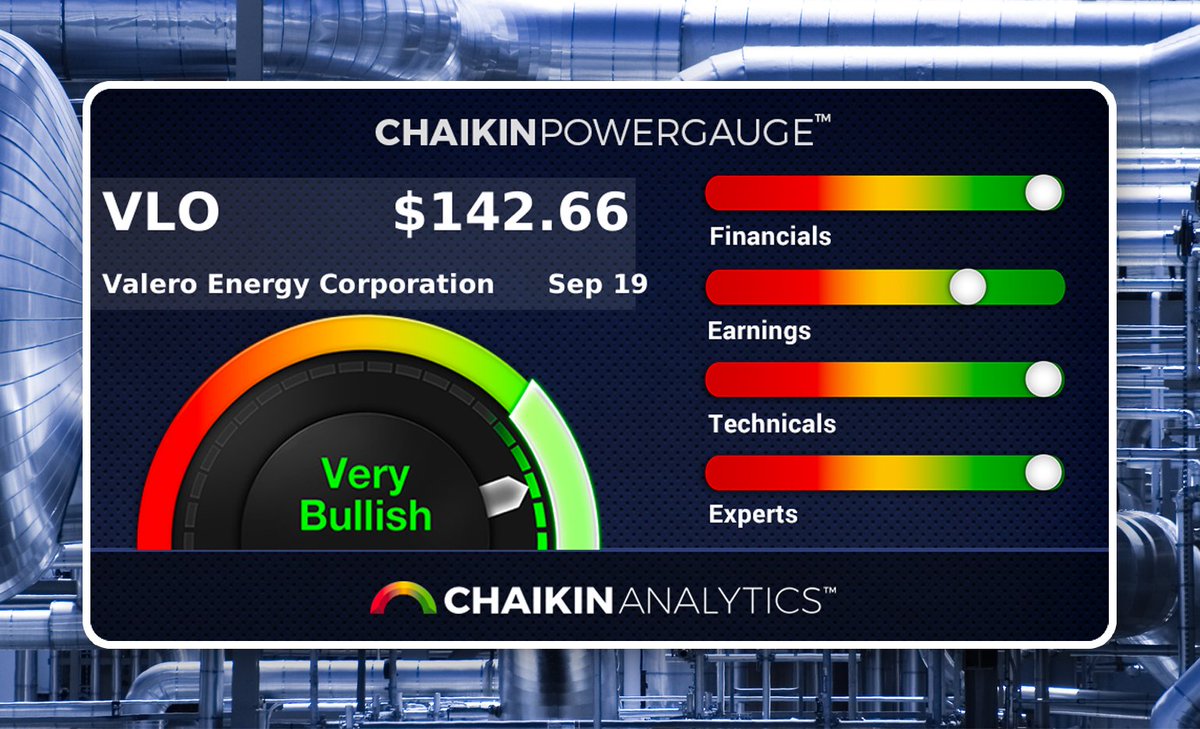

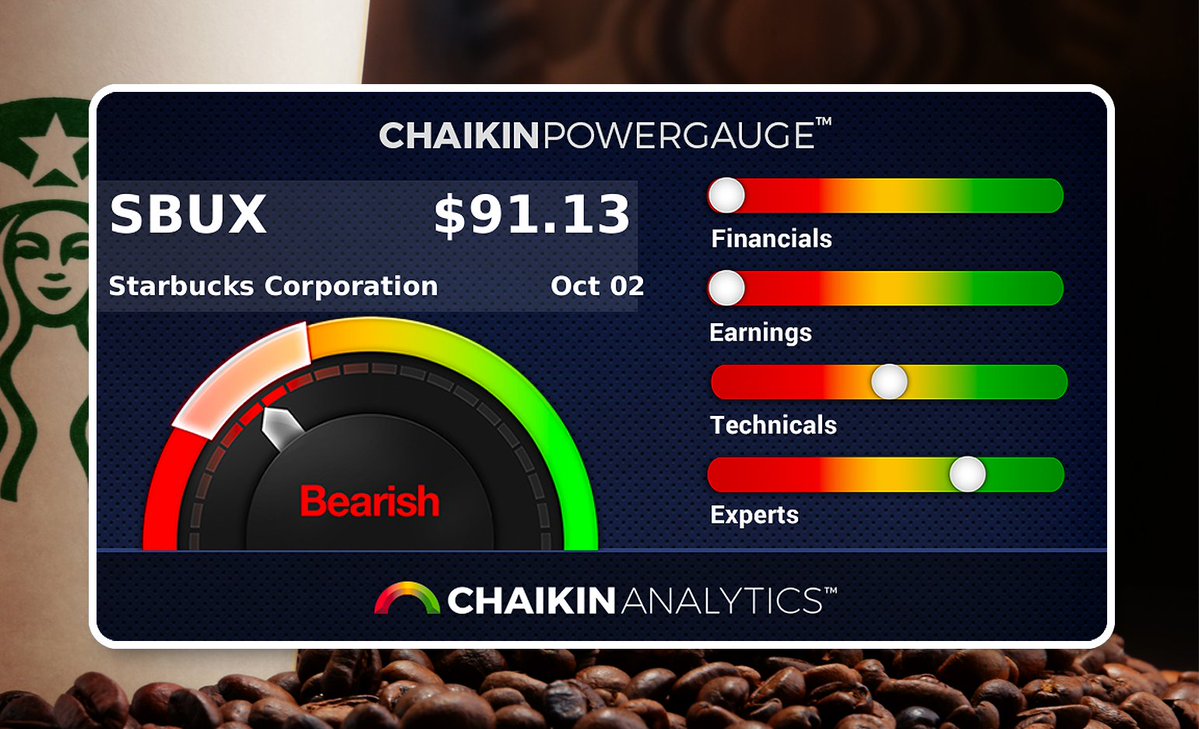

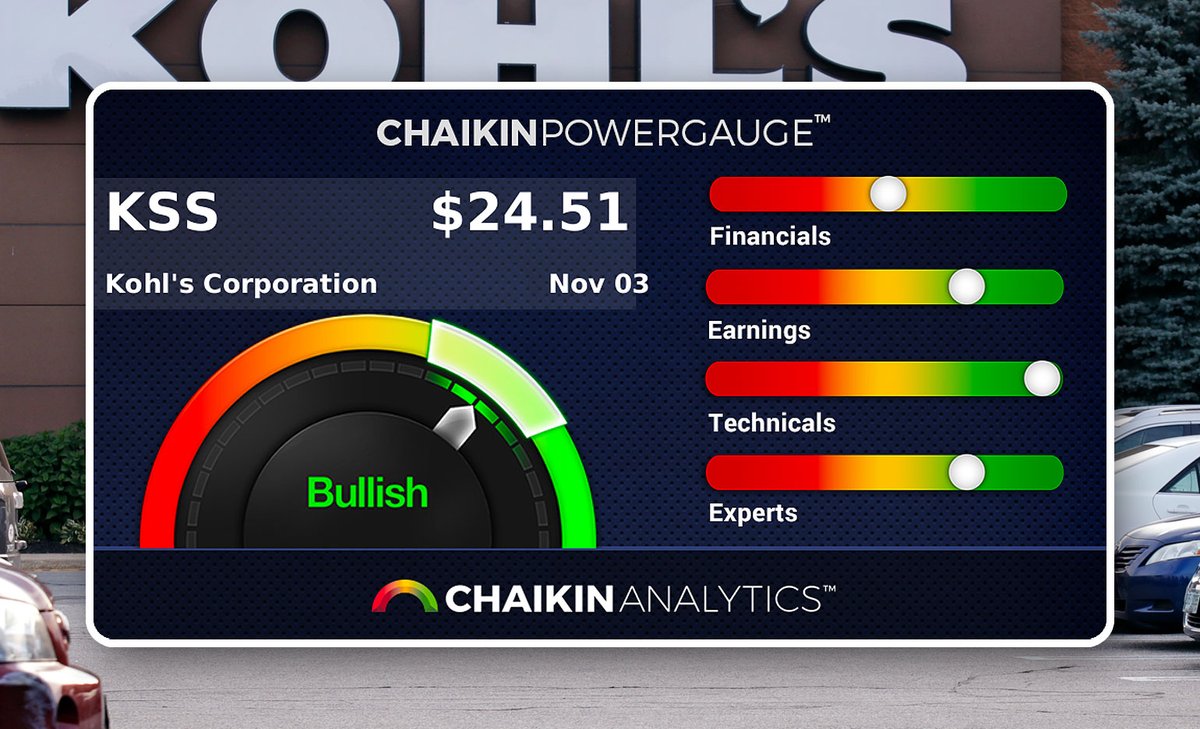

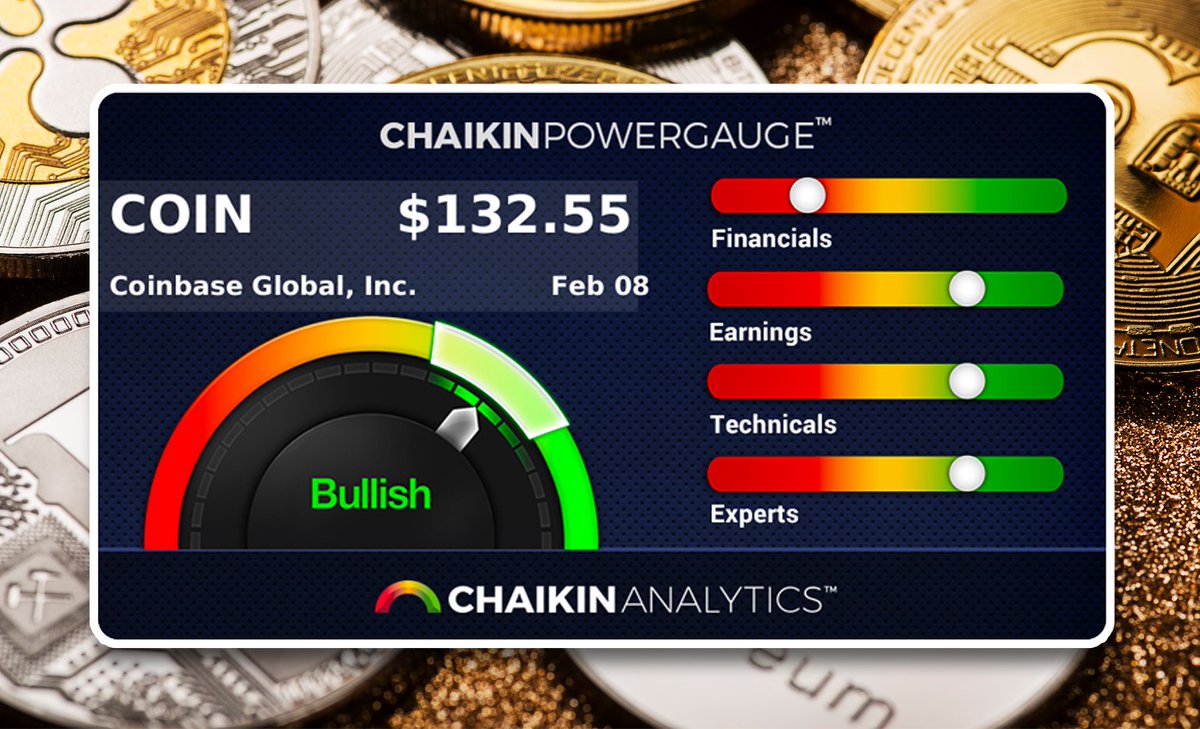

A.I. is the hottest trend in the U.S. stock market, and today, 50-Year Wall Street legend Marc Chaikin shares what to watch for with three popular stocks during the A.I. frenzy. Don't invest in artificial intelligence without reading this FREE report ➡️ sbry.media/3PfFH1m

A.I is set to create $7 trillion in new wealth, but our founder & CEO Marc Chaikin warns most investors are buying the wrong stocks. Learn more in his FREE report, which includes ratings of 3 popular stocks (BULLISH, NEUTRAL, or BEARISH). Get your copy ➡️ chkn.site/AIFrenzy

Alert🚨 Stansberry Investor Hour welcomes colleague and 50-Year Wall Street veteran Marc Chaikin back on the show this evening! #StayTuned

"You can have a good wine, but too much good wine is probably not good at some point," states Pete Carmasino. "Along the way, there are areas in the chart that point out tactical moves...that could be sells or buys," he tells @Invest_Hour. Watch Now ➡️ sbry.media/InvestorHour350

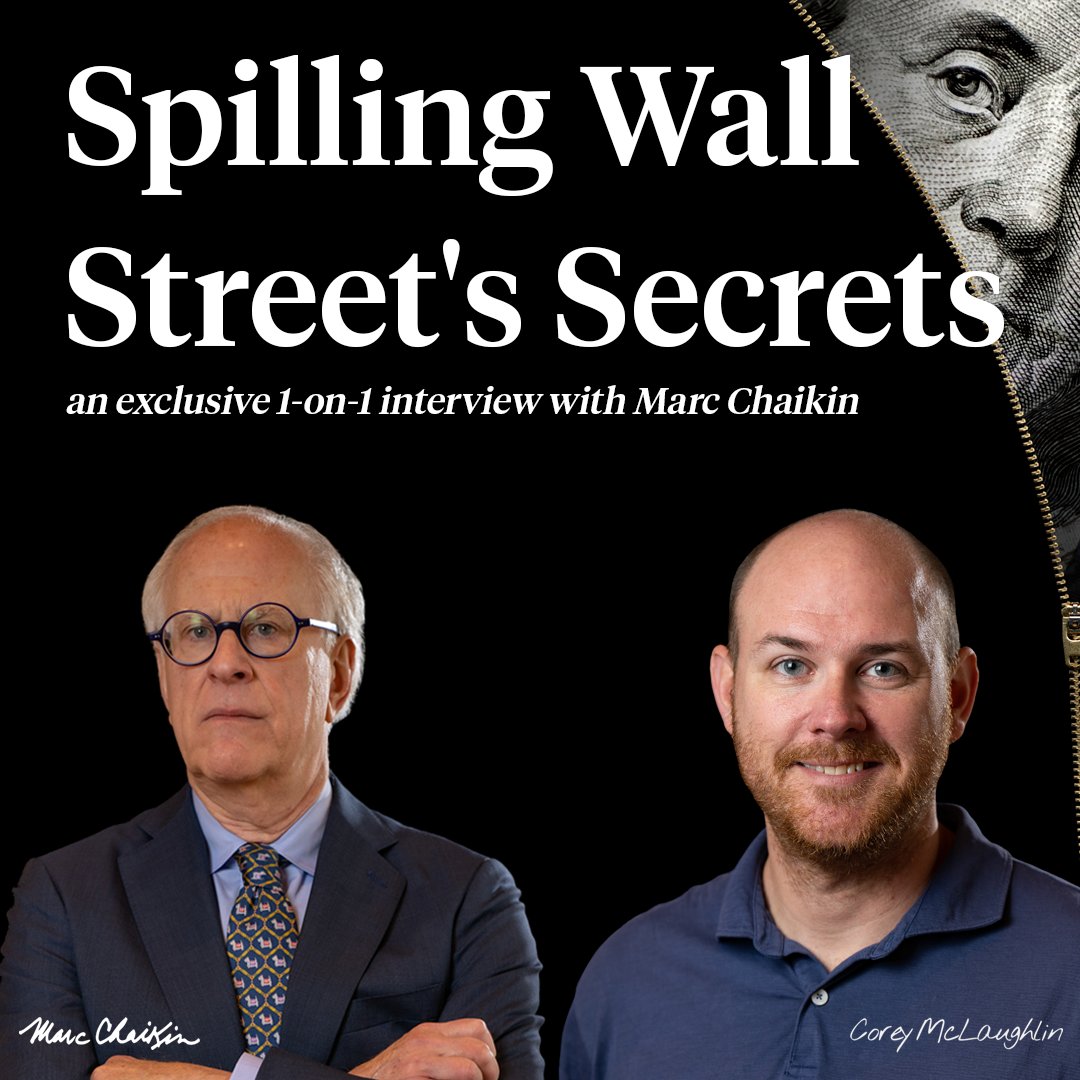

Today, Chaikin Analytics founder Marc Chaikin explains how a period in his Wall Street career played a big role in the process of creating the Power Gauge. And importantly, this “magic key” is still as powerful as ever ➡️ sbry.media/3PAjDOV