OGIE

@managedbyogie

Trader of Idea | Vertex of the Coliseum 🏛️

ID: 1770121871901528065

19-03-2024 16:15:33

186 Tweet

121 Followers

37 Following

I updated few minutes ago the ICT 30m Opening Range Indicator with the 1st Presented Displacement from the Midnight Opening range, (00:00 to 00:30NY) I will be posting in comments the video where you can find more information, a banger lecture from The Inner Circle Trader "The Secret

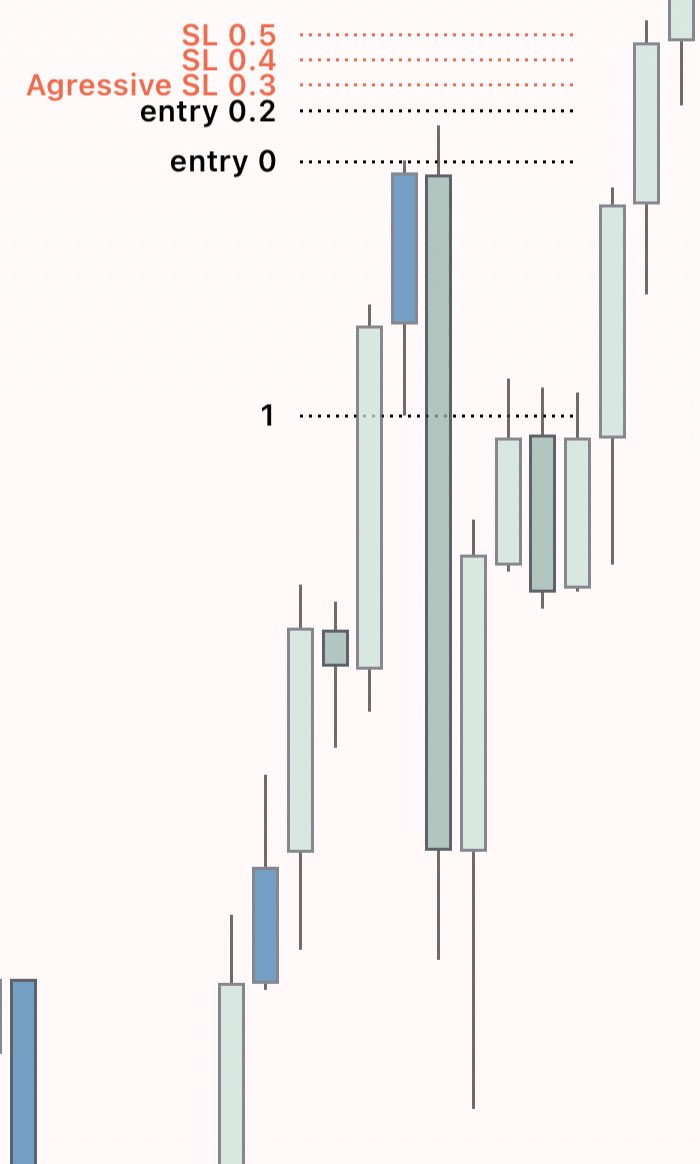

Alinda Innocent In this example we have H4 C3 Reversal: C2-C3 sSMT, this asset is strongest to upside move and it's likely to create HH sSMT, so you can place your entry at DR high and place your stop loss -0.3/-0.4 cause it's reversal into expansion 2 candle profile ( means small wick in C3 )

Who can teach you the real things: ICT: Rafael Matrix Trades too° Josh A SIGN OF TIME DexterLab Trading Pit Tribe AM The MMXM Trader TTrades🦍 Zeussy Disciplined_trader PoiSzn 🇿🇦 JJumbo Alexander fx4_living Garrett The Engineer SAV FX