Lexington Law

@lexingtonlaw

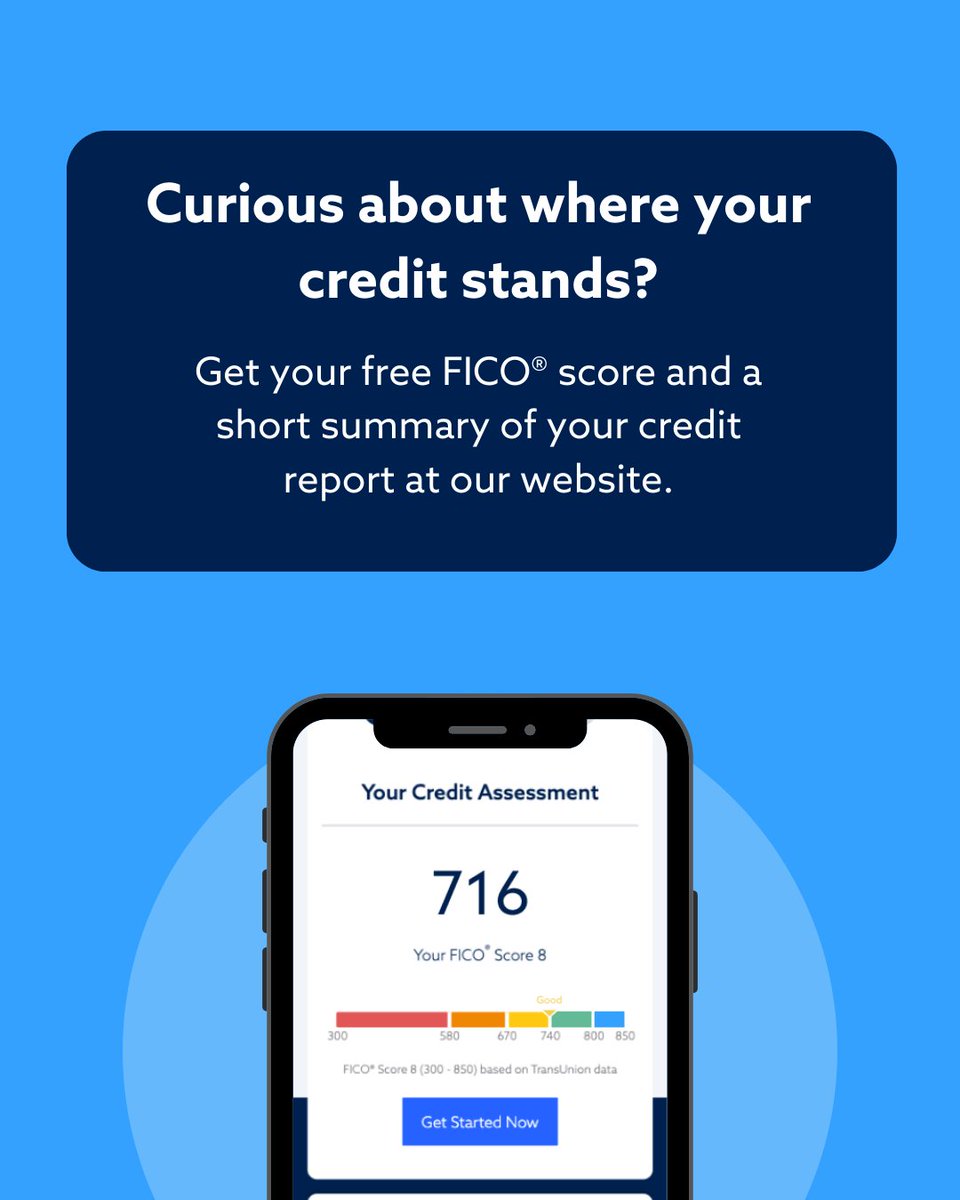

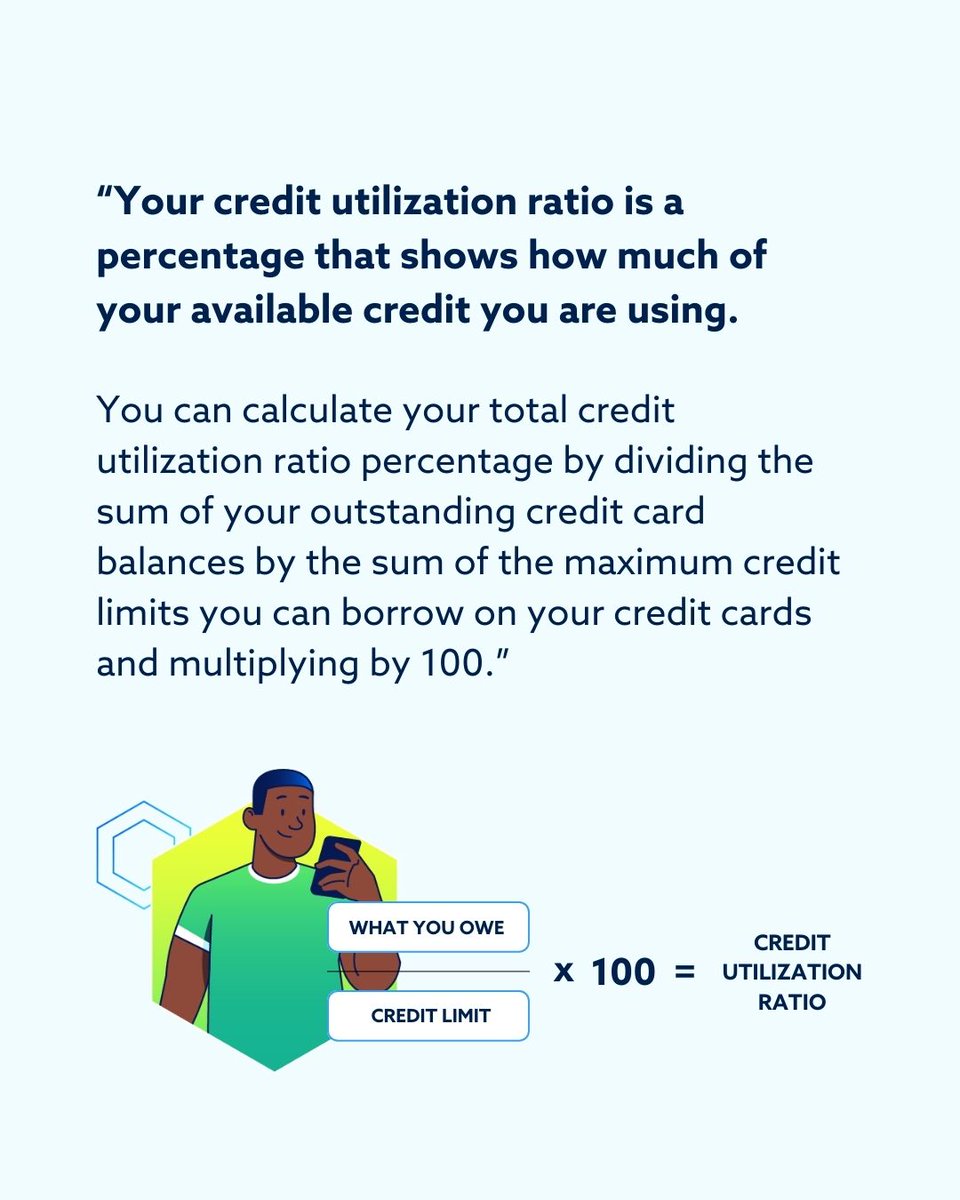

Laws are created to protect us. Lexington Law believes in your legal right to a fair, accurate and substantiated credit report. #LetLexingtonHelp

ID: 21769063

https://www.lexingtonlaw.com/?tid=31963 24-02-2009 16:38:13

5,5K Tweet

12,12K Followers

3,3K Following