Joe Best

@joeknowbest

ID: 938015057119760384

05-12-2017 11:59:51

73,73K Tweet

278 Followers

0 Following

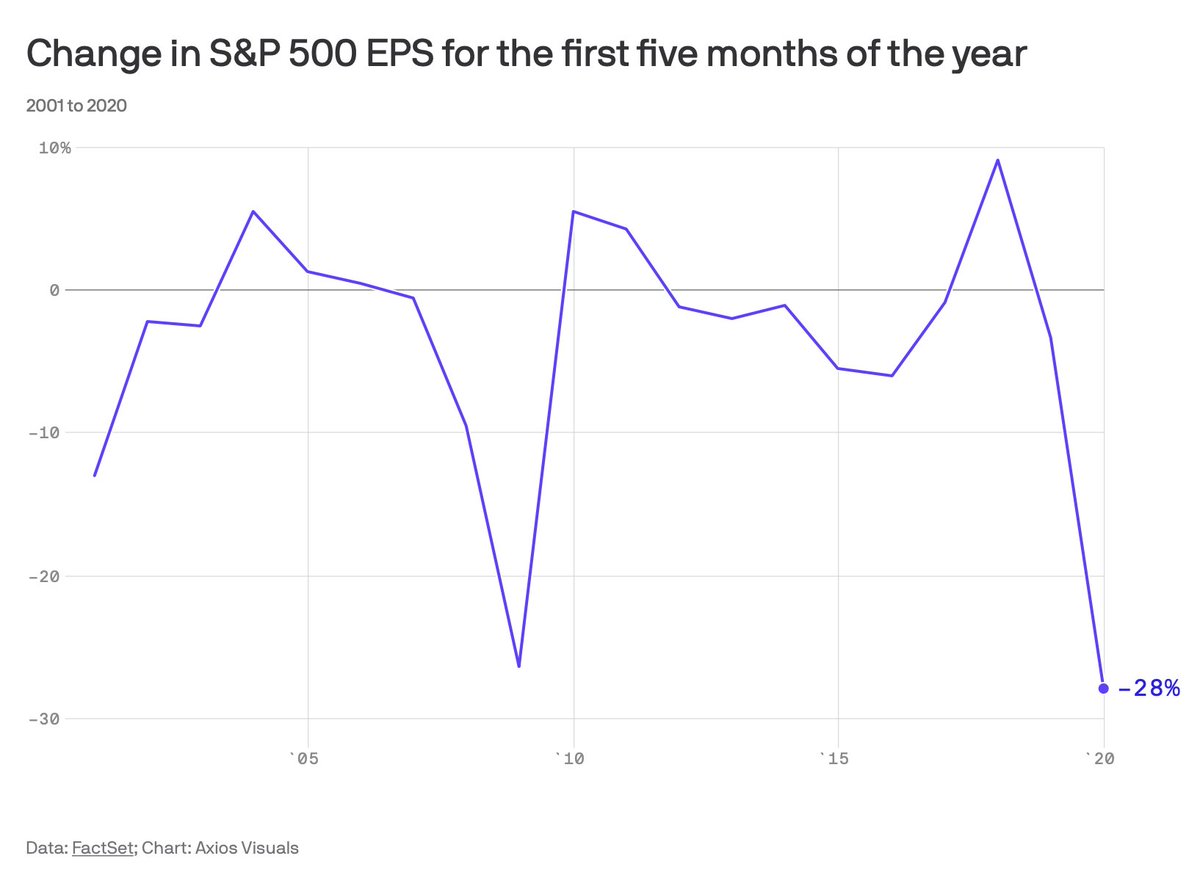

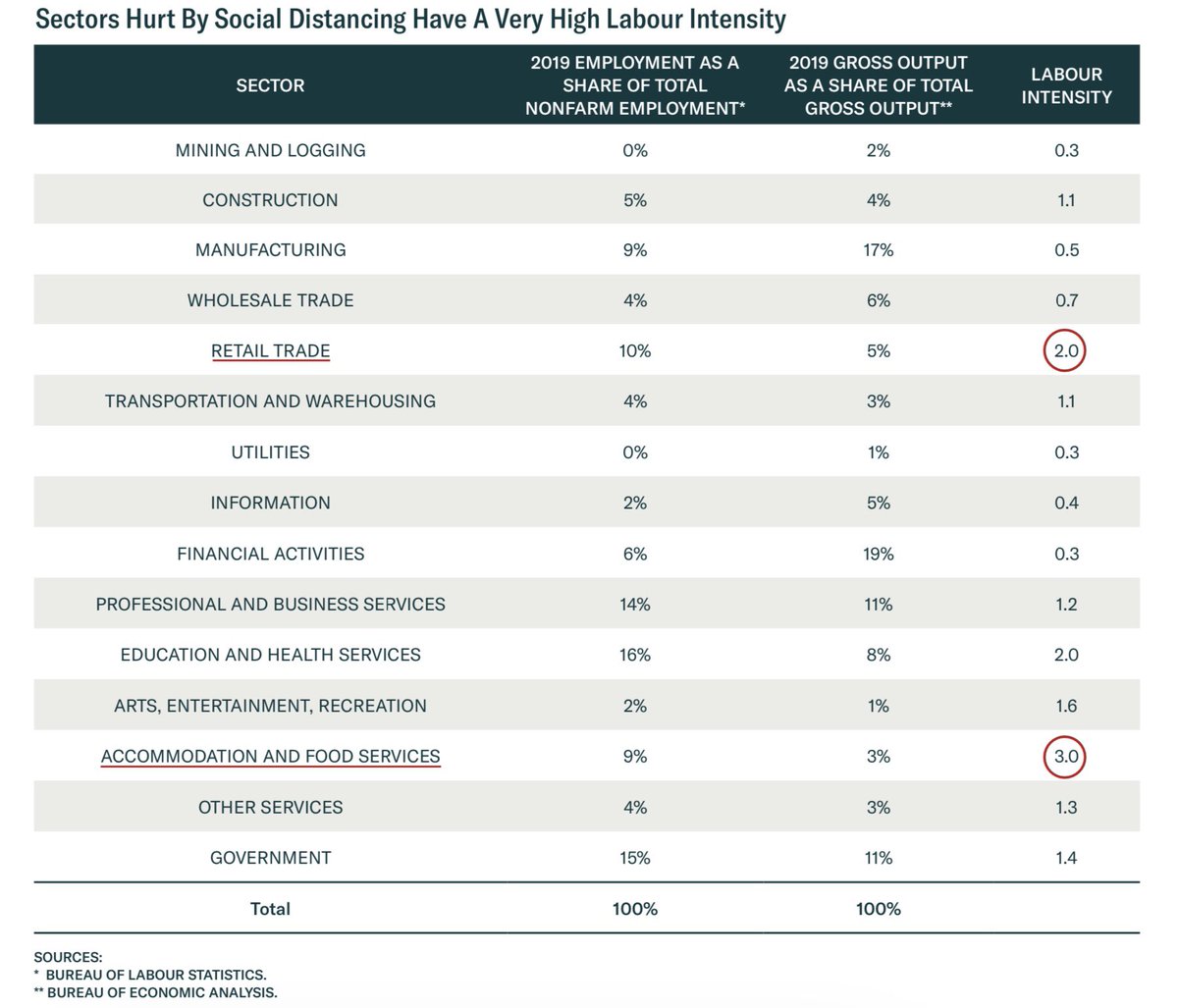

Sectors most hurt by social distancing make huge contributions to employment, but much smaller contributions to economic output BCA Research BLS-Labor Statistics BEA News

In a recent article for Frankfurter Allgemeine, Guntram Wolff, Peter Bofinger, Michael Hüther , Monika Schnitzer🇺🇦🇪🇺, Moritz Schularick and Martin Hellwig argue that last month's BVerfG ruling puts European Central Bank independence at risk. bru.gl/3gOpyNh

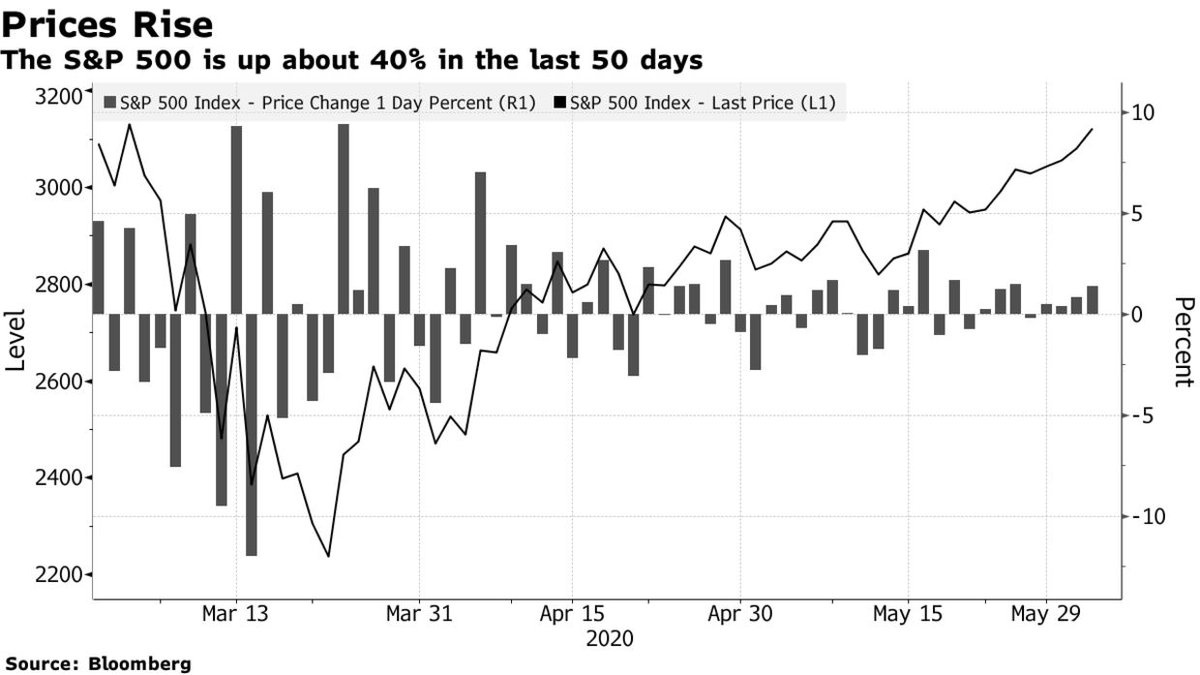

‘Bored’ Millennial Day Traders Boost Airline ETF’s Assets 2,930% bloomberg.com/news/articles/… ht Julia Cordova