Jingyi Pan

@jingyipan_

Economics Associate Director @SPGlobalPMI. Tweets and opinions are my own.

ID: 775564761819852800

13-09-2016 05:20:23

2,2K Tweet

2,2K Followers

517 Following

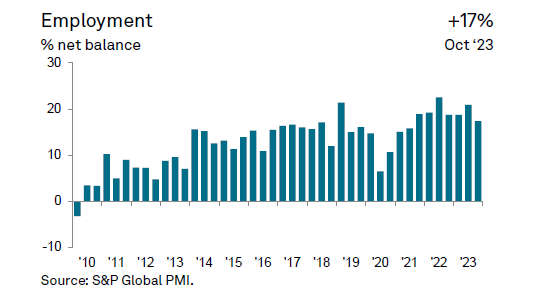

The Eurozone Composite #PMI pointed to the sharpest decline in private sector activity for nearly 3 years in October (46.5; Sep: 47.2), leading firms to cut staff for the first time since early-2021. Read more: ow.ly/N1L550Q4qK2 Hamburg Commercial Bank Economics #eurozone #trading