Ich aus MV

@ichausmv1

Everything I tweet is my personal opinion and not financial advice or anything like that!! DYOR!!

ID: 1442924879406374913

28-09-2021 18:51:29

2,2K Tweet

144 Followers

68 Following

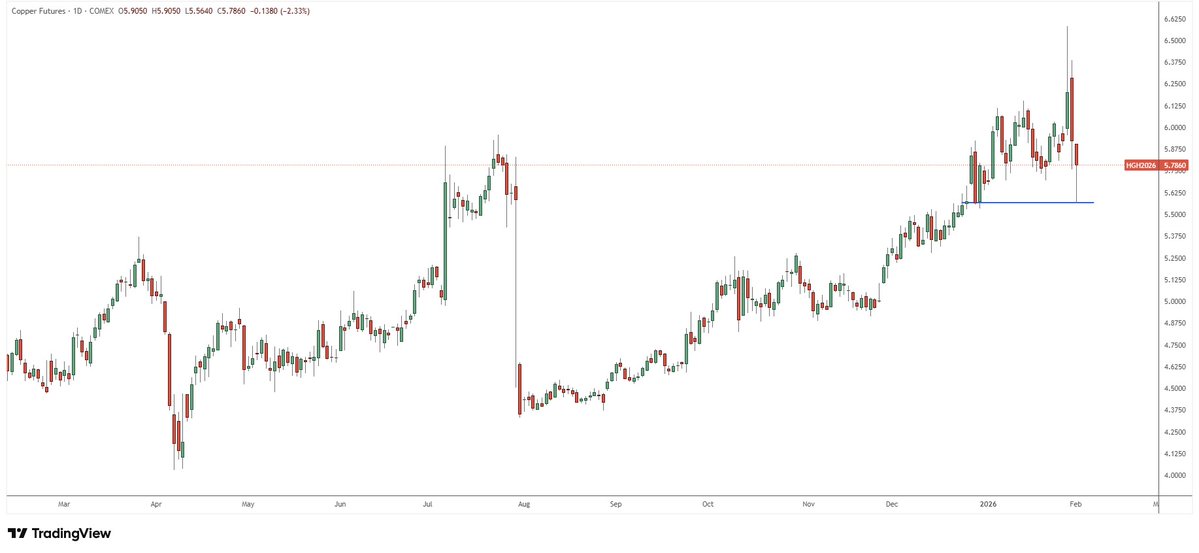

The Kobeissi Letter They are clearly caught in a forced liquidation wave, not a fundamental breakdown. The $10 trillion “wipeout” is mostly mechanical selling from leveraged positions, ETFs, and momentum funds all trying to raise cash at once. This kind of move spikes volatility, drains risk