Finding Value Finance

@finding_finance

Ratios | Market Conditions | Technical Analysis | Life

ID:1349830701797974016

https://www.youtube.com/user/ilikcagrls/videos 14-01-2021 21:28:22

13,3K Tweets

13,1K Followers

95 Following

Follow People

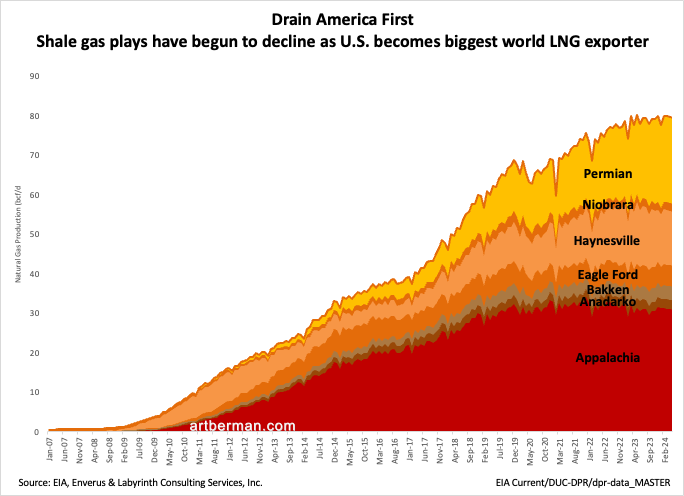

Drain America First

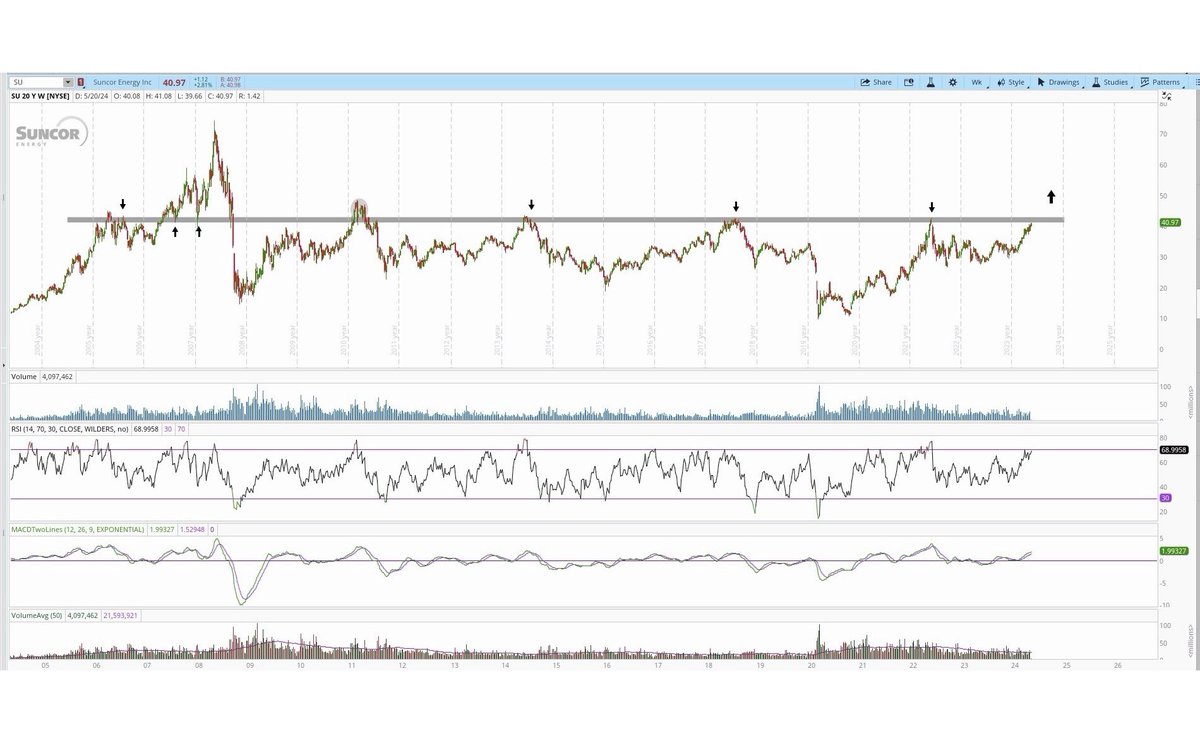

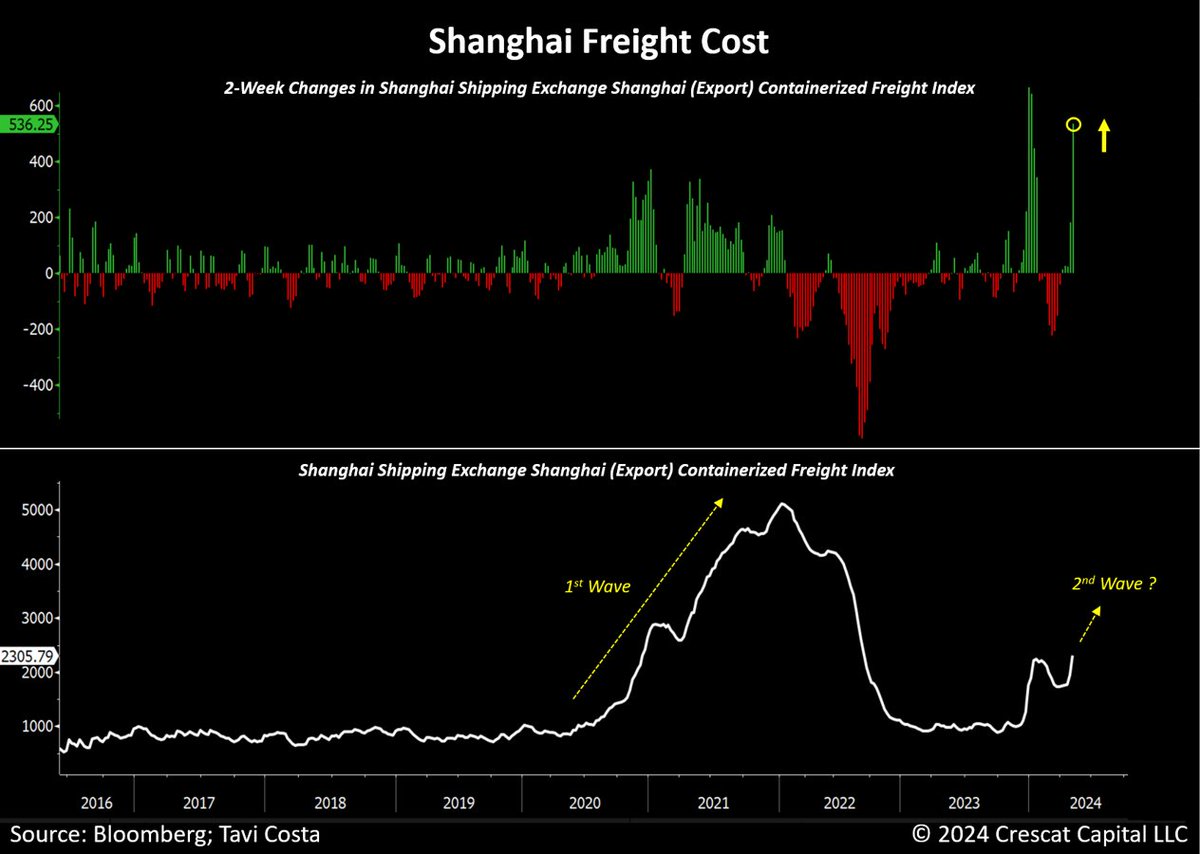

Shale gas plays have begun to decline as U.S. becomes biggest world LNG exporter

#energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT #natgas