Economics Global

@econglobal

Economics Global is an economic and investment research firm that focuses on global macro research and asset allocation for investors.

ID: 834507218225598464

https://www.economicsglobal.com/ 22-02-2017 20:56:40

11,11K Tweet

2,2K Followers

612 Following

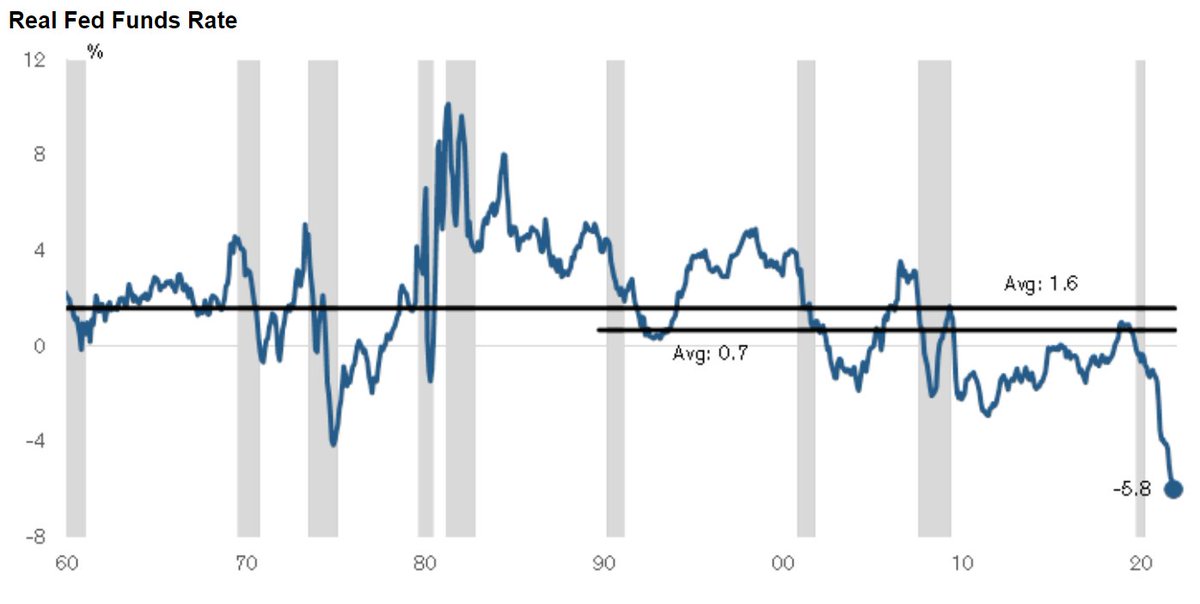

Pricing of a half-point rate hike at the Fed’s March meeting went from about 28% before figures to around 50% now, via Liz Capo McCormick