Dividend Kings 👑

@dividendkings

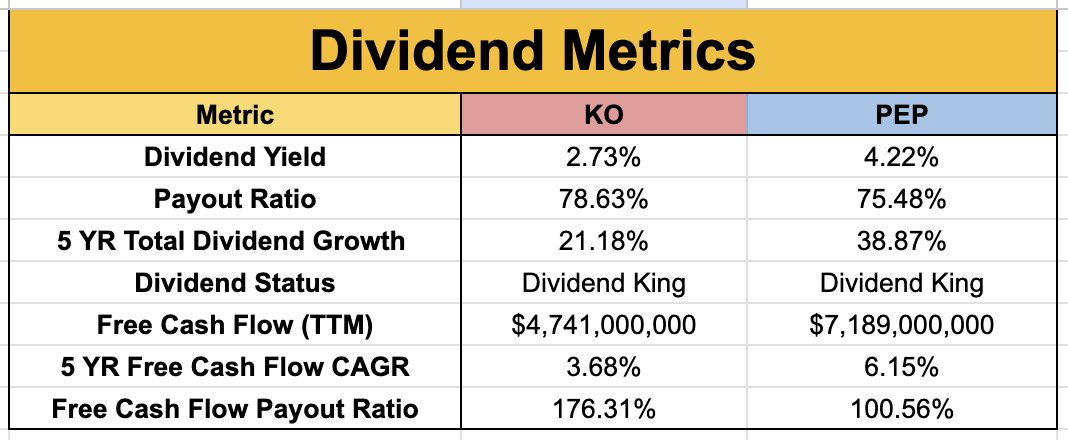

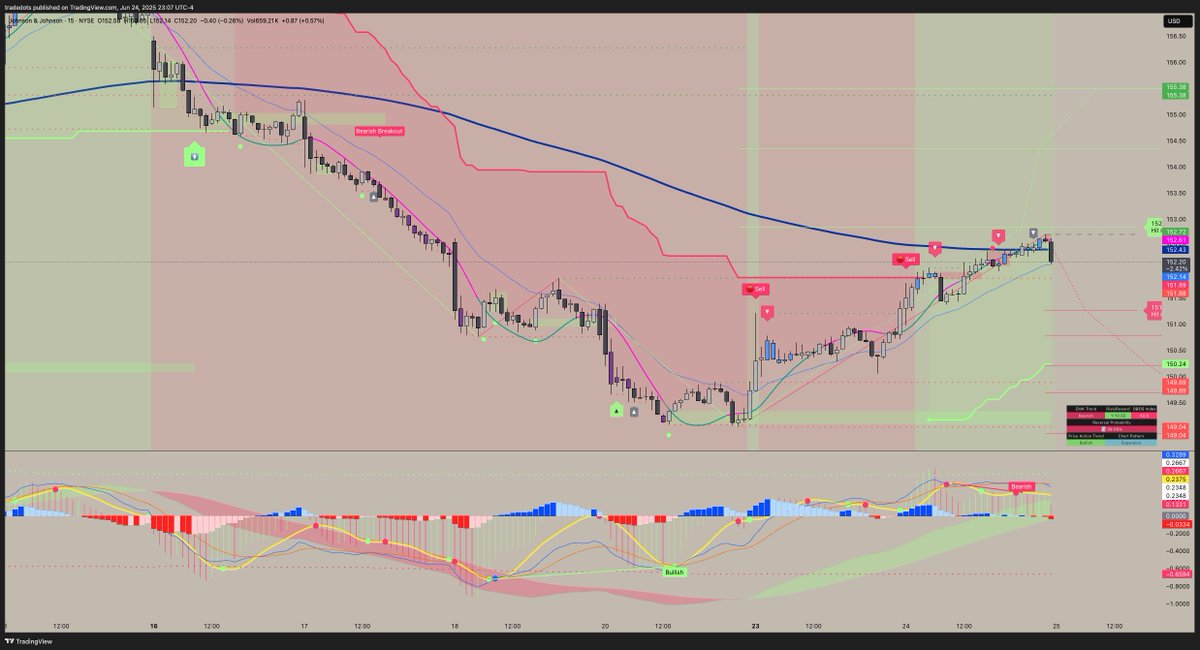

Start investing with the #DividendKings! Stocks with 50 years of dividend growth are Kings. PG KO NUE JNJ EMR ED MO HRL TGT LOW GPC ABT KMB CL PEP CINF DGI DRIP

ID: 910882754706989056

https://www.dividendinvestor.com/what-are-dividend-kings/amp/ 21-09-2017 15:05:46

1,1K Tweet

8,8K Followers

2,2K Following

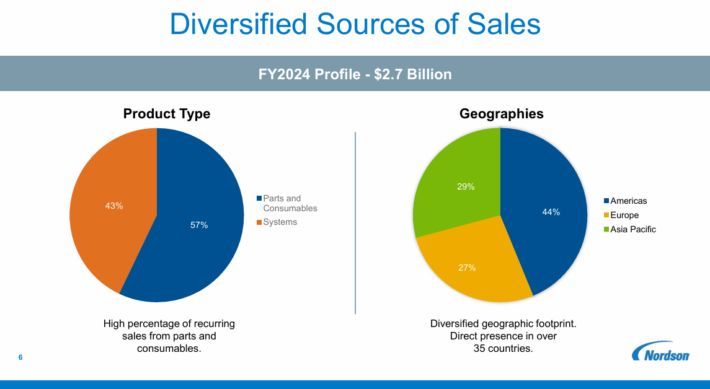

12 Industrials Sector Dividend Kings For Long-Term Growth - Sure Dividend buff.ly/ABfBo1t via Sure Dividend