Daniel Earle

@danielearle3

Global macro, commodities, equities. Solaris $SLS.to $SLSSF 'Copper Growth and Discovery'

ID: 1024331974188486656

31-07-2018 16:32:28

2,2K Tweet

3,3K Followers

872 Following

AYUDA - La canadiense Solaris Resources Inc. Resources y su subsidiaria Lowell Mineral, en coordinación con @xvgGeoengineer #ViceministrodeMineria de @RecNaturalesEC, envió 7 volquetas para apoyar las tareas de remoción de escombros a Quito por el aluvión en La Gasca. #mineria

China “electrify everything” -> dominate renewables, see offshore wind per (((The Daily Shot))) Renewables 5x Cu intensity vs fossil fuels Offshore wind 2x Cu intensity vs solar Global offshore 5x growth to 2030 Over 200GW @ 10kt Cu per GW - where's all the #copper coming from?

#EV megatrend accelerating per BloombergNEF '22 10.5m units, +60% from '21 Bear in mind, '21-22 actuals 50% above forecast At 10% adoption, critical mass -> sales take off China/EU – slow to '19 then fast, 15%/20% now going to 40-50% by '30. US 8% next $tsla $rivn $lcid

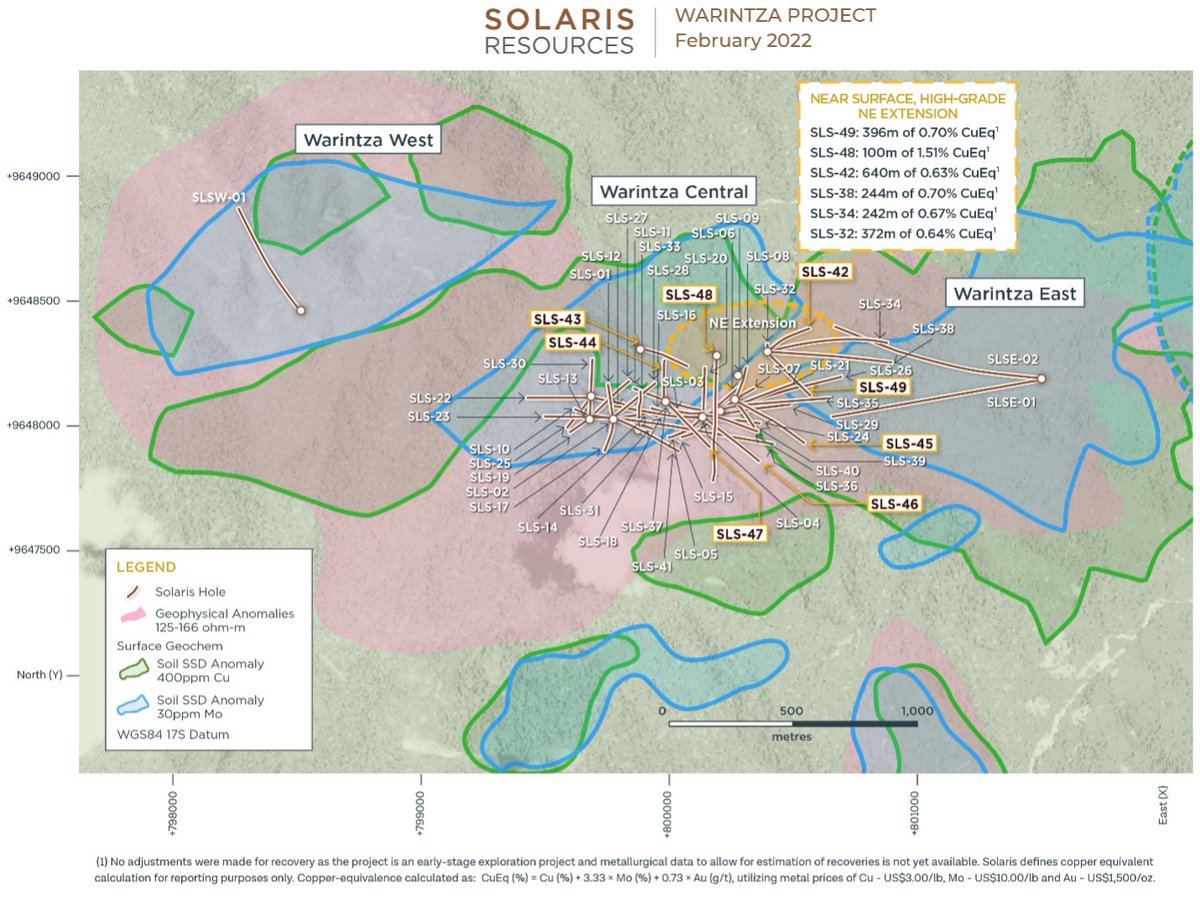

#copper surges above $5.00/lb. Where do we get more #copper? 🧐 The #Warintza project of $SLS.TO can be part of the answer.🚀🚀🚀 Solaris Resources Inc. Daniel Earle