Coaltracker

@coaltracker

I am a dedicated investor in resource stocks for the last 50 years. Coal is my specialty. My posts are my thoughts and not to be considered financial advice.

ID: 1016210300733874176

09-07-2018 06:39:50

2,2K Tweet

1,1K Followers

48 Following

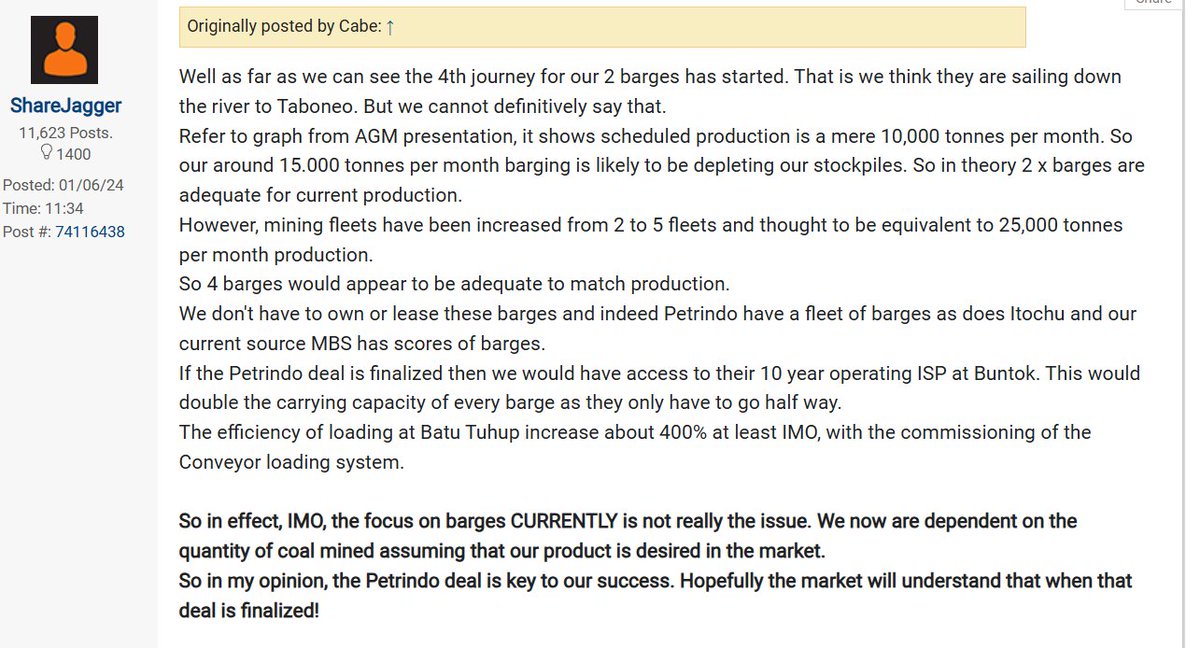

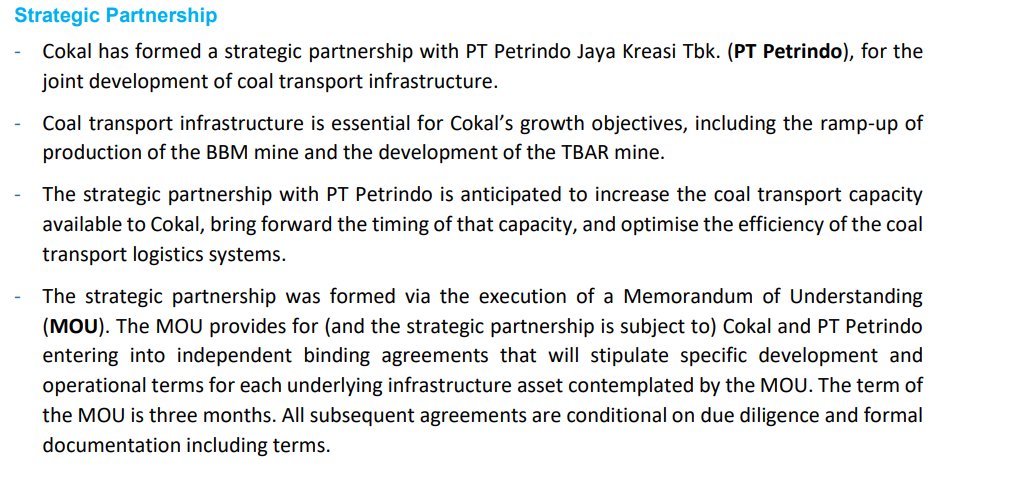

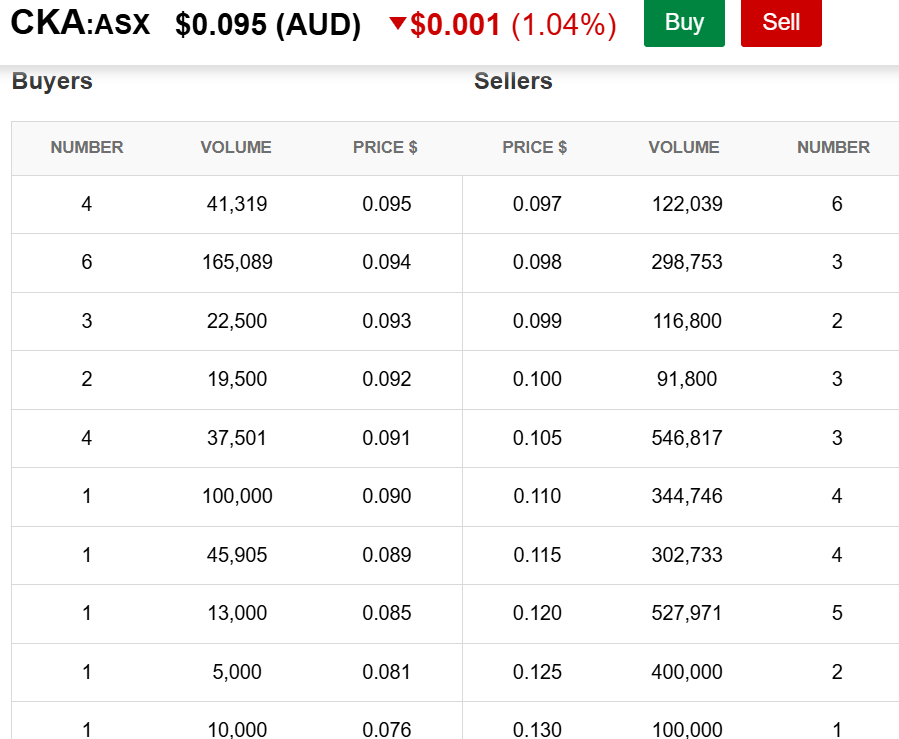

$CKA Huge news in Jakarta with 2 x Massive coal mining entities jumping in bed with little old Cokal In Australia Ho Hum😂More big news next week from Investor Meeting Petrosea Signs Term Sheet for Contractor Management with COKAL Ltd jakartaglobe.id/special-update… via The Jakarta Globe