Catskill Crypto

@catskillcryptos

ID: 1591877040390692864

13-11-2022 19:34:17

109 Tweet

3,3K Followers

2,2K Following

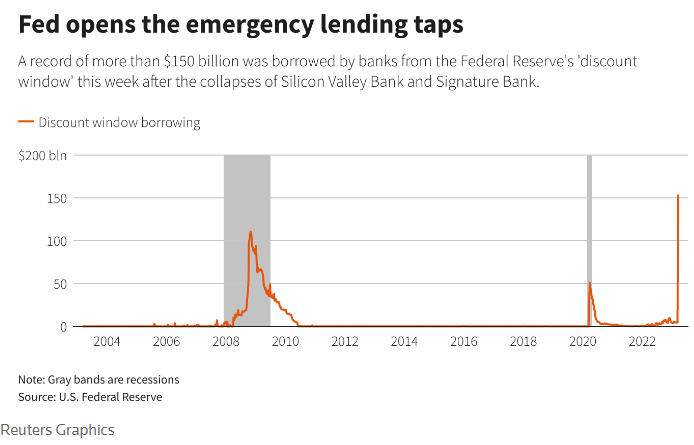

One of the most absurd aspects of the Silicon Valley bank failure is that its CEO was a director of the same body in charge of regulating it: the San Francisco Fed. I'll be introducing a bill to end this conflict of interest by banning big bank CEOs from serving on Fed boards.

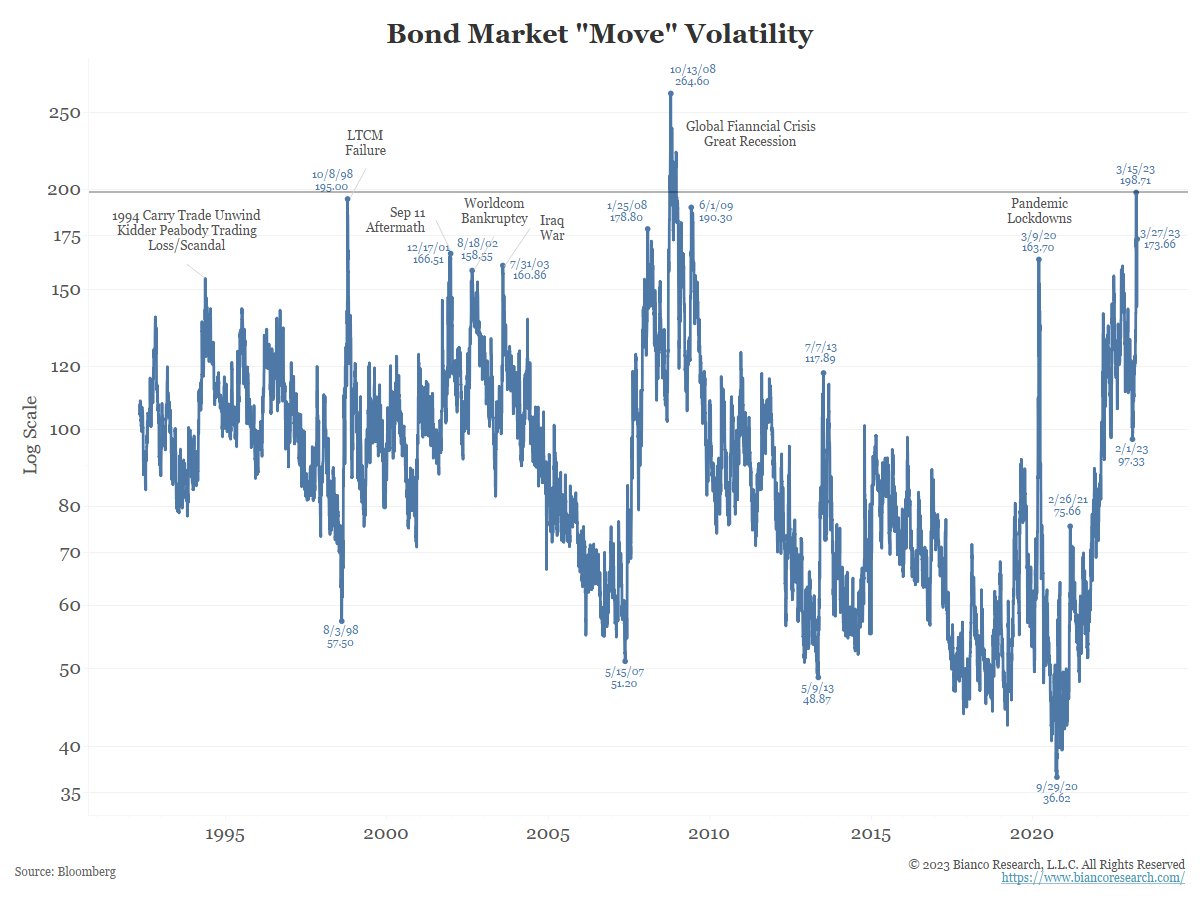

A MAJOR player that understands CDS better than just about anyone. Let me translate, this is my opinion. boaz weinstein can correct/embellish in the reply. ---- A major deal is not using bond spreads, but rather Credit Default Spreads (CDS) for the MAC (Material Adverse Change)

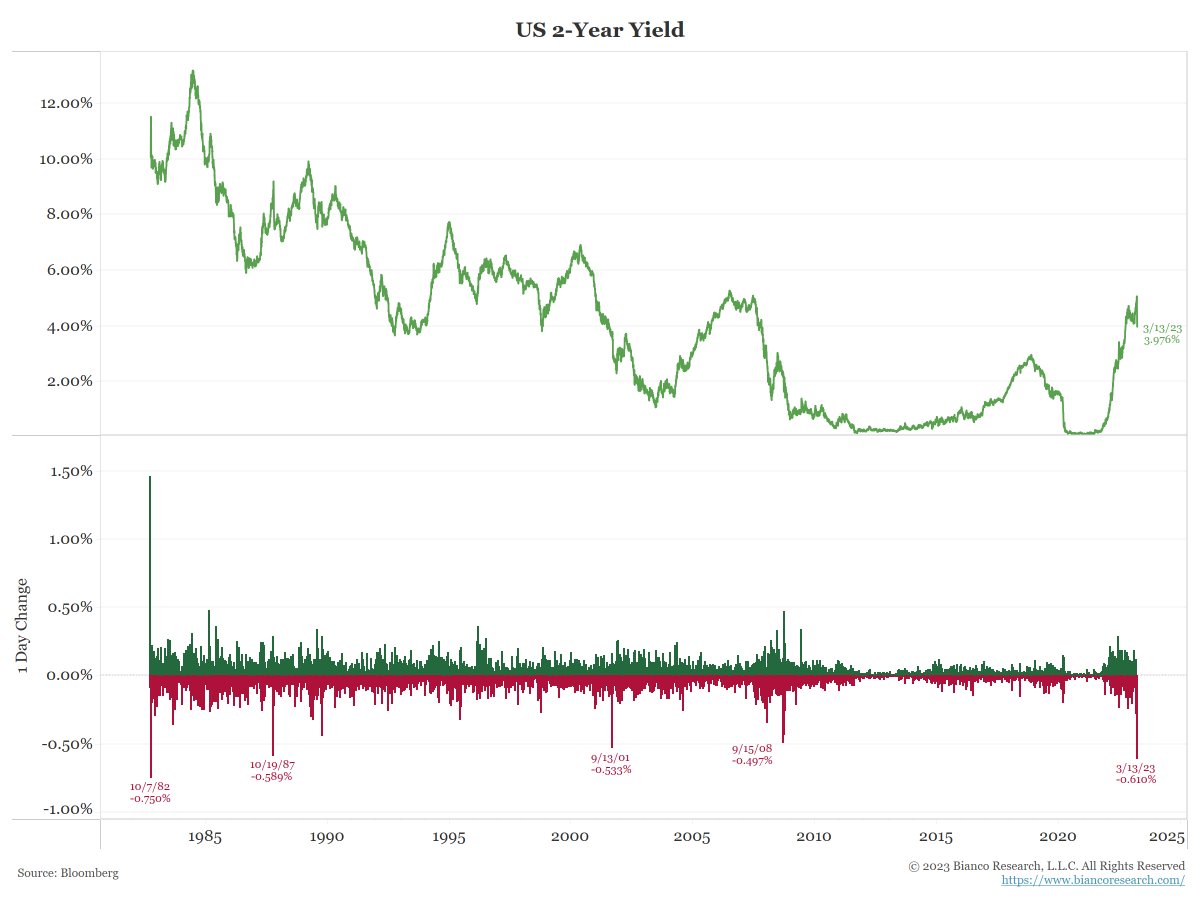

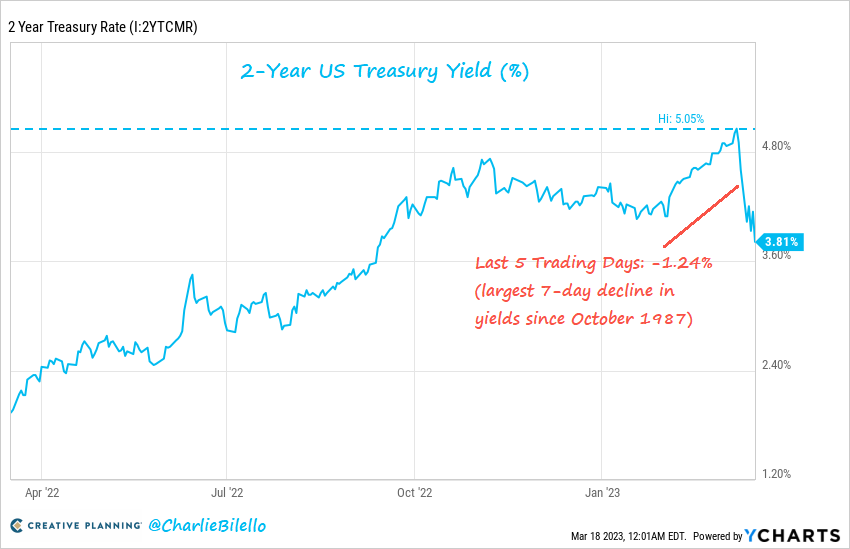

🇺🇸 Yield Curve The inversion of the US 10Y-3M yield curve continues to deepen 👉 isabelnet.com/?s=yield h/t (((The Daily Shot))) #markets #yieldcurve #yields #yield #bonds #treasuries #bondmarket #recession #recessions #investing