Alex Kurland

@atkurland

General Partner @MeritechCapital, previously @kleinerperkins

ID: 428618437

http://www.meritechcapital.com 05-12-2011 00:08:46

257 Tweet

1,1K Followers

116 Following

Thrilled to welcome ashleypaston to Meritech Capital!

See below Meritech Capital's report on the 2021 Cohort of High-growth SaaS IPOs. 27 companies that are cumulatively worth almost $250B. meritechcapital.com/blog/2021-revi…

Some analysis (and cool charts!) from Meritech Capital on Durable Growth: the most important lever for long-term value creation for public SaaS companies. Thank you Anthony DeCamillo and Dan Knight. meritechcapital.com/blog/durable-g…

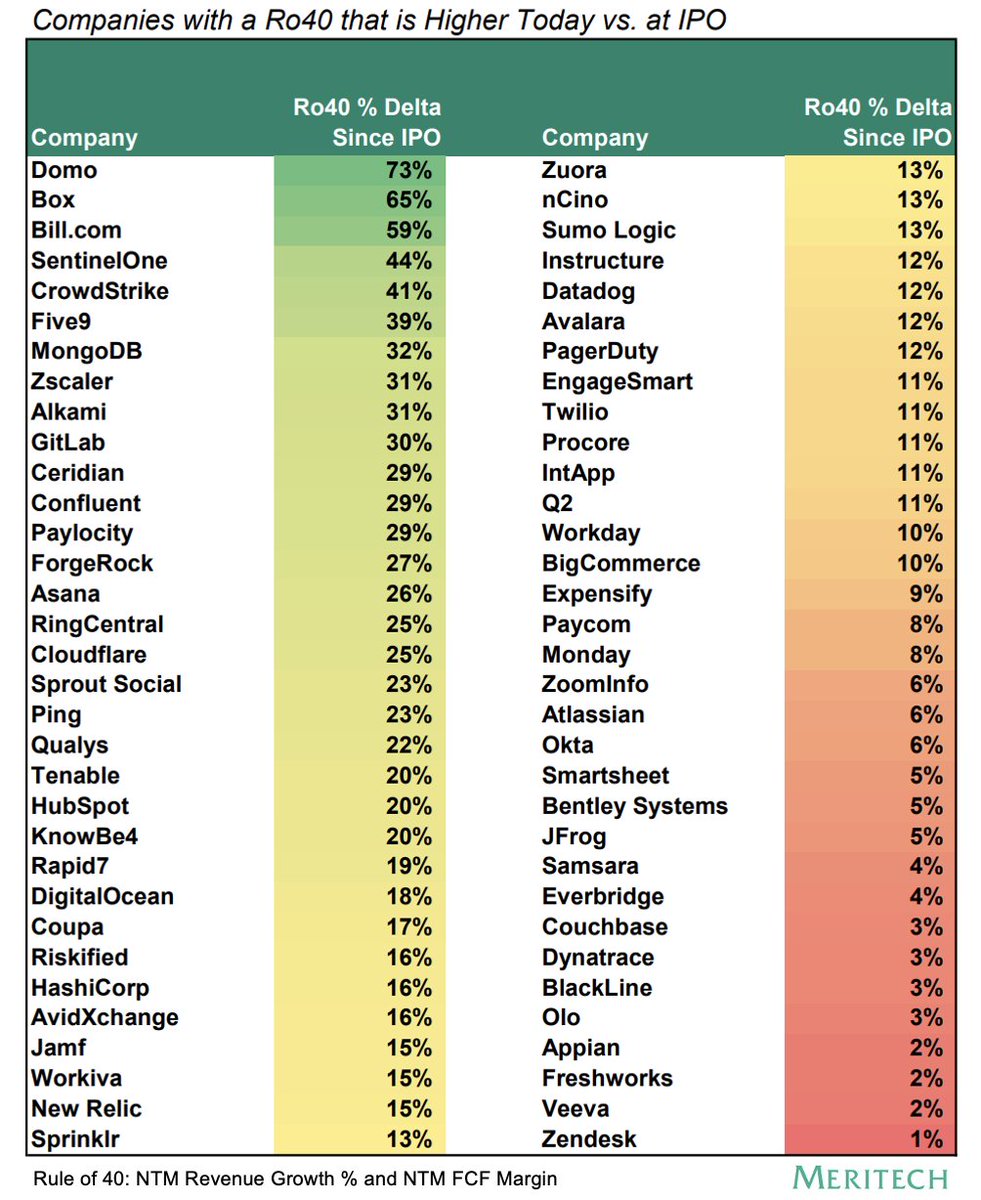

Had a debate about SaaS companies showing leverage in business model post IPO. Reached out to my friends Meritech Capital on it. - Database is 99 SaaS companies - 66 increased "Rule of 40" (rev growth + fcf %) while public, 33 decreased - Avg at IPO was 22%. Now 27% - List below

Thrilled to see Meritech Capital Partner ashleypaston named to the 2023 Forbes 30 Under 30 Venture Capital list! Ashley's drive, thoughtfulness, focus and humility have had a profound impact on our organization, as well as the entrepreneurs we support. bit.ly/3GTEN72

What is the new normal for public SaaS valuations? Only 17 public SaaS companies trade >10x ARR. Meritech Capital analyzed the financial + operating metrics of these 17 companies to show what it takes to be a member of The 10x ARR Club in 2023. meritechcapital.com/blog/the-10x-a…

5/ Entire post and presentation are below. Thank you Tanner, Dan Knight and Anthony DeCamillo. meritechcapital.com/blog/multi-pro…

Klaviyo $KYVO will be the first SaaS IPO in almost 2 years and one of the fastest-growing and most efficient public SaaS businesses when they start trading. A summary is below. Thanks Anthony DeCamillo, Tanner, & Dan Knight meritechcapital.com/blog/klaviyo-i…

Some cool charts from the Meritech Capital Software Pulse: a recurring update on the $2T public SaaS industry. Read below to dive into best-in-class public SaaS company valuation drivers and KPIs. Thanks Anthony DeCamillo, Tanner, and Dan Knight meritechcapital.com/blog/meritech-…

We are thrilled co-lead Huntress Series D financing. We’ve been in awe of their growth from a highly robust EDR solution to a complete security platform that protects the SMEs that power our global economy. More here: bit.ly/4cuowSJ. Kyle Hanslovan Chris Bisnett

Excited to partner with Huntress to support their mission of securing the 99% of businesses that power our global economy. Congrats to Kyle Hanslovan & Chris Bisnett on this well deserved milestone! More here: bit.ly/4cuowSJ

Thrilled to partner with Clay 👀 + support their mission of building the creative GTM tool for growing businesses. Clay has provided a ton of value to Meritech + our portfolio companies and we love the community that's formed around the platform. Congrats Kareem Amin Varun Anand

The value of the growth function is growing! Clay 👀 is giving the power of programming to GTM teams and allowing them to operationalize massive amounts of data at scale. Congrats to Clay on the Series B and excited for the journey ahead Kareem Amin Varun Anand