Anbu Kannappan

@anbukannappan

ID: 369924113

08-09-2011 05:12:48

20 Tweet

31 Followers

267 Following

It was great collaborating with the Credible Finance team. The Credible Finance PayFi Vault is now live on Byzanlink RWA Markets, bringing onchain exposure to short-duration payment financing all powered by Hedera.

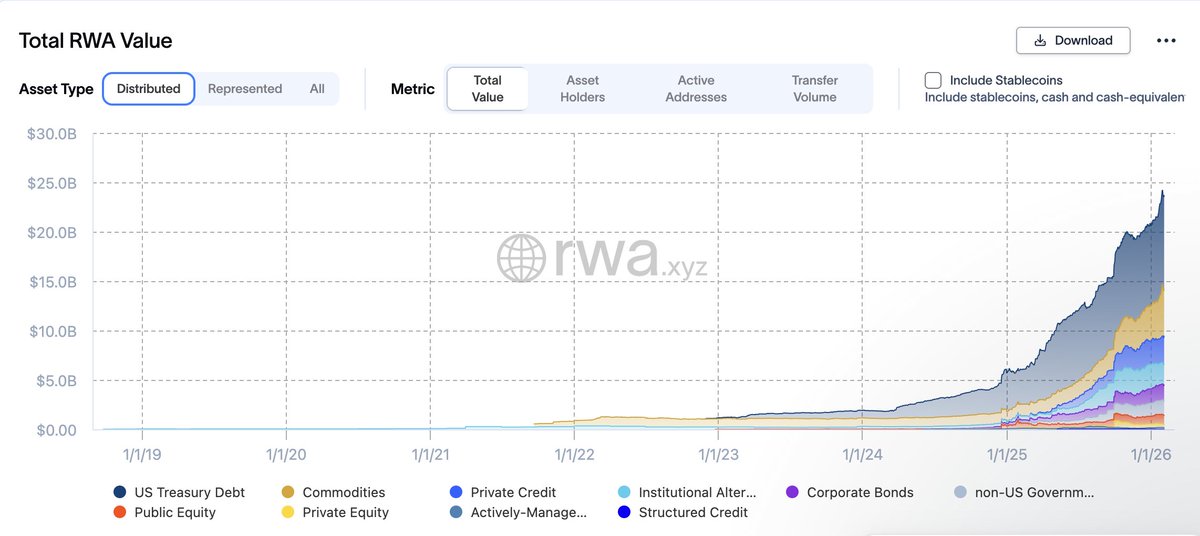

Great conversations on the ground this week with our Founder & CEO Anbu Kannappan. Institutional finance is moving onchain, and Byzanlink is here to build the infrastructure behind it.

Byzanlink was on stage last night at the Tokenized Capital Summit 2026. Really enjoyed the conversations around tokenisation and the infrastructure needed to support institutional onchain capital markets. Good to see so much practical thinking in the room.