Amy C. Arnott

@amycarnott1

Portfolio Strategist, Morningstar Research Services. Important disclosure information. bit.ly/MRS0818

ID: 1260569218728316929

http://www.morningstar.com 13-05-2020 13:55:45

155 Tweet

722 Followers

86 Following

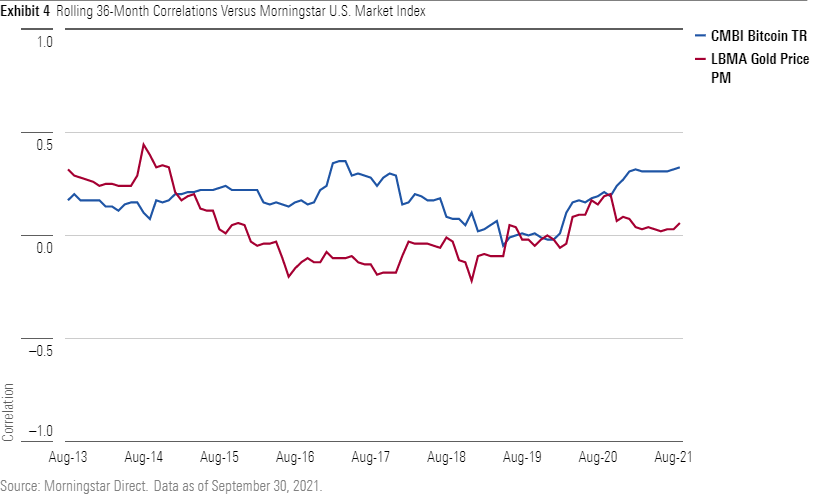

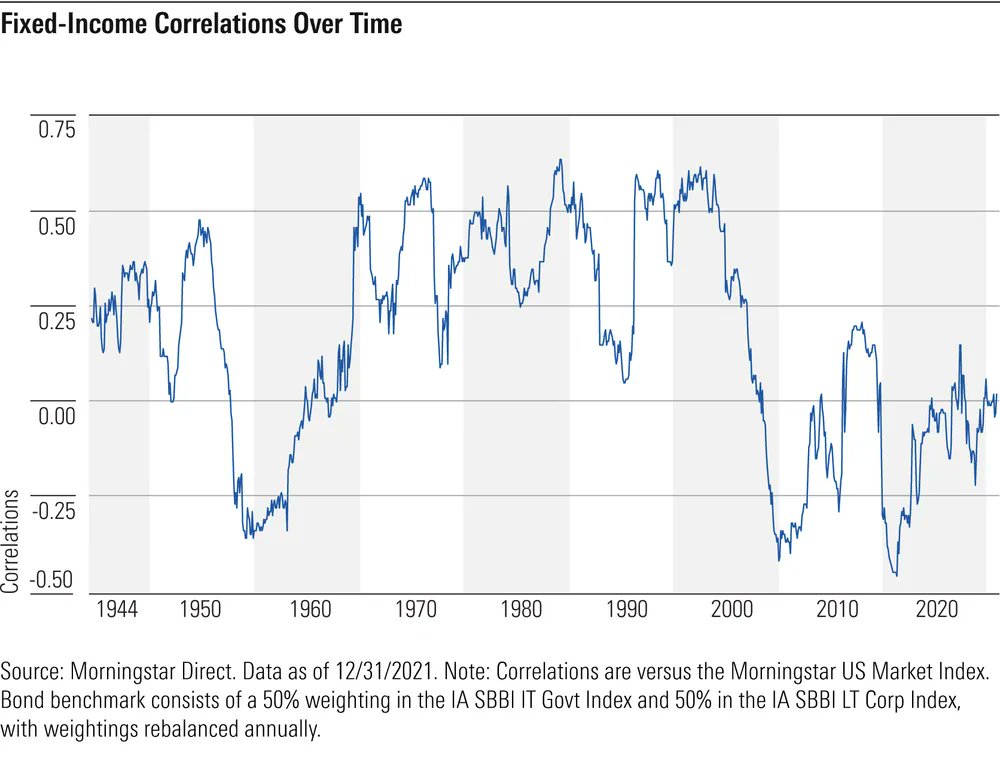

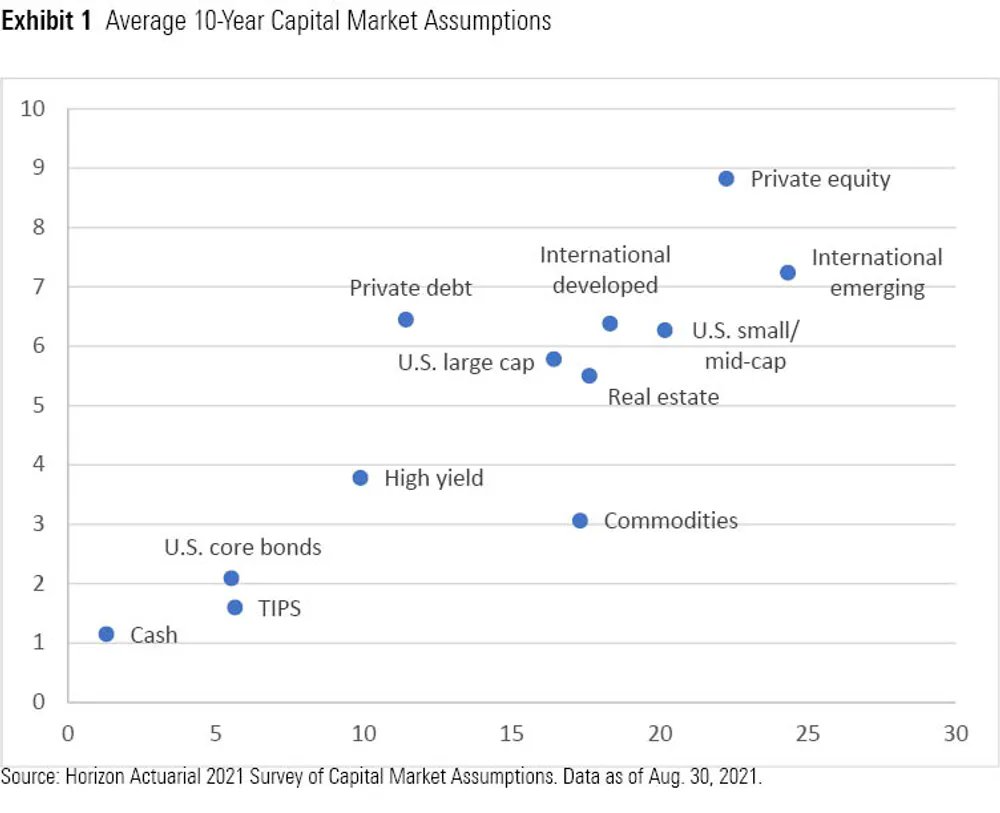

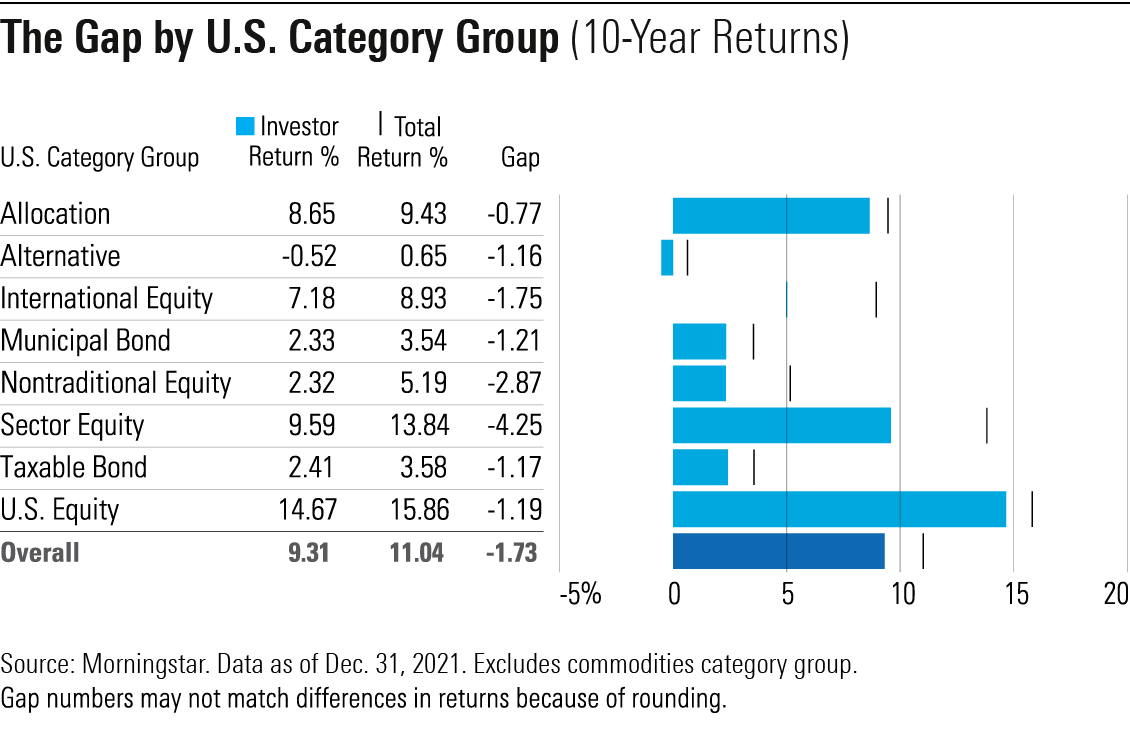

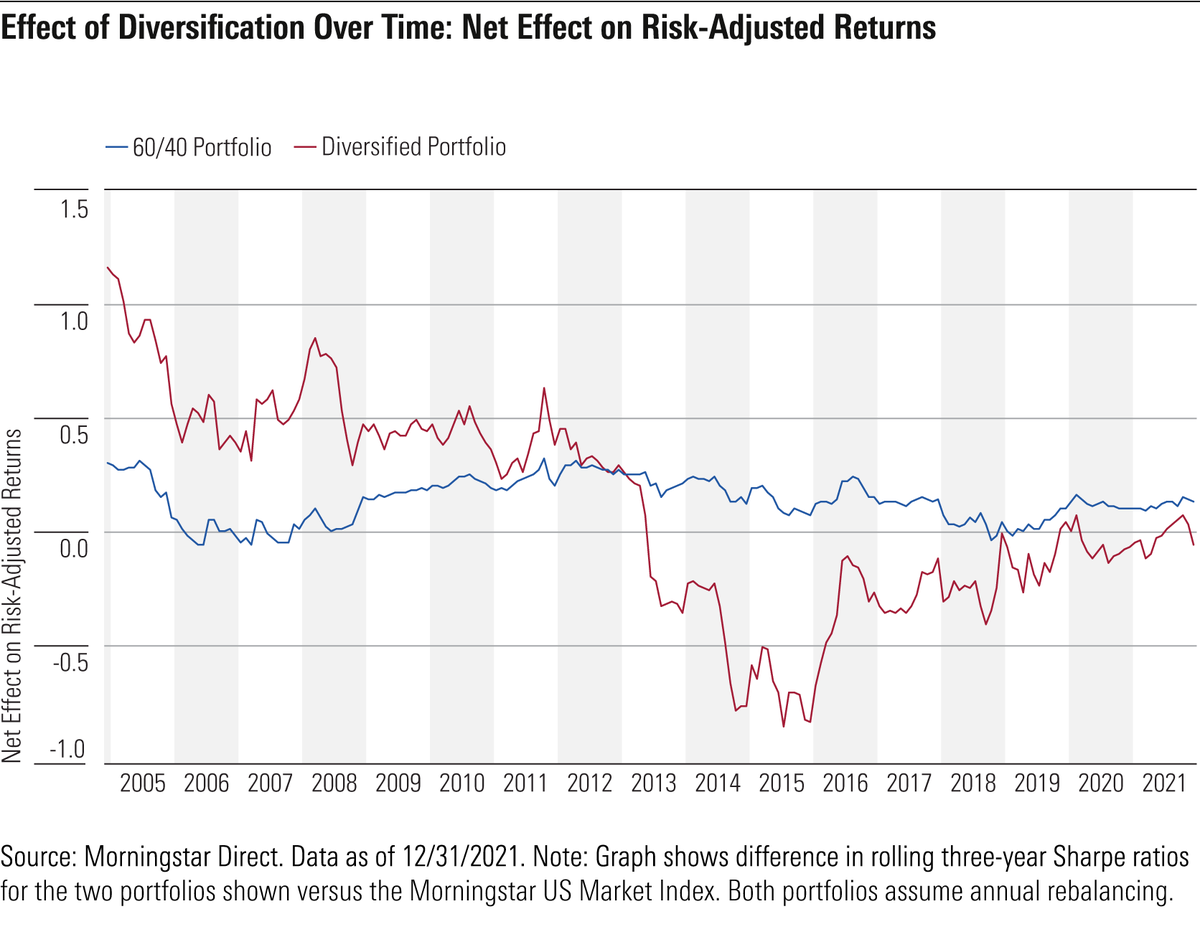

Excited to launch our 2022 Diversification Landscape paper with co-authors Christine Benz and Emory Zink. New this year: a look at what regime changes for interest rates and inflation mean for building diversified portfolios. spr.ly/6010Kj8hw

Excited to announce Morningstar's brand-new Robo-Advisor Landscape Report, which includes our take on 16 leading digital advice providers in the United States. Hats off to co-authors Roberto Rojas, Placeholder, Alec Lucas, Gabriel Dennis, and Liz Templeton. spr.ly/6019KvB4R