Akshay Mehra

@akshay__mehra

in search of the unconventional @hummingbirdvc | writer, musician

ID: 103549023

http://www.akshaym.co 10-01-2010 11:39:54

399 Tweet

937 Followers

751 Following

London peeps — excited to host a fintech x ai breakfast next Friday (july 4) with Akash Bajwa. Come by! More details below:

Lovable crushing it! They're just getting started 🚀 Nikita Andersson Hummingbird Ventures Anton Osika – eu/acc

Congrats to Viswa Colluru and the rest of the team at Enveda! Amazing milestone and we're excited to be on this journey w you Hummingbird Ventures

An excellent piece from Nicholas Chirls on courage being the last true differentiator in venture. nickchirls.com/2025/10/09/cou…

Great to be on with Utsav Somani Dhruv Sharma 🙏

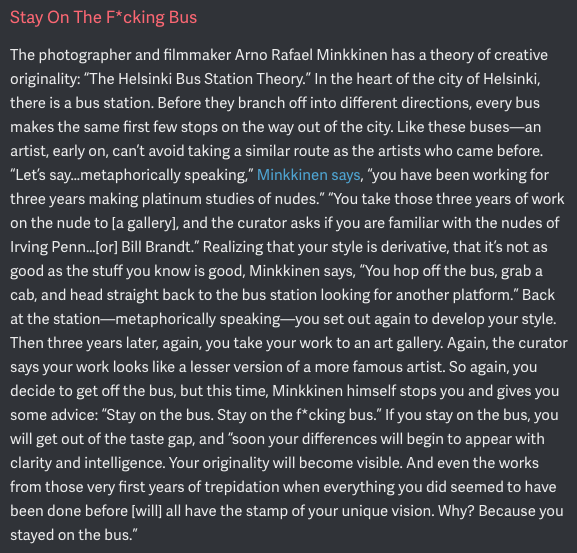

From Billy Oppenheimer's newsletter (check it out if you haven't). A reminder that early work looks like a derivative, but turns into something original only if treated as a craft / infinite game.

This emphasis on exploration + focusing on founders stumbling upon ideas is what makes gradCapital so great. The comfort with ambiguity. It’s a subtle but underrated mindset shift away from the top-down worldview most investors lead with Prateek Behera Abhishek Sethi