David Meier

@davidmeier_tmf

Senior equity analyst at The Motley Fool. Former long-only and long/short fund manager at MFAM and 1623 Capital. Views are my own.

ID: 540259604

29-03-2012 20:35:58

2,2K Tweet

1,1K Followers

619 Following

"Unintended value leakage" has got to be a good garage band name, right Peter Atwater? x.com/MikeBurgersbur…

Today, we pay tribute to a great. Rest in peace, Charlie. Dylan Lewis David Meier open.spotify.com/episode/6OLEBC…

Given the variety of topics discussed, this podcast is so worth your time. Well done, John Rotonti Jr!

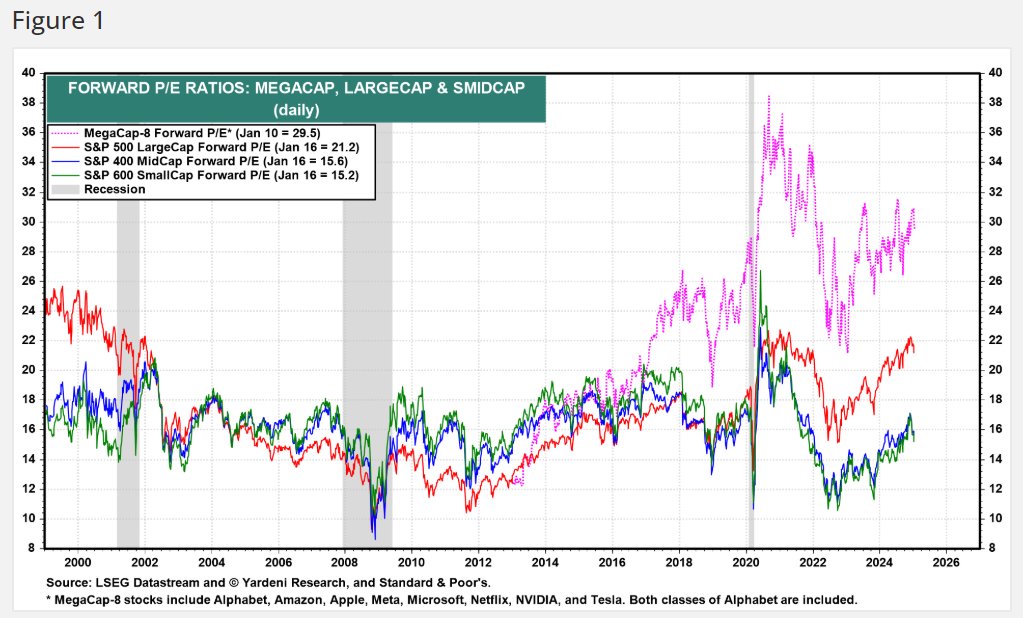

I agree with Puru Saxena here and continue to believe that high-quality small and midcap innovators are still the best place to look for opportunities. (Chart from Yardeni Research yardeni.com/charts/stock-m…)

Delighted to join The Situation Room with Pamela Brown and Jean Chatzky to chat about how investors are reacting to tariffs and how Motley Fool Money listeners are feeling. Thanks for the invite!