David Antin

@davidantin

Private Investor, former CEO of Ned Davis Research @ndr_research & Institutional Investor @iimag

ID: 223961301

07-12-2010 19:58:15

125 Tweet

427 Takipçi

428 Takip Edilen

NDR Weekly Crowd Sentiment Poll highest since 2/2, but still 10 pts below 1/9 record. Add the lowest VIX since Jan. and near-record NFIB small biz sentiment, plenty of confidence all around. Ned Davis Research

Patrick Chovanec argues no good reason why China should be forced to devalue. China should overvalue currency and draw down reserves as part of balancing that needs to take place in global economy to avoid threatening global stability. #NDRInvest

First boss/mentor, late-great #MartyZweig, pioneered concept of “breadth thrusts”...8 times since start of 2018, market’s had days w/ 10x as much down vol as up vol, but not a single day with 10x as much up vol as down vol...troubling divergence Ned Davis Research

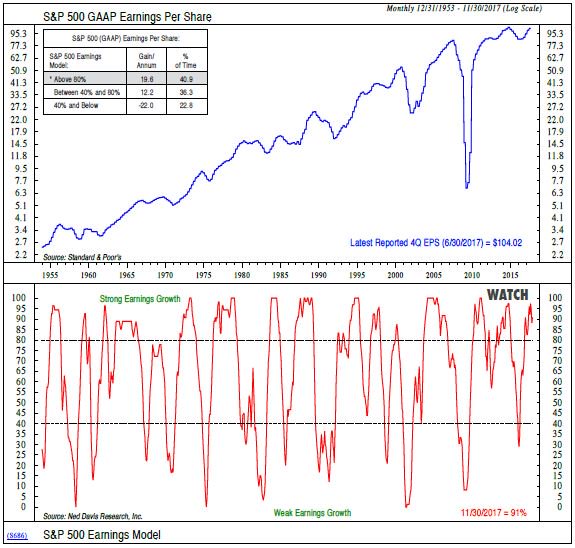

Earnings growth acceleration may be difficult in 2018, even if taxes are cut. Watching $SPX earnings growth model. Deterioration would strengthen case for double-digit #equity correction. bit.ly/2l8ejHe Ed Clissold

Had to end a some point. Longest stretch without a 3% correction in $SPX now in the history books Ned Davis Research

Despite #tradewar banter and choppiness, long-term trends intact. For global allocation stay overweight #equities, underweight #bonds. For regional allocation stay overweight #emergingmarkets. Still bullish on #gold, bearish on $DXY Ned Davis Research bit.ly/2oX3sPj

Don't believe the hype, global #monetarypolicy remains extremely accommodating - Download our latest report from Alejandra Grindal spr.ly/6018DnNXy

Just Announced: Dan Fuss, Deborah Fuhr, ETFGI, Patrick Chovanec , Michael Santoli, and Thornton May have all been added as speakers to the NDR Investment Conference this July! Register now to claim your early bird discount spr.ly/6019Db7WL

Are you an #Advisor looking for some relevant CE credits? Join us at the NDR Investment Conference on July 24 with these industry veterans. CFP credit = 5 hours. CFA/CIPM = provided a certificate of attendance. Ned Davis Research x.com/NDR_Research/s…