Daniel Sotiroff

@danielsotiroff

Morningstar ETF analyst. Runner of long distances. Morningstar Research Services. Important disclosure information. shorturl.at/yCNP3

ID: 3290070889

https://thepfengineer.com/ 24-07-2015 14:38:19

1,1K Tweet

1,1K Followers

389 Following

Income plays an important role in achieving financial goals. Daniel Sotiroff compares 3 types of income-seeking ETFs available to investors: bond, dividend, and covered call ETFs. spr.ly/6014SPh60

.Daniel Sotiroff weighs in on the ETF share class filings awaiting SEC approval and what they could mean for investors spr.ly/6019trtqz

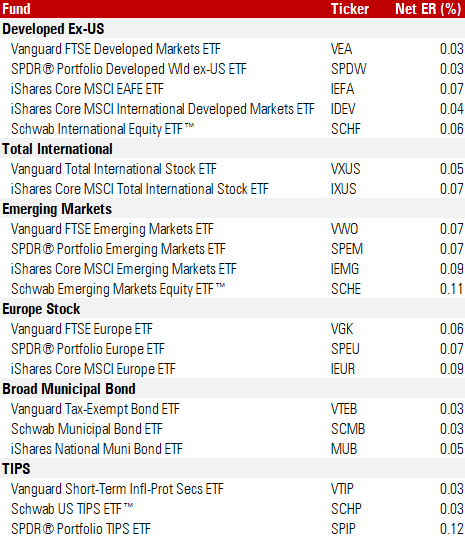

My colleague Daniel Sotiroff adds context and details regarding the widespread fee cuts by Vanguard here: spr.ly/6015xa905

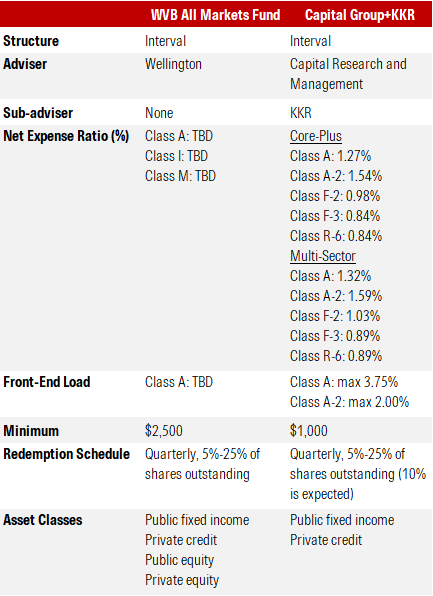

.Daniel Sotiroff asks critical questions about ETFs holding private assets and why the asset management industry is enamored with the convergence of public/private investing. Excellent food for thought to start my morning! morningstar.com/funds/how-priv…

The Vanguard/Wellington/Blackstone interval fund filing is here. (h/t Daniel Sotiroff) Will feature a mix of public and private assets, largely via investments in a mix of Vanguard and Blackstone funds. $2,500 minimum initial investment. sec.gov/Archives/edgar…