Daniel Keiper-Knorr

@d_keiperknorr

VC @Speedinvest ¦ skier ¦

It's better to be off-piste than pissed off.

ID: 826552548941295616

https://www.linkedin.com/in/danielkeiperknorr 31-01-2017 22:07:39

147 Tweet

763 Followers

926 Following

Billie raises €30M for its B2B invoicing and payments platform. Speedinvest = proud seed investor techcrunch.com/2019/07/16/bil…

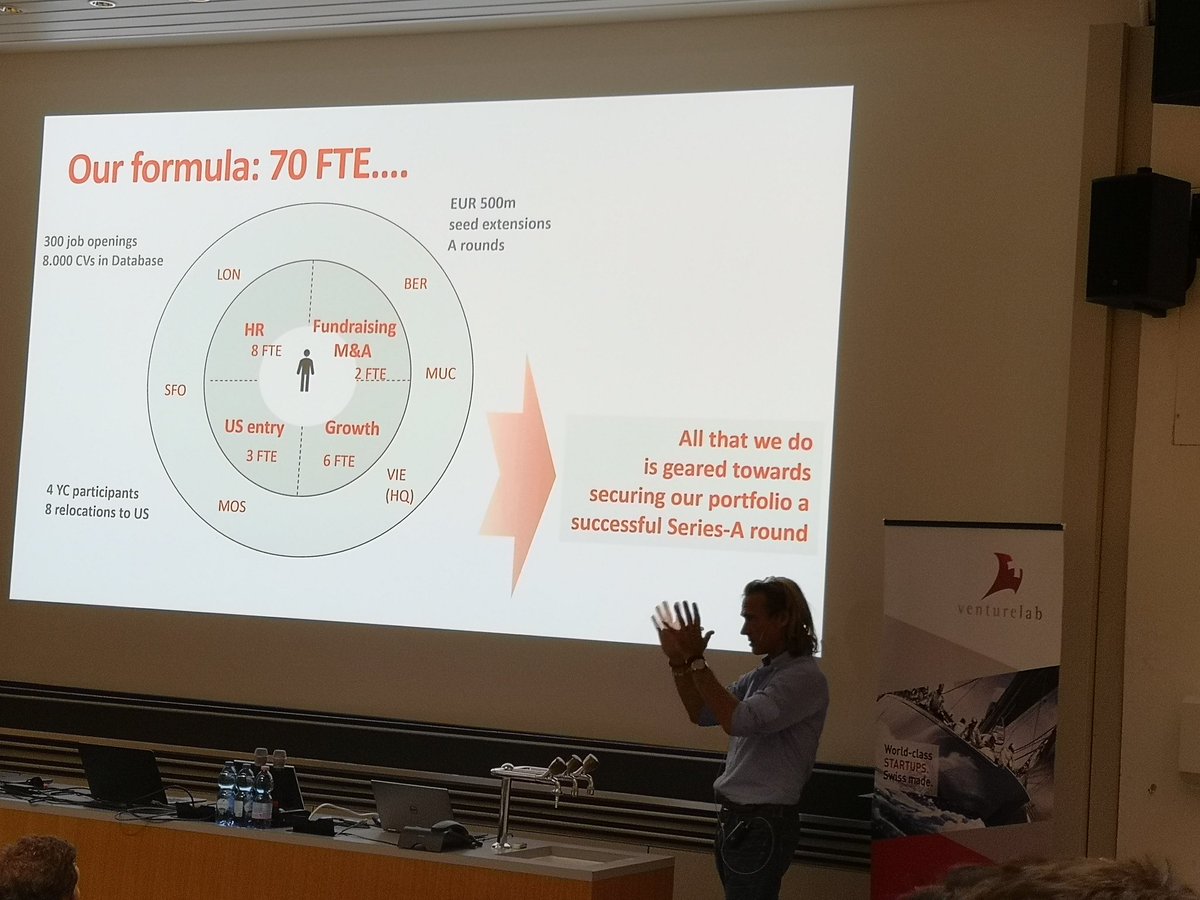

. Daniel Keiper-Knorr presenting the secrete sauce of Speedinvest #vleadersfintech #fintech #vc

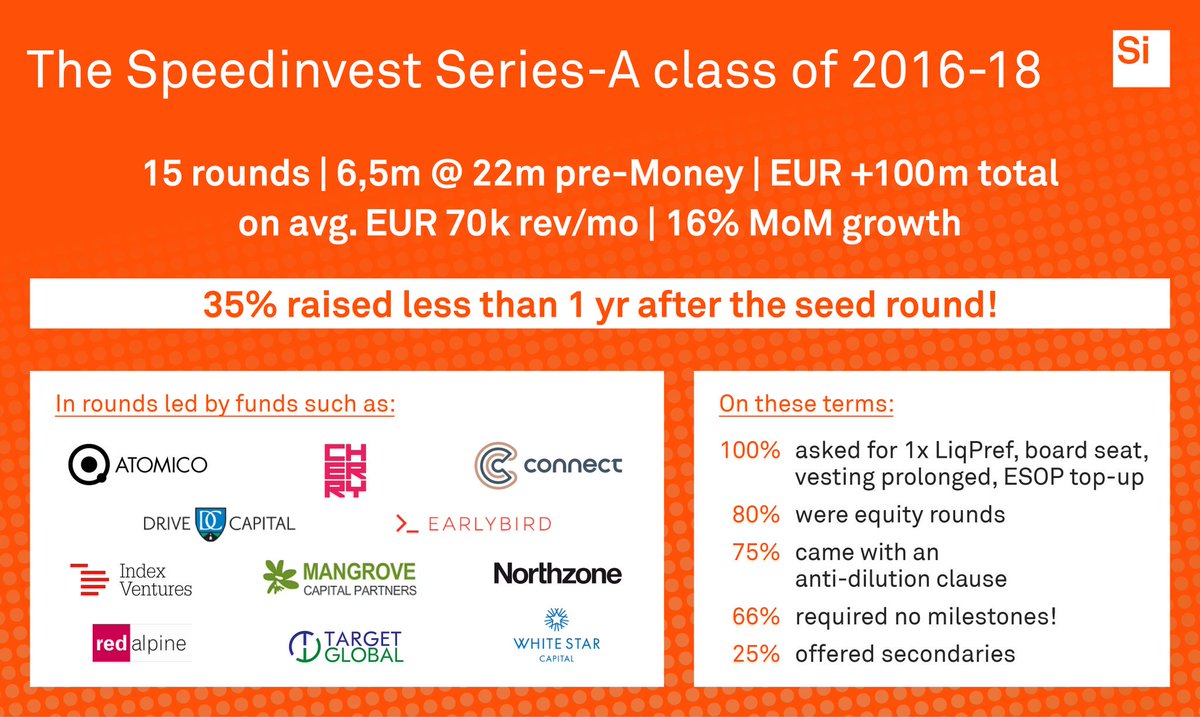

EU vs US in tech VC: this is how EU can close the gap to the US: we have a competitive edge in innovation and engineering. We just have to close the funding gap. Speedinvest thanks @Atomico (Luca Eisenstecken, Tom Wehmeier), Stack Overflow , Austria at the OECD, Dealroom.co for the data

Atomico Sifted Revolut N26 James Clark 📈📉¯\_(ツ)_/¯ Europe has “lower entry valuations compared with the US and Asia, resulting in very capital-efficient investment opportunities,” says Daniel Keiper-Knorr, cofounder and partner at Speedinvest. Daniel Keiper-Knorr SeedInvest

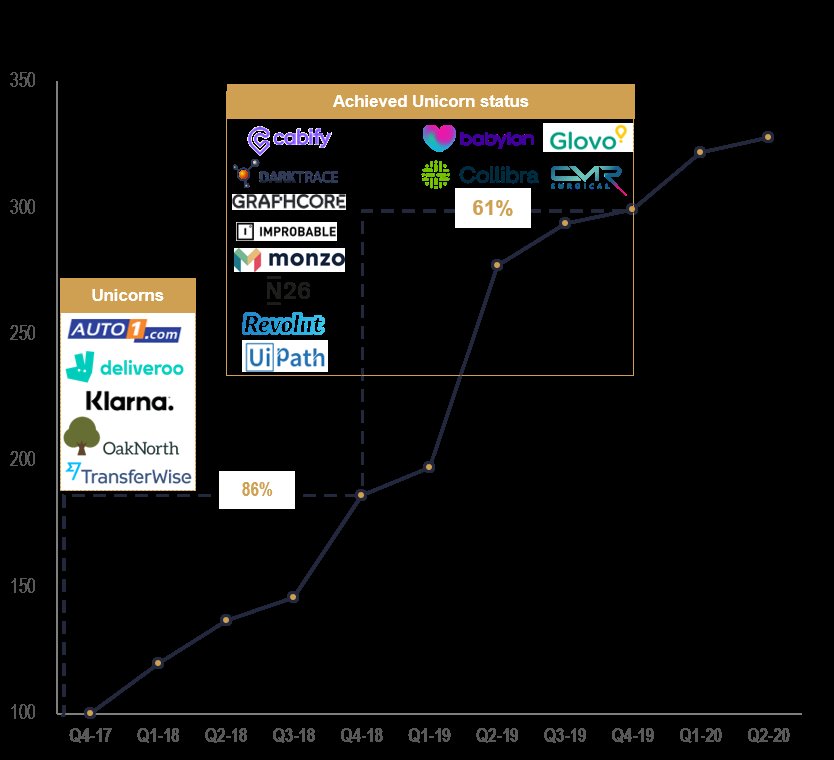

This is the 2017 vintage of European tech scale ups. 3x performance as shown in the new T100 index calculated by Lazard Eamonn Carey Techstars Speedinvest vgb.lazard.com/suv-h12020upda…

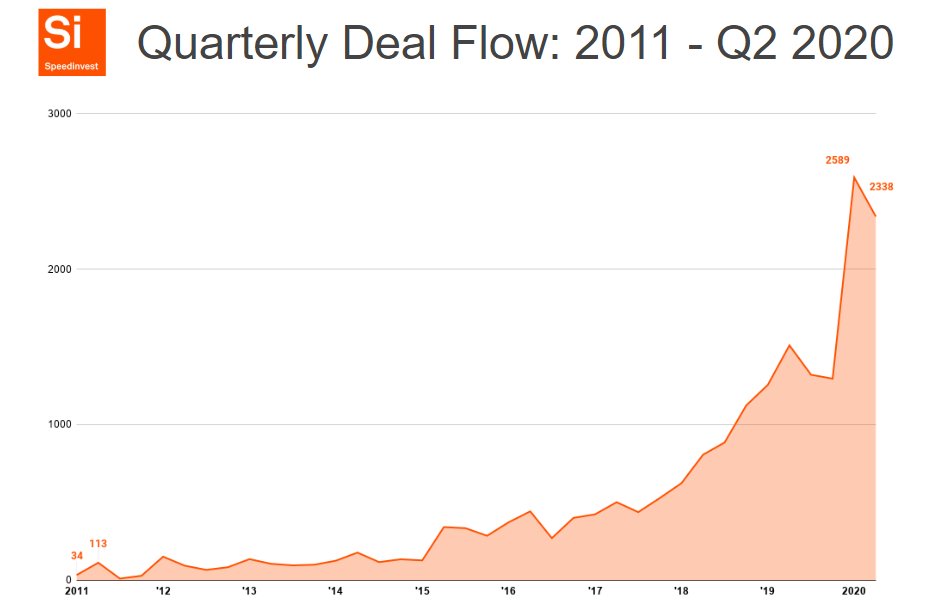

Our dealflow turned into a real dealFLOOD. Speedinvest's current intake rate is 1+ pitchdeck / hour. 24/7. honoured that so many founders consider us to be their partner on their entrepreneurial journey. 🙏

The aver EU tech exit: 17m enterprise value and 80% of all exits below 50m. Do these numbers work for founders & VCs? We discuss today at Latitude59 w/ Eamonn Carey of Techstars , Heikki Haldre of ExitAcademy Places are limited, pls register here: exitacademy.org/exits-exist-la…