Cameron Stewart

@cstewartcfa

CFO, YouTuber, Private Equity and Value Investor.

Learn to Invest Like a Pro: cashflowinvestingpro.com

- Not Financial Advice -

ID: 1367794010

https://www.youtube.com/channel/UCpJRuue8x5Qag2Wz6uAzyjw 20-04-2013 19:12:30

3,3K Tweet

4,4K Takipçi

238 Takip Edilen

Now that the budget bill has passed Congress, we can see what the projections look like for deficits, government debt, and debt service expenses. In brief, the bill is expected to lead to spending of about $7 trillion a year with inflows of about $5 trillion a year, so the debt,

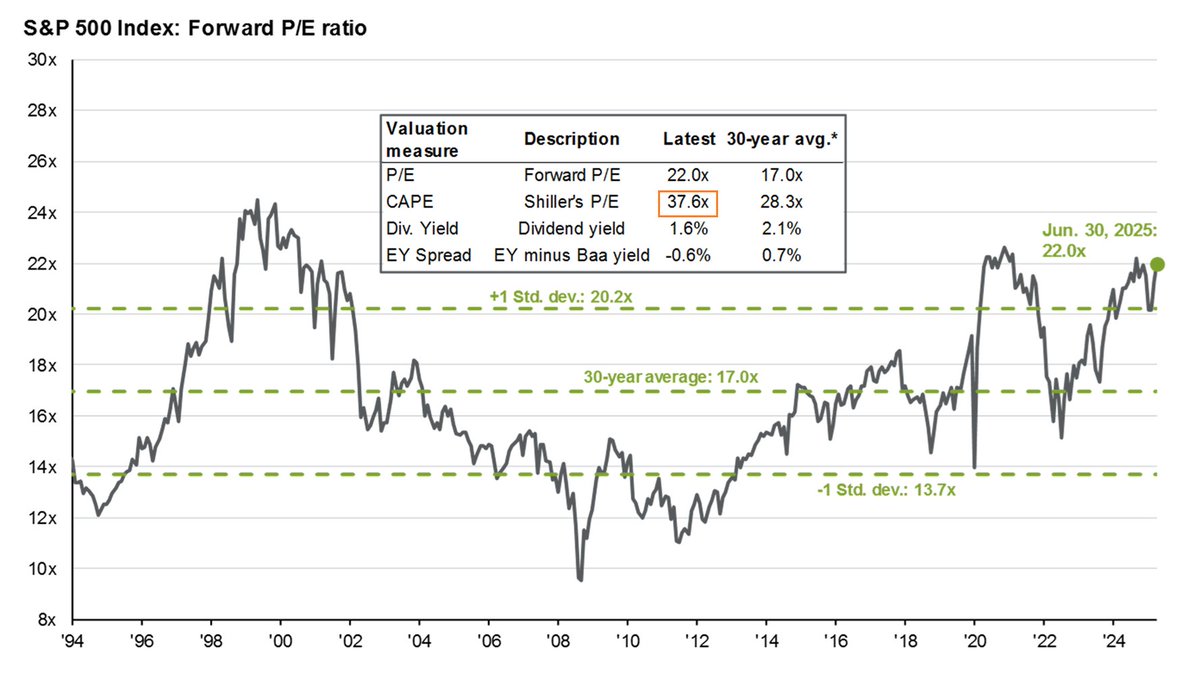

🚨The Shiller P/E ratio on the S&P 500 is higher than it has been 96% of the time in history - EXTREMELY expensive. The price to the last 10 years of earnings average, adjusted for inflation, is 38x, the 2nd-highest since the Dot-Com Bubble. 👇 globalmarketsinvestor.beehiiv.com/p/the-us-stock…