Woetoe

@cryptoswoetoe

I tend to do alright on perfect one minute candle entries for longs on #Bitcoin and some alts. Join my free Telegram group: t.me/cryptowoetoe

ID: 570069440

http://linktr.ee/cryptowoetoe 03-05-2012 15:42:52

2 Tweet

24 Followers

690 Following

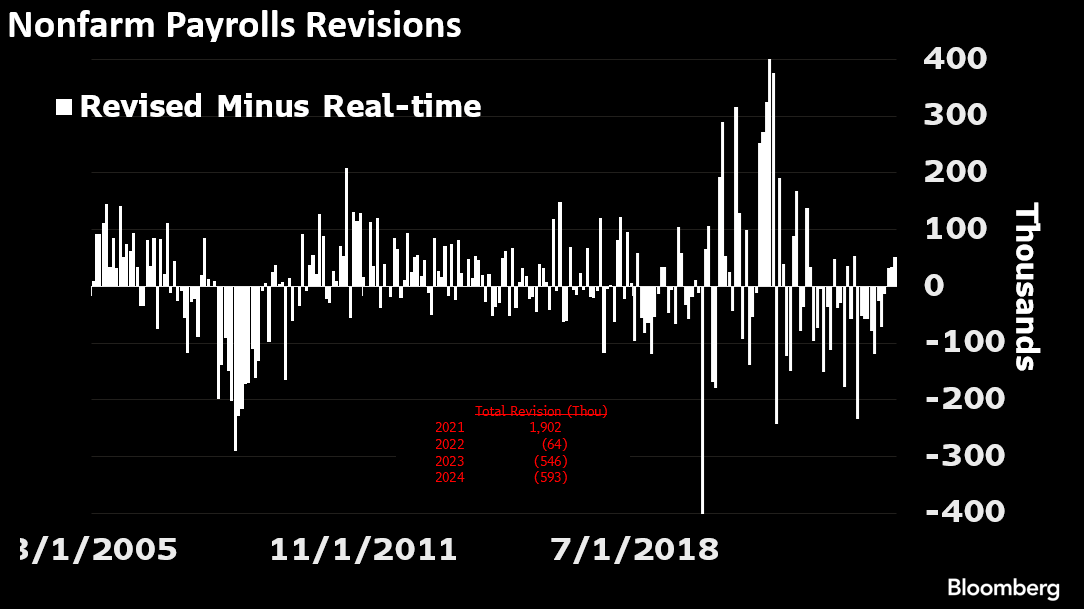

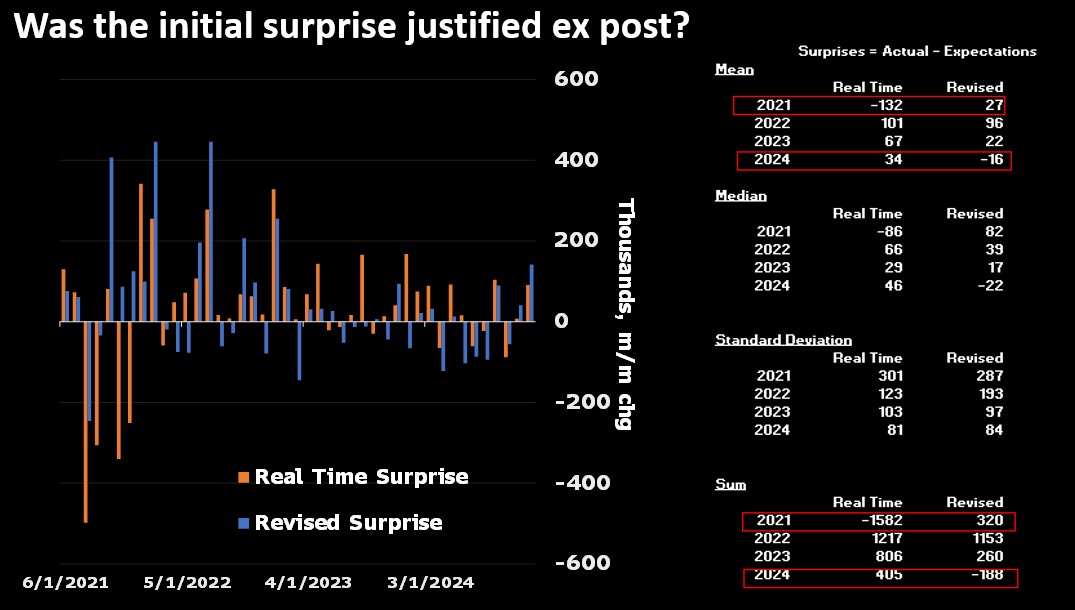

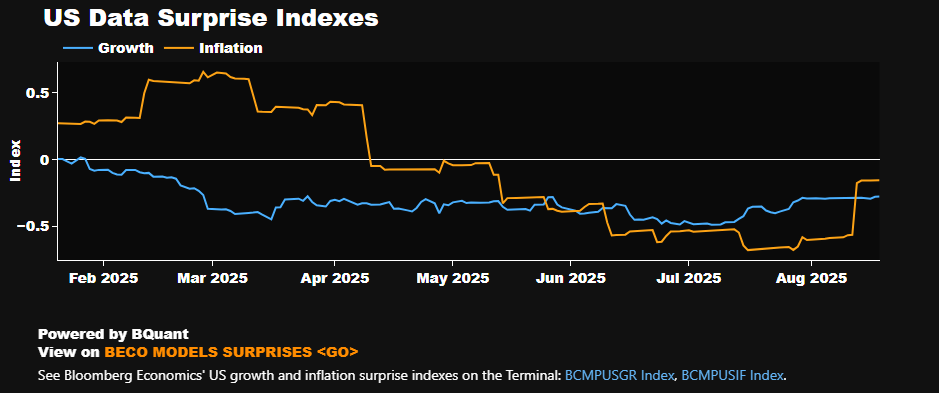

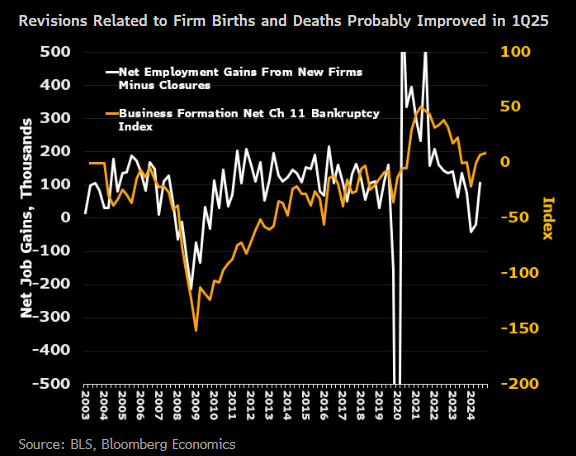

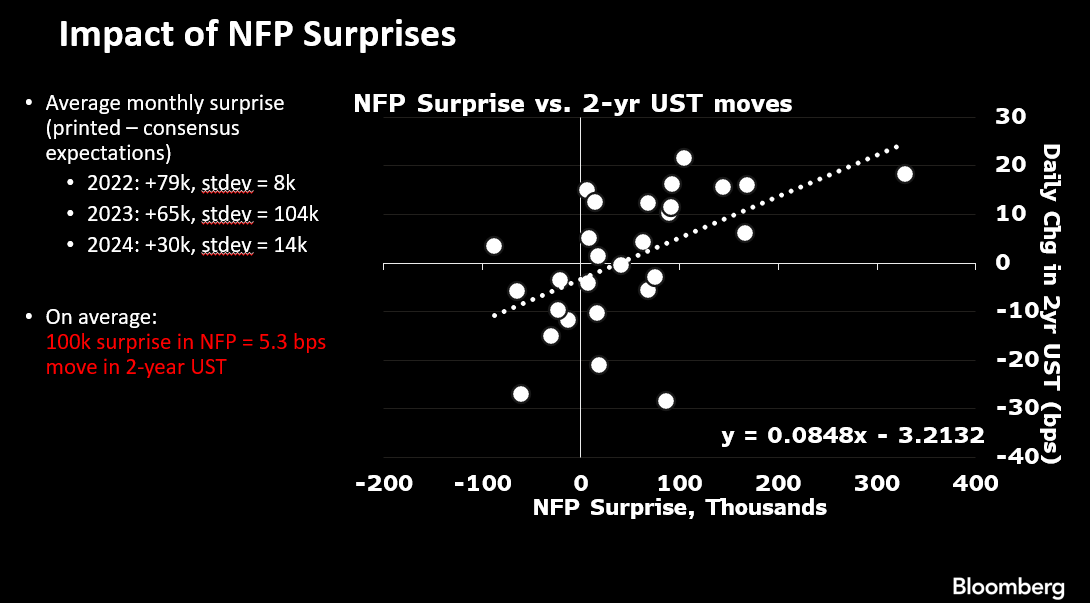

To answer Guy Berger's question, here are some of my slides in the NABE panel "Ensuring the Quality of US Statistics" on March 3, 2025. 1. First, real time NFP surprises drive market moves. We all know that. On average, every 100k surprise = about 5 bps move in 2year.

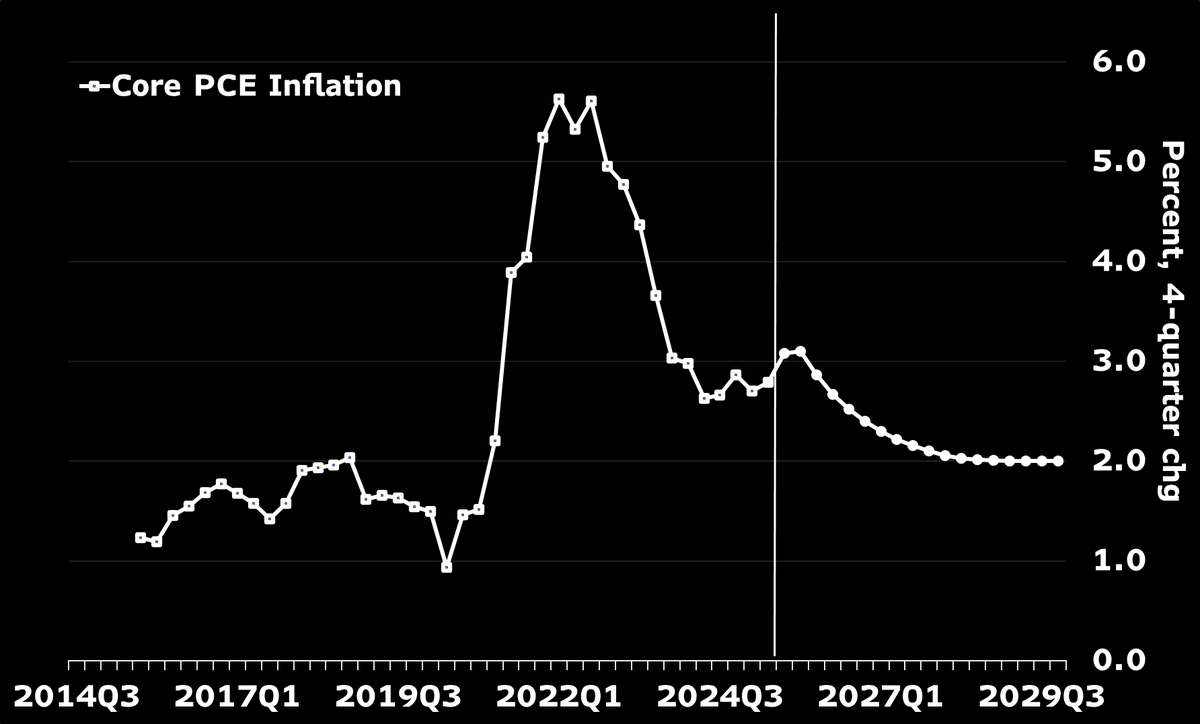

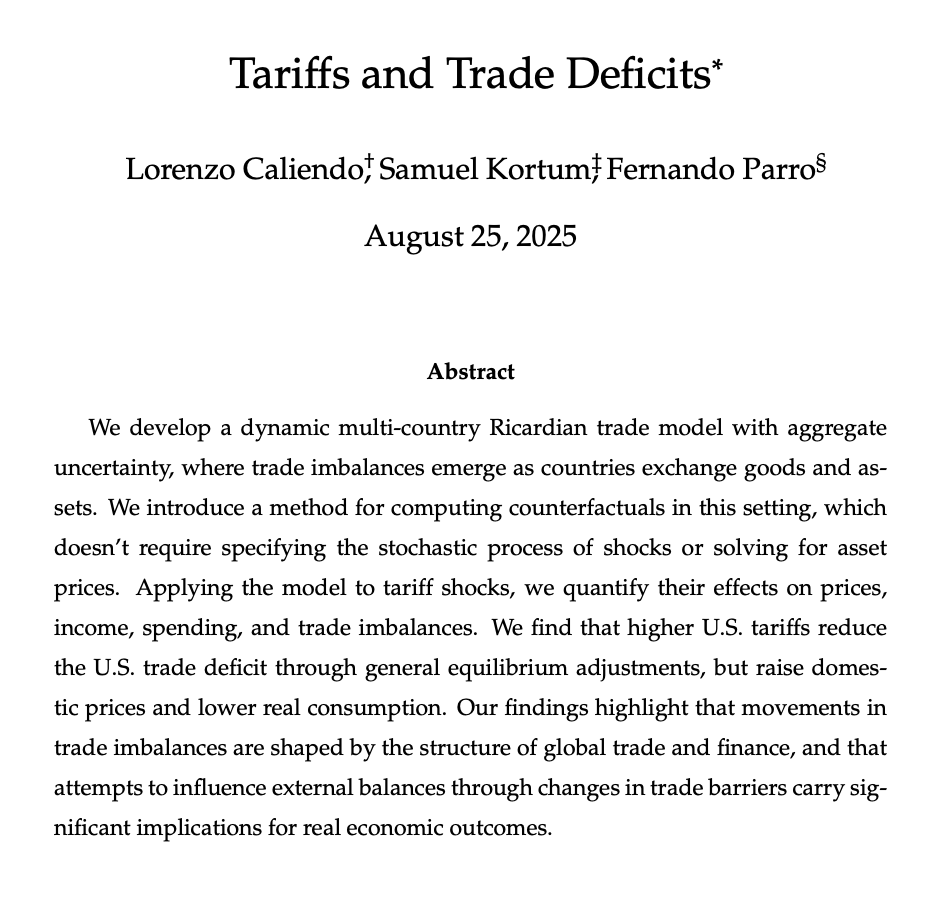

My full piece Bloomberg Terminal "Jackson Hole Pivot May Not Be the One Markets Want" blinks.bloomberg.com/news/stories/T…

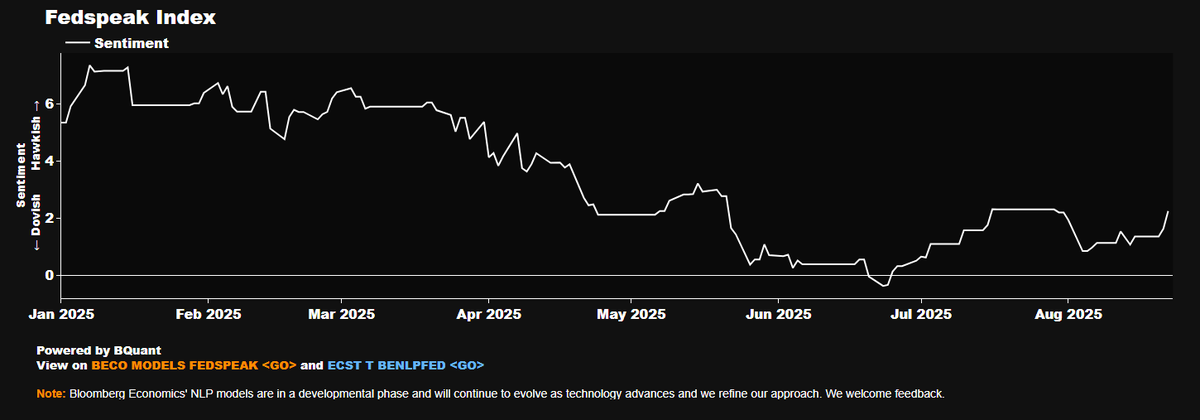

I explain what I hear that made me judge this speech as NOT DOVISH. Bloomberg Terminal blinks.bloomberg.com/news/stories/T…