Olivia Vande Woude

@cryptoreine

BD @avalabs 🔺 || former @troweprice || @shefiorg 💫 || @williamandmary || Opinions are my own & not the views of my employer || 🇺🇸

ID: 1347249764350484485

07-01-2021 18:32:38

1,1K Tweet

1,1K Followers

3,3K Following

High-quality asset supply ✅ Distribution channels for said high-quality asset supply ✅ Powered by Avalanche🔺

"Finality in a few minutes" doesn’t cut it for capital markets. Avalanche🔺 delivers hard settlement in ~1 second, with no probabilistic risk, rollup complexity, or forks to unwind. If you’re collateralizing credit or processing redemptions, this matters.

Finance doesn’t run on bridges, but rails. Legacy systems have had SWIFT, capital markets have FIX... You don’t route billions via 3rd-party middlemen & call it infrastructure. With Avalanche🔺 there are no bridges, fragmentation... simply deterministic, cross-chain settlement

With Avalanche🔺's Granite upgrade, block times may become flexible... enabling sub-2s settlement & tailored performance per chain. A sampling of onchain finance use cases unlocked: -Real-time FX settlement -High-speed DeFi execution -Automated margining in derivatives

how I envision the Avalanche🔺 Granite upgrade potentially enabling validators to dynamically adjust their preferred blocktime, potentially accelerating block production + confirming transactions faster. 🔺

tokenization is about putting equities on Avalanche🔺 and doing it right

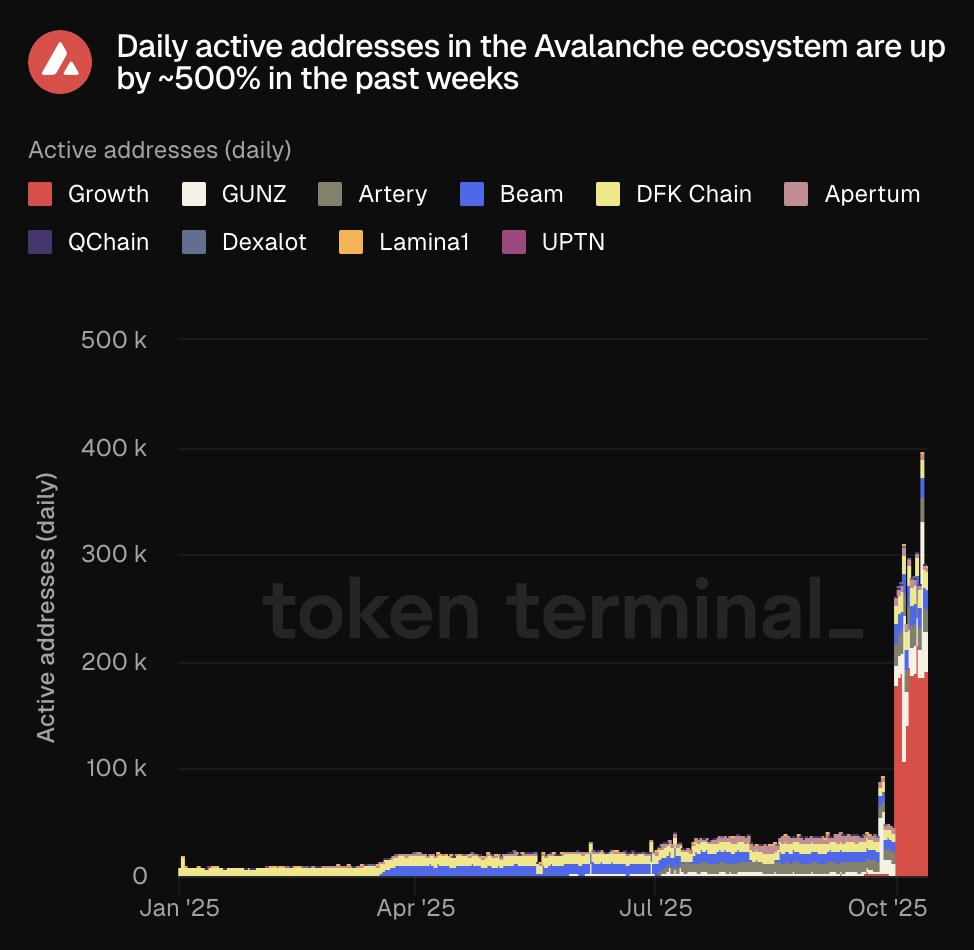

🔺👥 ICYMI: Daily active addresses in the Avalanche🔺 ecosystem are up by ~500% in the past weeks.