Center for Responsible Lending

@crlonline

We are a non-partisan research, analysis and advocacy organization focused on creating #FinancialFairness and economic opportunity for all.

#DefendCFPB

ID: 19770715

http://www.responsiblelending.org 30-01-2009 15:04:58

13,13K Tweet

6,6K Takipçi

1,1K Takip Edilen

“The overdraft fee rule close(d) a paper-check era loophole that has allowed big banks to trick people into paying excessive overdraft fees and earn billions in profits from some of their most vulnerable customers,” wrote @ChuckBell Consumer Reports Advocacy. loom.ly/IOiGAyA

91-year-old veteran faces snowballing payday loan with 682% interest rate. Stephanie Sierra @ABC7NewsBayArea #StopTheDebtTrap "You reach out in a moment of desperation and then they lock you in... But this isn't credit. This is real harm," Ellen Harnick, CRL loom.ly/_KNOn9s

"Today, they are slashing the [CFPB]'s budget by 70%. This is ridiculous because the Bureau has saved American consumers $21 billion by returning to them funds that big banks and predatory lenders swindled out of them." -House Committee on Financial Services - Democrats Ranking Member Maxine Waters #HandsOffCFPB

The truth is that Section 1071 serves compelling national interests whose benefits far outweigh its modest costs. loom.ly/j3WWxyQ Mike Calhoun @TheOpenBanker

"Julian Bond had a message for younger people: Your time is now. Your time is now and it is important to step up and fulfill your destiny," Wade Henderson Wade Henderson, Vice Chair CRL Board of Directors. Learn more and get involved at julianbondinstitute.org

NAACP of Maryland, Unions, and Consumer Advocates Urge Governor Wes Moore to Veto Bill that Legalizes Predatory Payday Loans and Weakens Ban on Lending Discrimination #StopTheDebtTrap loom.ly/mlSxXo4

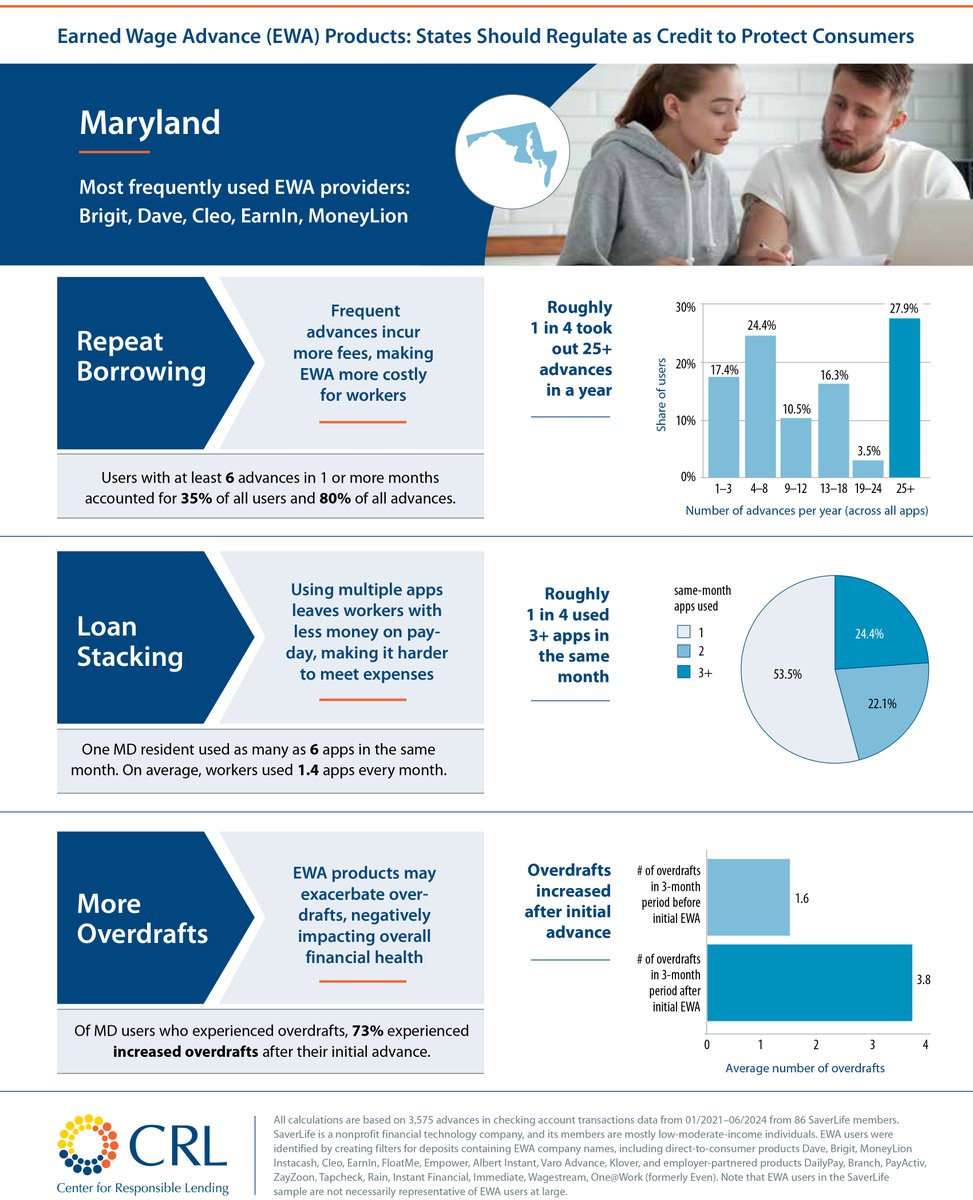

On Governor Wes Moore's desk sits #HB1294, which would give predatory, app-based payday lenders a legal green light🟢💡to exploit Marylanders. 𝐓𝐡𝐞 𝐠𝐨𝐯𝐞𝐫𝐧𝐨𝐫 𝐬𝐡𝐨𝐮𝐥𝐝 𝐯𝐞𝐭𝐨 𝐭𝐡𝐢𝐬 𝐛𝐢𝐥𝐥. #ProtectConsumers #StopTheDebtTrap #Fintech marylandmatters.org/2025/05/10/leg…

Legalizing Exploitation: Why Maryland Must Reject Predatory Lending Apps Governor Wes Moore loom.ly/gMuwlPk

Julian Bond recognized that the passage of civil rights laws would not be enough to bring about justice. There had to be economic opportunity. If you didn't have the means to live a meaningful life, then your life was still held back by the legacy of discrimination. ~Mike Calhoun

Julian Bond's commitment to civil rights activism was reinforced by his time at Morehouse College College where he studied under Martin Luther King, Jr. Learn more at the new Julian Bond Institute for Financial Equity Research: loom.ly/diRkO38

She Escaped Her Abuser. But Not Before He Buried Her in Debt. katie herchenroeder Mother Jones loom.ly/AthOwMA