RBA

@corptrader

Robert Agans CFA®, FRM®. Credit Trader & Macro-Credit Analyst. Developed a proprietary multi-factor credit model & credit market timing mechanisms.

ID: 113971634

13-02-2010 17:10:18

5,5K Tweet

1,1K Followers

246 Following

Spring vacation reading has arrived! Congratulations Lawrence McDonald on your big day. Best wishes to you, your family and the The Bear Traps Report team

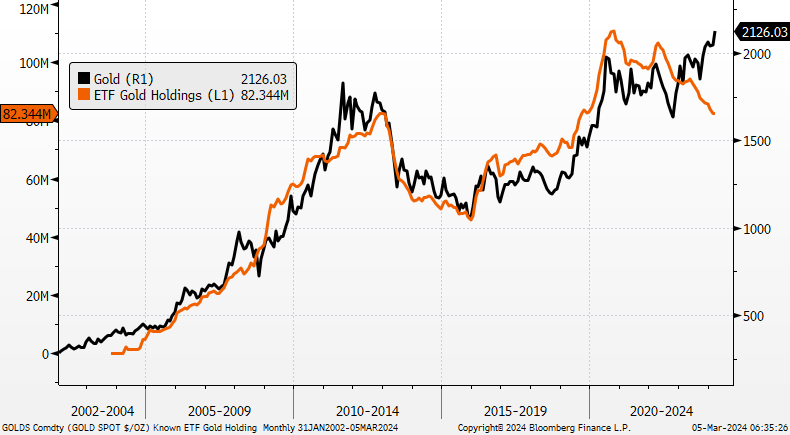

yesterday Treasury Secretary Scott Bessent stated the need to price credit risk out of US govt debt and President Donald J. Trump flagged "one of the most important announcements that have been made in many years about a certain subject" soon find out why all that Gold was re-patriated back to US soil, perhaps