Christian Flanders

@cflanders_7

Independent Trader. Aiming for SUPER PERFORMANCE in the stock market. USIC 2024 2nd Place +433%. Avia tennis player.

ID: 2468597881

29-04-2014 02:20:59

376 Tweet

5,5K Takipçi

369 Takip Edilen

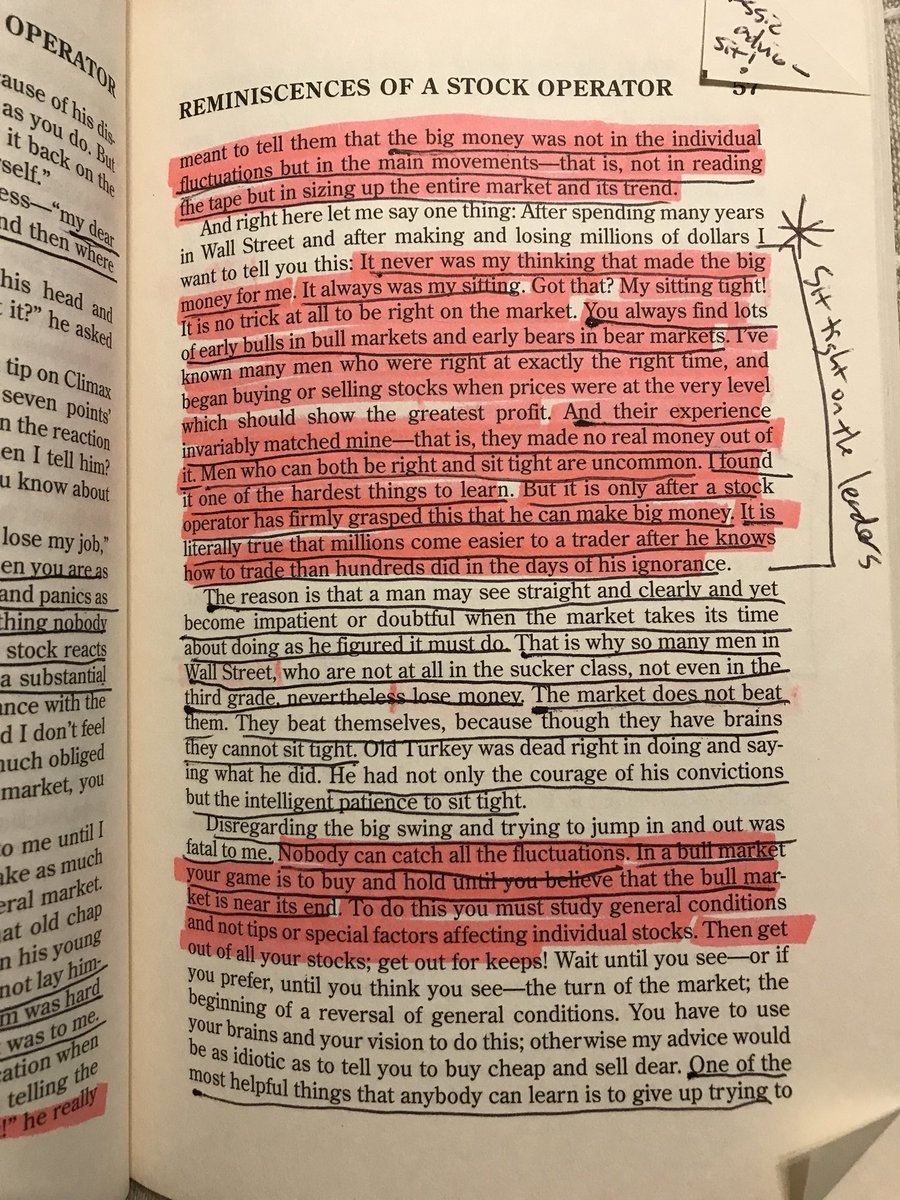

Last night, Oliver Kell shared this with me — felt like the need of the hour. In a world full of noise, it’s a solid reminder: cut the distractions, focus up, and lock in. Reminiscences of a Stock Operator mode: ON 🫡📈