Cetera Investment Management

@ceteraim

Cetera Investment Management LLC, owned by @CeteraFinancial, provides market perspectives, portfolio guidance & other investment advice to its affiliated firms.

ID: 2183019032

https://www.cetera.com/cetera_investment_management 08-11-2013 21:22:30

4,4K Tweet

2,2K Followers

697 Following

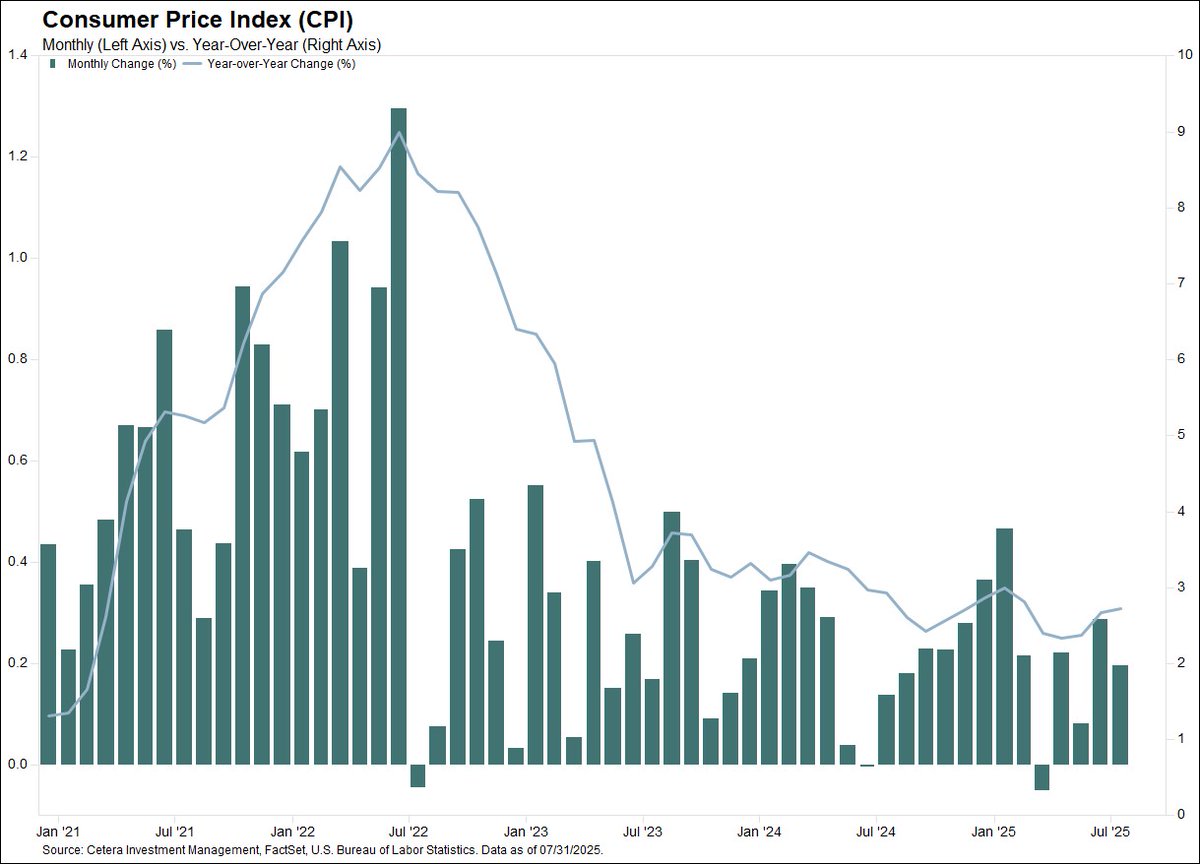

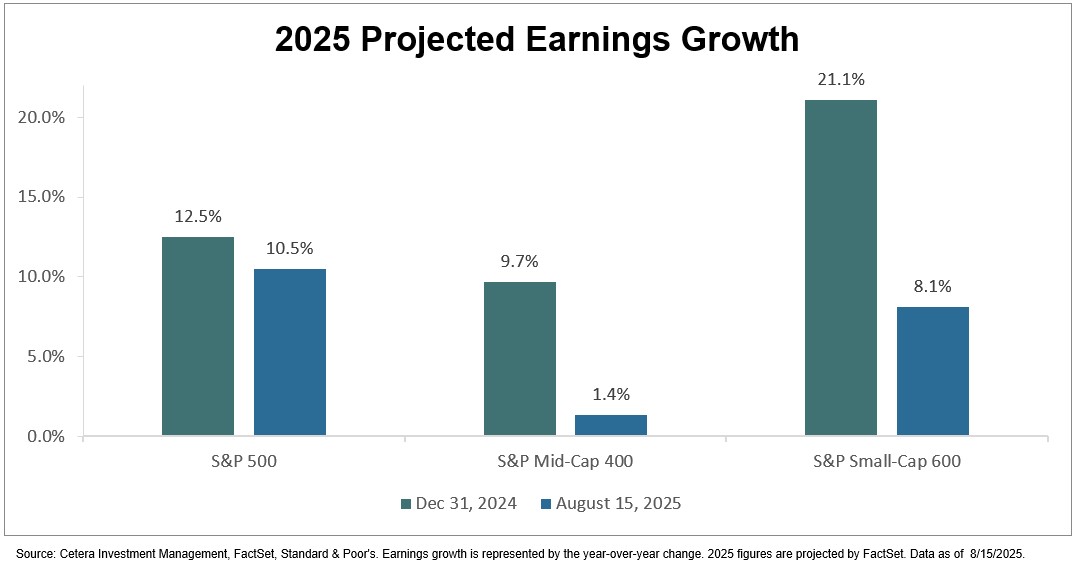

With markets focused on this week’s CPI report, inflation may be about to surprise — and not in the way investors hope. Join CIO Gene Goldman, CFA on this week’s episode of #TheWeekAhead as he breaks down why CPI could come in hotter than expected, what that means for Fed policy, and

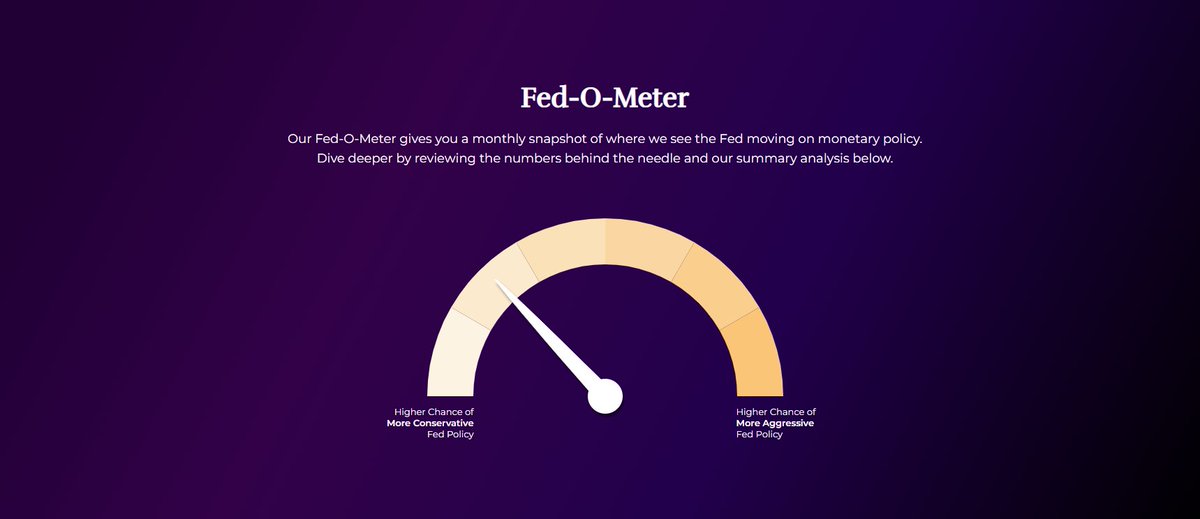

With Fed Chair Jay Powell set to speak at the Fed’s Jackson Hole Symposium this Friday, markets are watching closely for clues on interest rates, inflation, and central bank independence. Join CIO Gene Goldman, CFA on this week’s episode of #TheWeekAhead as he breaks down the three