CelestialEye

@celestialeye_

GM!

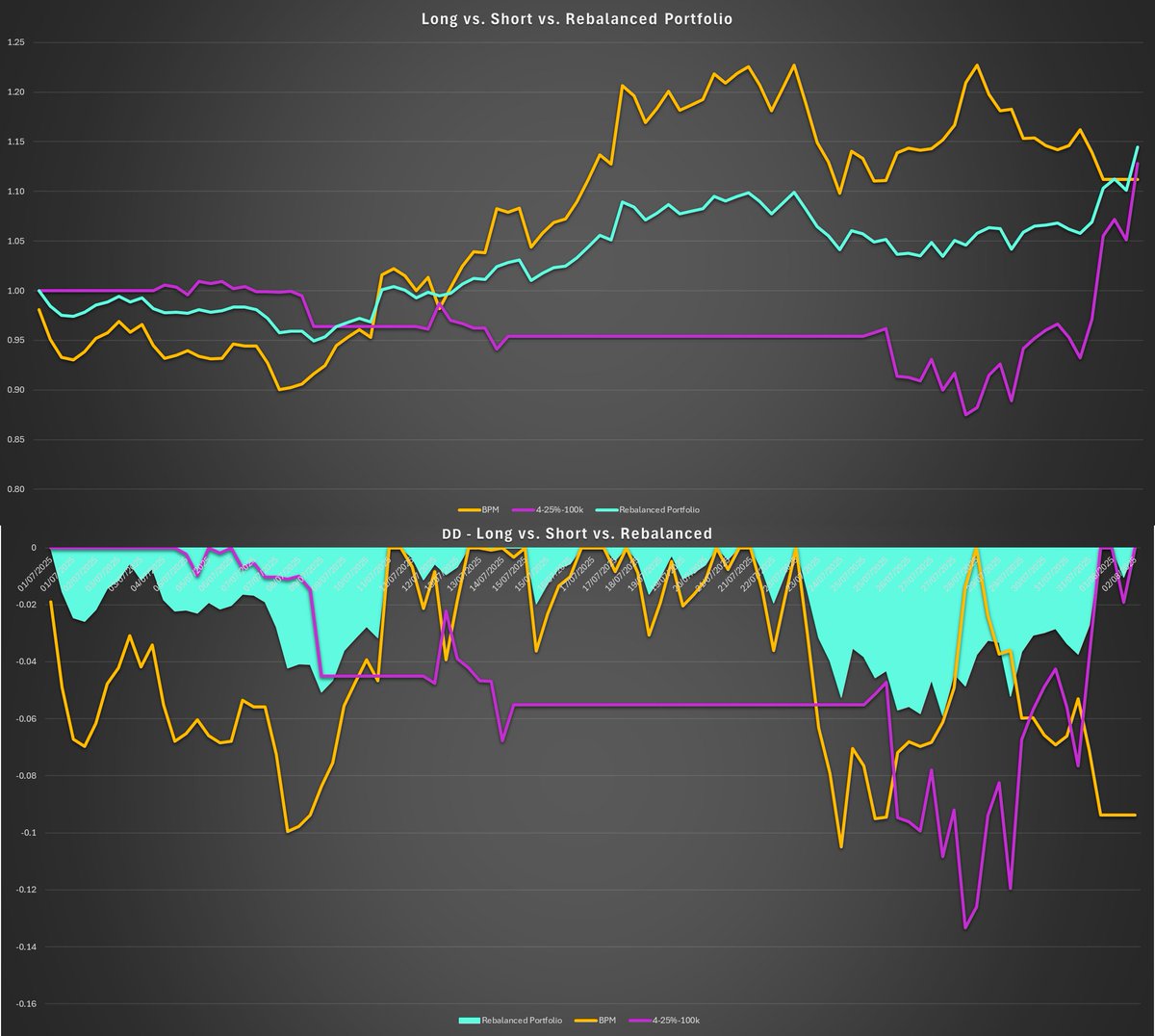

Trading by chance ❌ ➡ Systems & Algos 🚀

Creating Portfolios that work.

QuantraSystems - Co-founder and Developer 💻 👇

@QuantraBase

ID: 1597973536639008770

https://www.quantra.ai/links/ 30-11-2022 15:24:23

830 Tweet

585 Followers

183 Following