CA Pradeep Kumawat

@capradeepkumaw1

Chartered Accountant

ID: 1288733263243042816

30-07-2020 07:09:08

146 Tweet

1,1K Takipçi

1 Takip Edilen

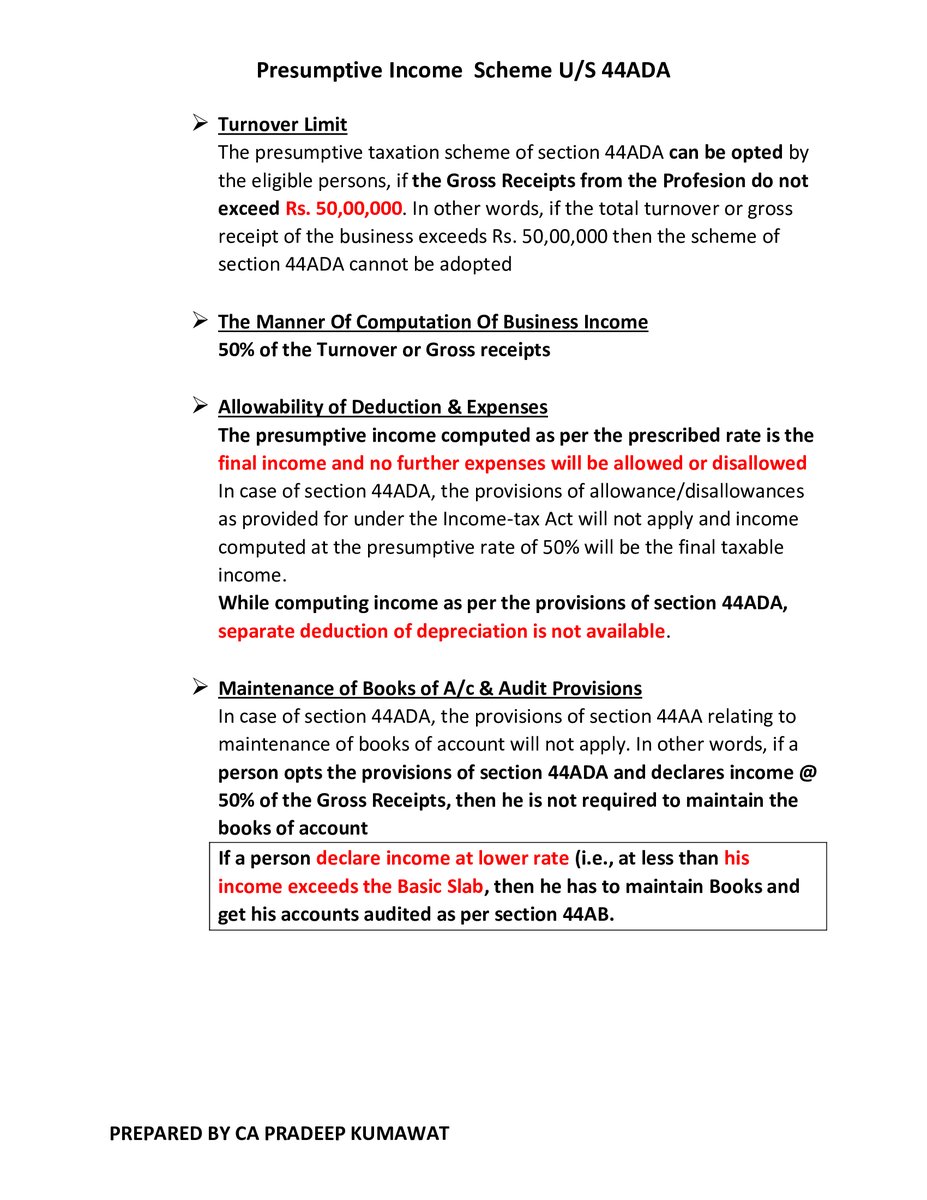

Important aspects regarding Presumptive Income U/s 44ADA Taxation Updates (CA Mayur J Sondagar) Abhas Halakhandi CA Akhil Pachori Abhishek Raja "Ram" Tilotama Vikram CAclubindia Saurin Shah Pratibha Goyal Bhanwar Borana CA Kuldeep KD - Chairman ICAI Jaipur (22-23) Tax Guru CA Chirag Chauhan Dinesh Wadera

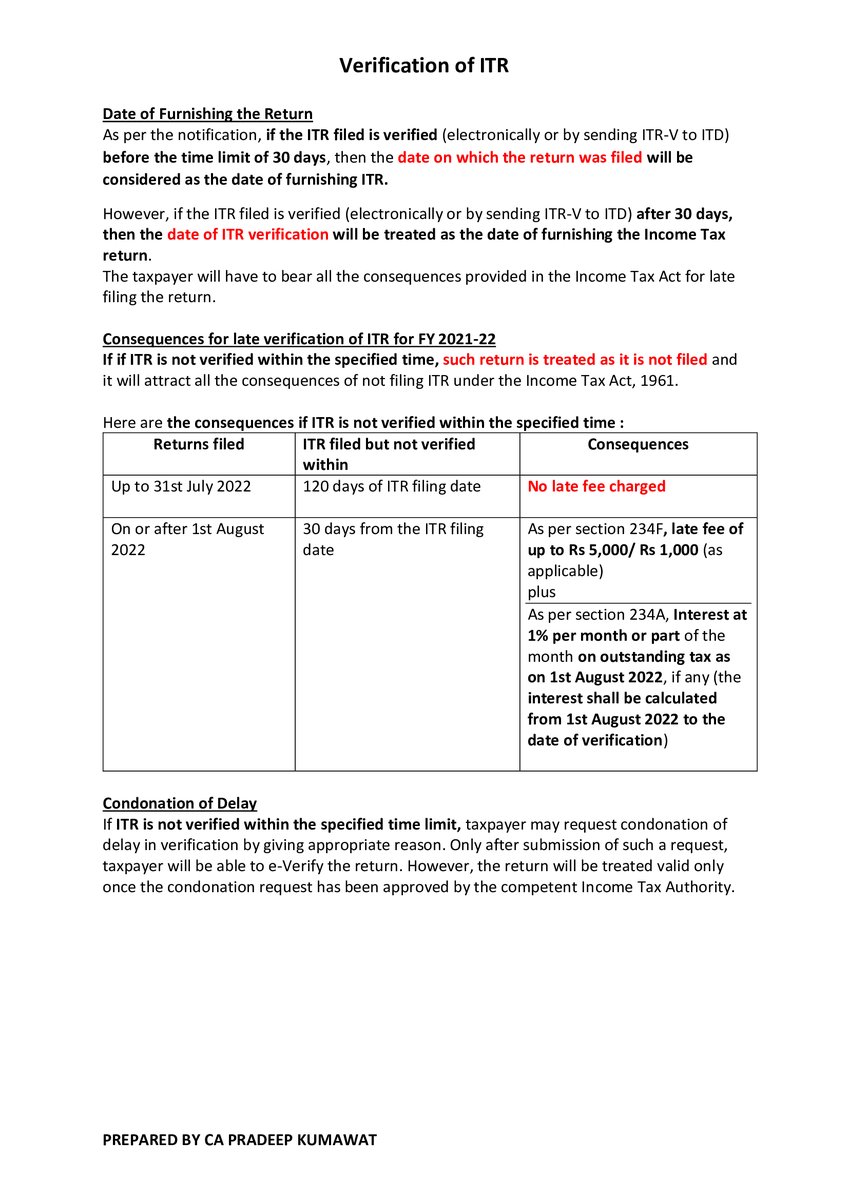

Important aspects regarding Verification of ITR Taxation Updates (CA Mayur J Sondagar) Abhas Halakhandi CA Akhil Pachori Abhishek Raja "Ram" Tilotama Vikram CAclubindia Saurin Shah Pratibha Goyal Bhanwar Borana CA Kuldeep KD - Chairman ICAI Jaipur (22-23) Tax Guru CA Chirag Chauhan Dinesh Wadera

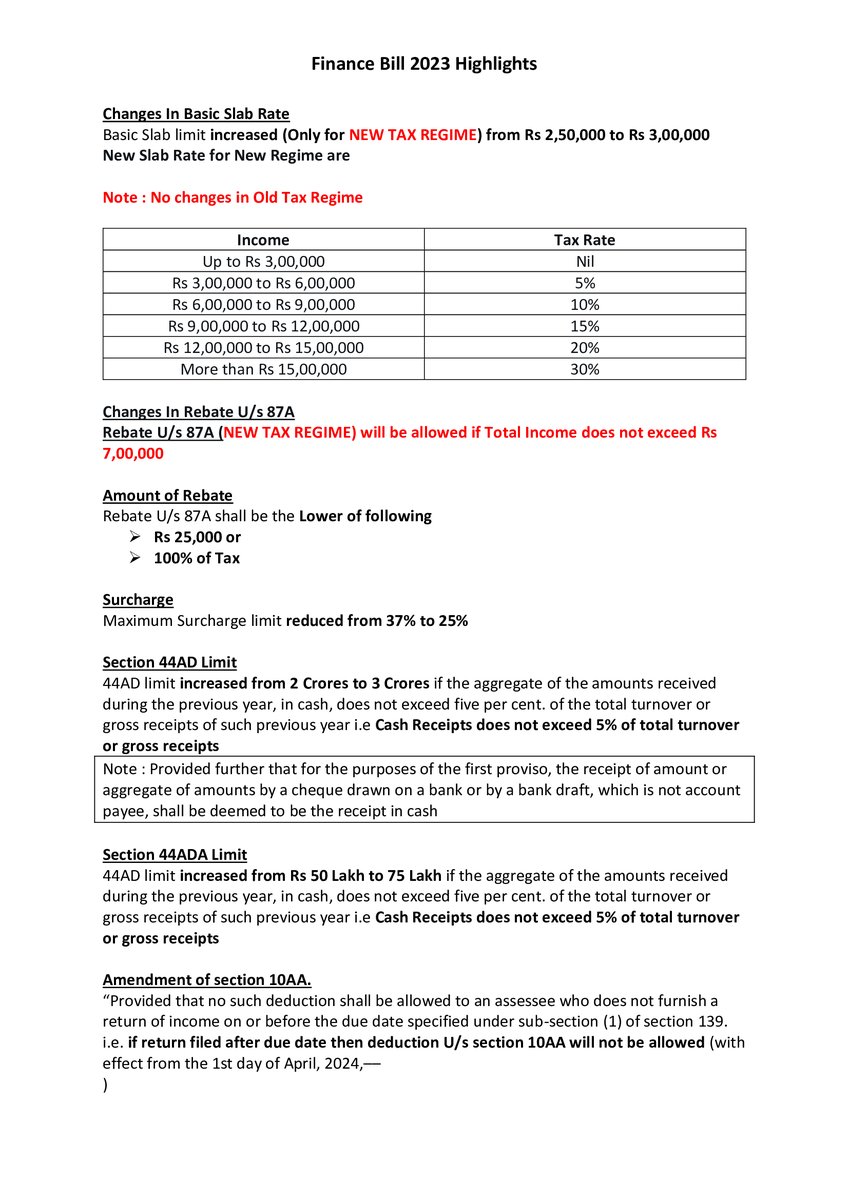

Key Highlights of Budget 2023 Taxation Updates (CA Mayur J Sondagar) Abhas Halakhandi CA Akhil Pachori Tilotama Vikram CAclubindia Saurin Shah CA Kuldeep KD - Chairman ICAI Jaipur (22-23) Tax Guru #Budget2023 #incometax

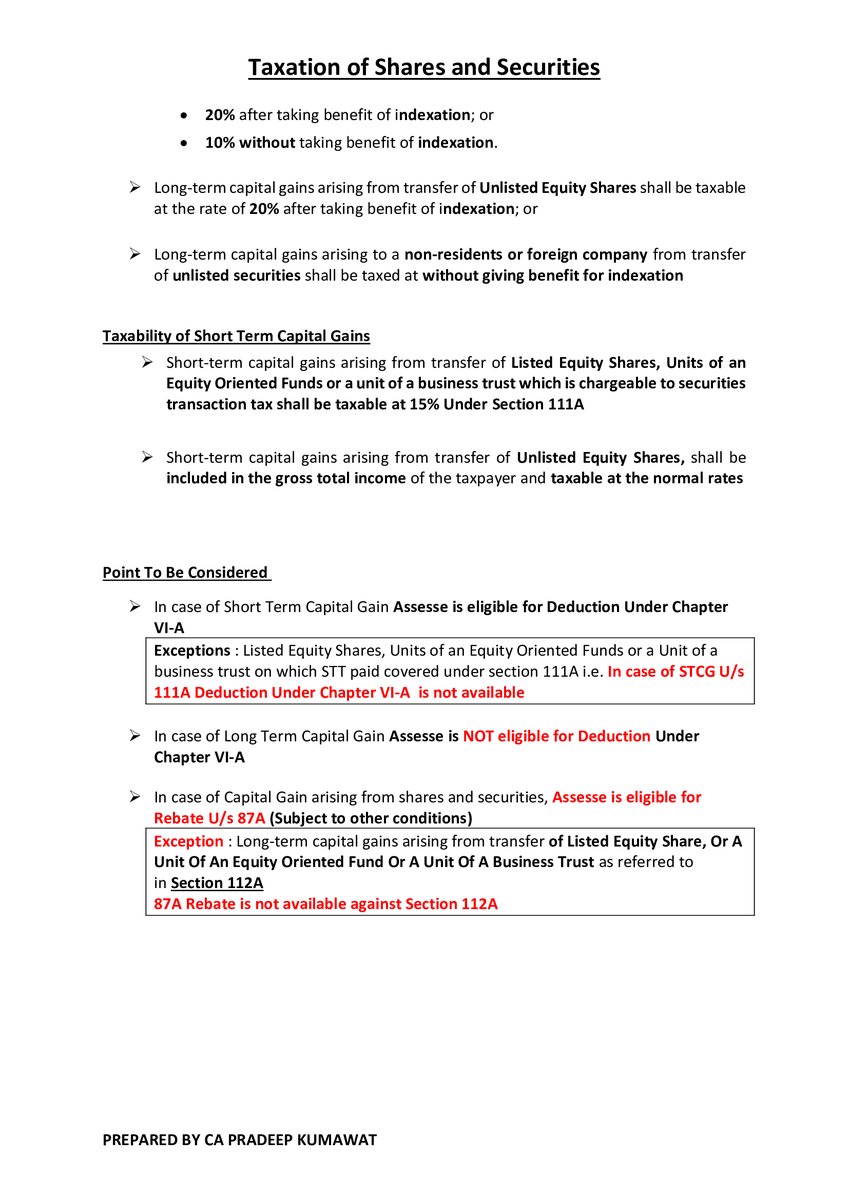

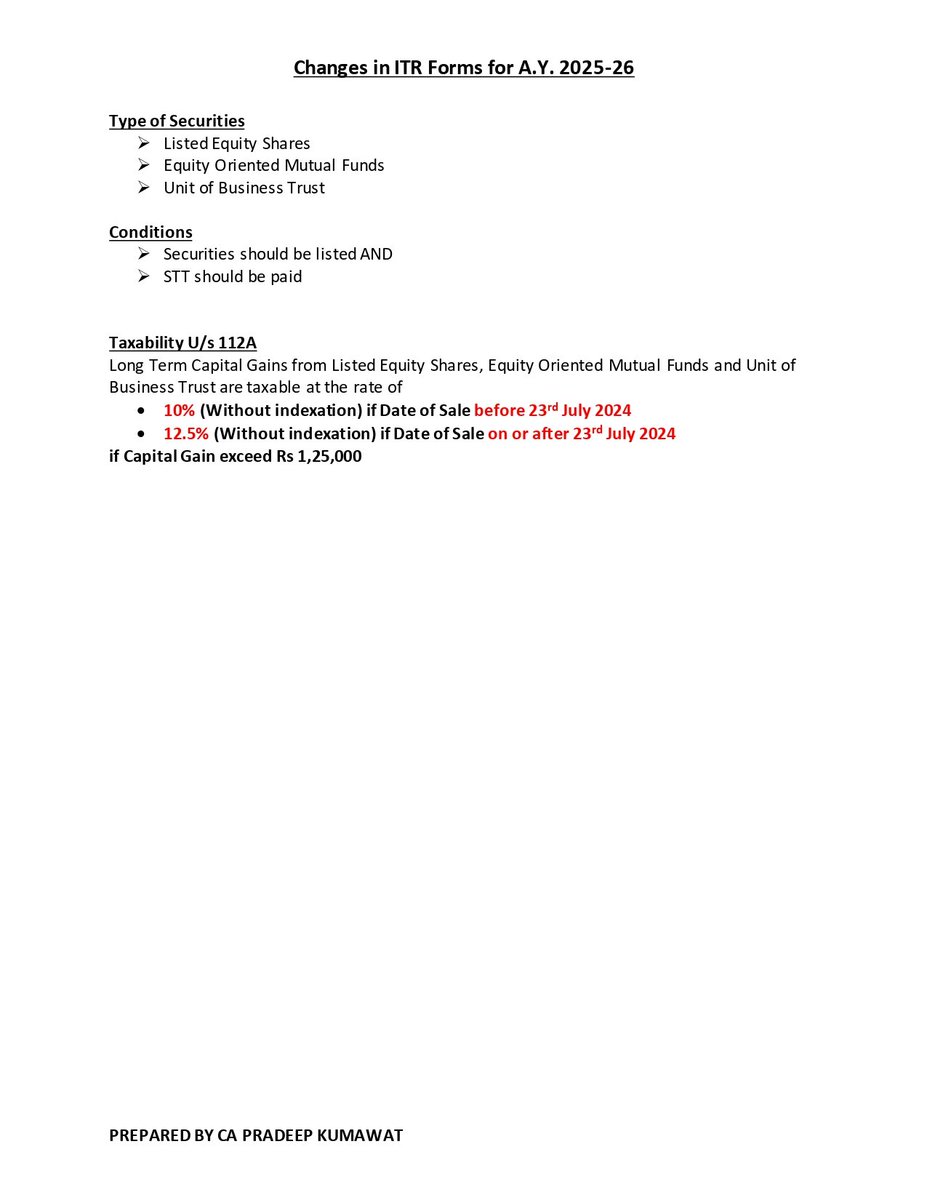

Taxation of Capital Gain on Equity Shares and Mutual Funds Taxation Updates (CA Mayur J Sondagar) Abhas Halakhandi CA Akhil Pachori Tilotama Vikram CAclubindia Saurin Shah CA Kuldeep KD - Chairman ICAI Jaipur (22-23) Tax Guru Dinesh Wadera

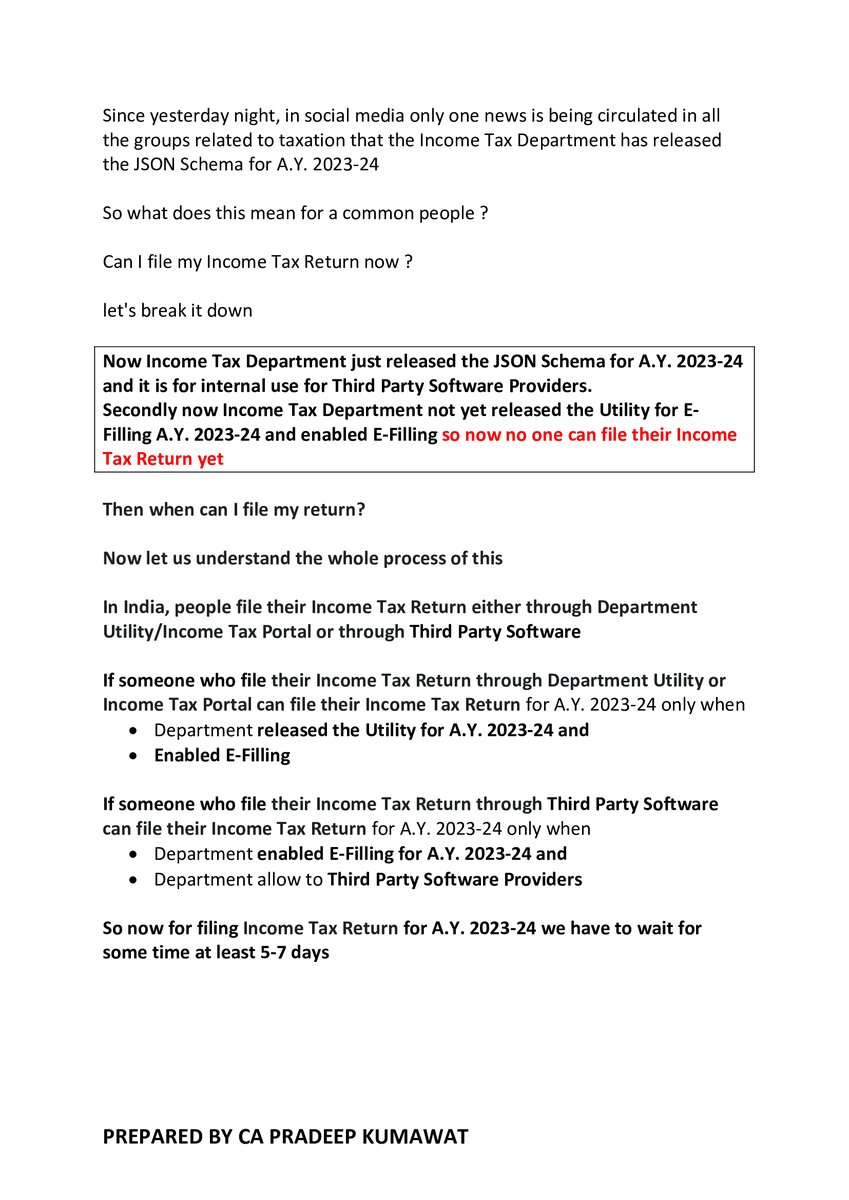

Income Tax Department released JSON Schema for A.Y. 2023-24 for ITR 1 & ITR 4 What it means? Can I file my Income Tax Return now? Taxation Updates (CA Mayur J Sondagar) Abhas Halakhandi CA Akhil Pachori Tilotama Vikram CAclubindia Saurin Shah Pratibha Goyal CA Kuldeep KD - Chairman ICAI Jaipur (22-23) Tax Guru CA Chirag Chauhan Dinesh Wadera

Income Tax Department has allowed third party software providers to file income tax return. So ITR filing session will officially start now Taxation Updates (CA Mayur J Sondagar) Abhas Halakhandi CA Akhil Pachori Tilotama Vikram CAclubindia Saurin Shah Pratibha Goyal Tax Guru Dinesh Wadera

Income Tax Department has allowed third party software providers to file income tax return. So ITR filing session will officially start now Taxation Updates (CA Mayur J Sondagar) Abhas Halakhandi CA Akhil Pachori Tilotama Vikram CAclubindia Saurin Shah Pratibha Goyal Tax Guru Dinesh Wadera

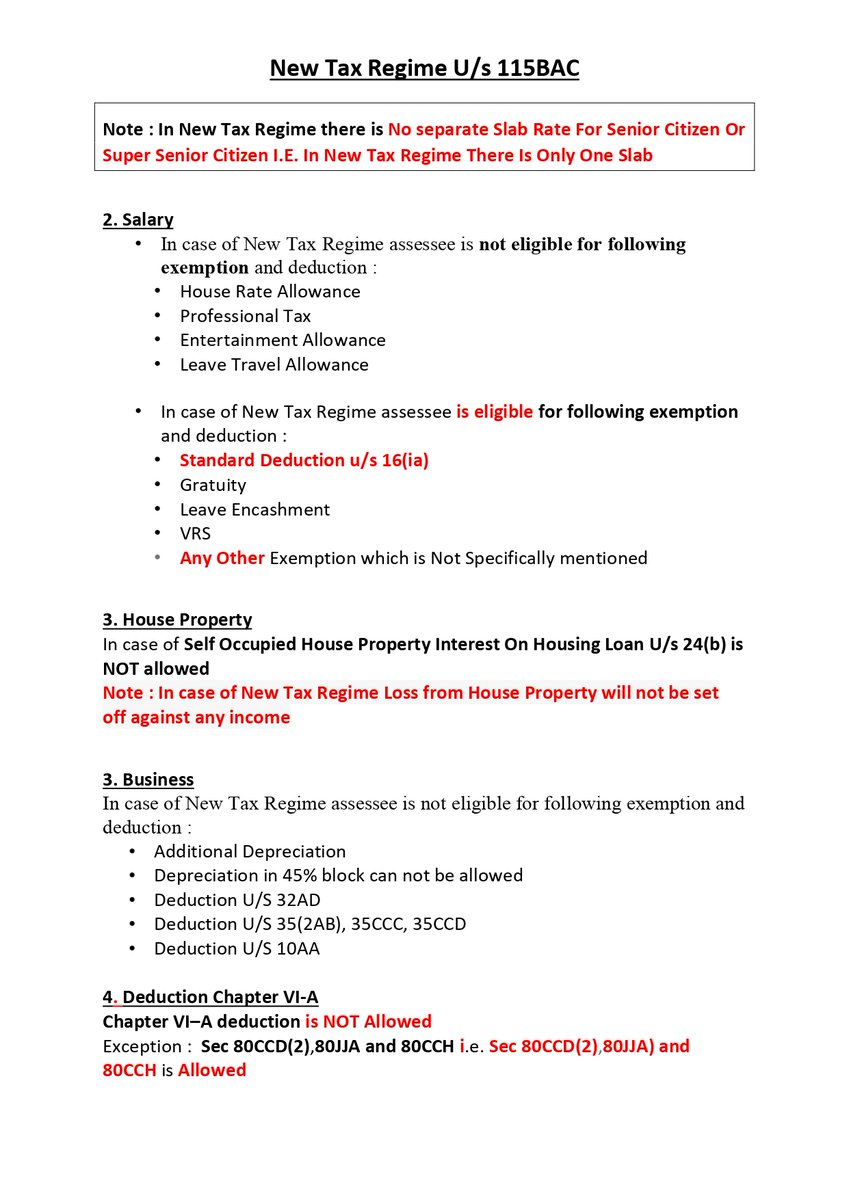

Overview of New Tax Regime U/s 115BAC A.Y. 24-25 Taxation Updates (CA Mayur J Sondagar) Abhas Halakhandi CA Akhil Pachori Tilotama Vikram CAclubindia Saurin Shah Pratibha Goyal Tax Guru Dinesh Wadera

Form 10-IEA [require to file if opt Old Tax Regime] Most crucial topic for current A.Y. Before filing ITR please must read the article Taxation Updates (CA Mayur J Sondagar) Abhas Halakhandi CA Akhil Pachori Tilotama Vikram CAclubindia Saurin Shah Pratibha Goyal Tax Guru Dinesh Wadera

![CA Pradeep Kumawat (@capradeepkumaw1) on Twitter photo Form 10-IEA [require to file if opt Old Tax Regime] Most crucial topic for current A.Y. Before filing ITR please must read the article

<a href="/TaxationUpdates/">Taxation Updates (CA Mayur J Sondagar)</a> <a href="/AbhasHalakhandi/">Abhas Halakhandi</a>

<a href="/akhilpachori/">CA Akhil Pachori</a> <a href="/TilotamaG/">Tilotama Vikram</a> <a href="/CAclubindia/">CAclubindia</a>

<a href="/SaurinShahCA/">Saurin Shah</a> <a href="/PratibhaGoyal/">Pratibha Goyal</a> <a href="/taxguru_in/">Tax Guru</a>

<a href="/dineshwadera/">Dinesh Wadera</a> Form 10-IEA [require to file if opt Old Tax Regime] Most crucial topic for current A.Y. Before filing ITR please must read the article

<a href="/TaxationUpdates/">Taxation Updates (CA Mayur J Sondagar)</a> <a href="/AbhasHalakhandi/">Abhas Halakhandi</a>

<a href="/akhilpachori/">CA Akhil Pachori</a> <a href="/TilotamaG/">Tilotama Vikram</a> <a href="/CAclubindia/">CAclubindia</a>

<a href="/SaurinShahCA/">Saurin Shah</a> <a href="/PratibhaGoyal/">Pratibha Goyal</a> <a href="/taxguru_in/">Tax Guru</a>

<a href="/dineshwadera/">Dinesh Wadera</a>](https://pbs.twimg.com/media/GOKQ3SKXYAApwDd.jpg)

Major Change in ITR Forms for A.Y. 2025-26, Now Capital Gain can be shown in ITR-1 Read the full update Taxation Updates (CA Mayur J Sondagar) CAclubindia Saurin Shah Tax Guru

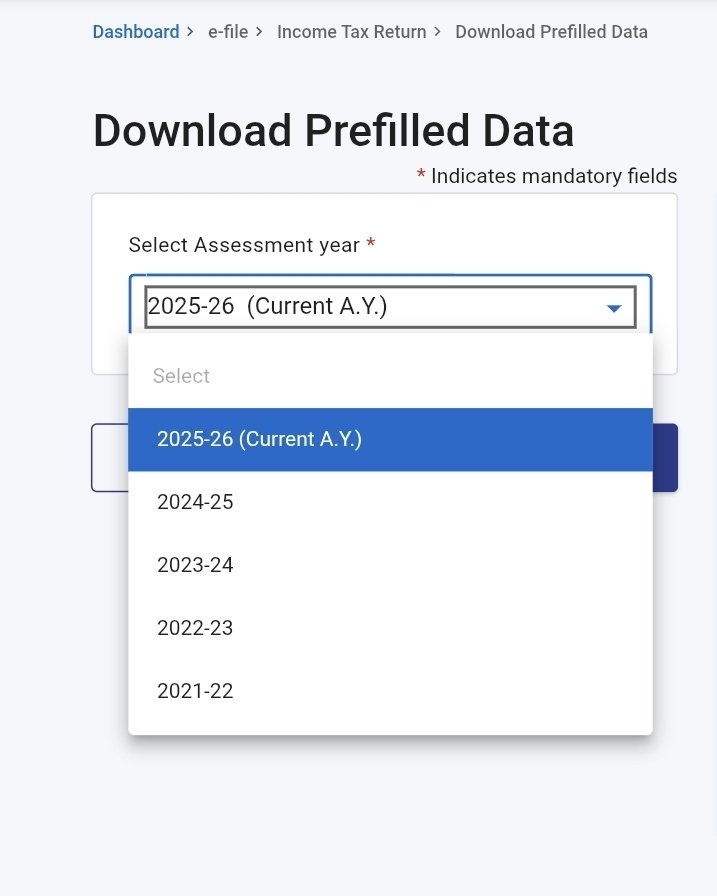

ITR Filing Started for AY 2025-26 For ITR 1 and ITR 4 Excel Based Utility and Schema Released for ITR 1 and ITR 4 Prefilled Data Download option enabled for AY 2025-26 ITR Filing due date 15/09/2025 Income Tax India

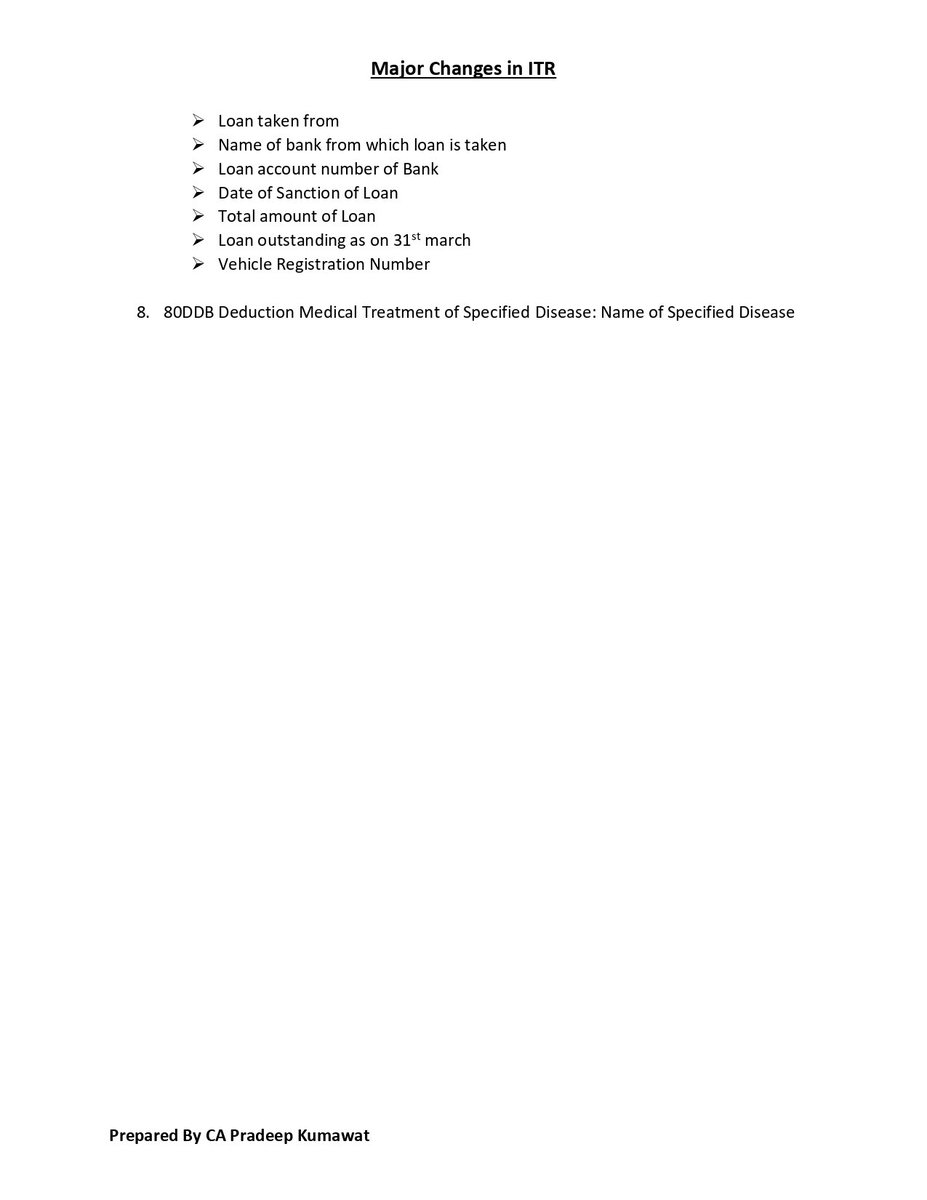

Major Change in ITR for A.Y. 2025-26, Now Sahaj and Sugam are also become complicated Read the full update Taxation Updates (CA Mayur J Sondagar) CAclubindia Saurin Shah Tax Guru

Income Tax Department has allowed third party software providers to file income tax return. So ITR filing session will officially start now Taxation Updates (CA Mayur J Sondagar) Tax Guru CAclubindia

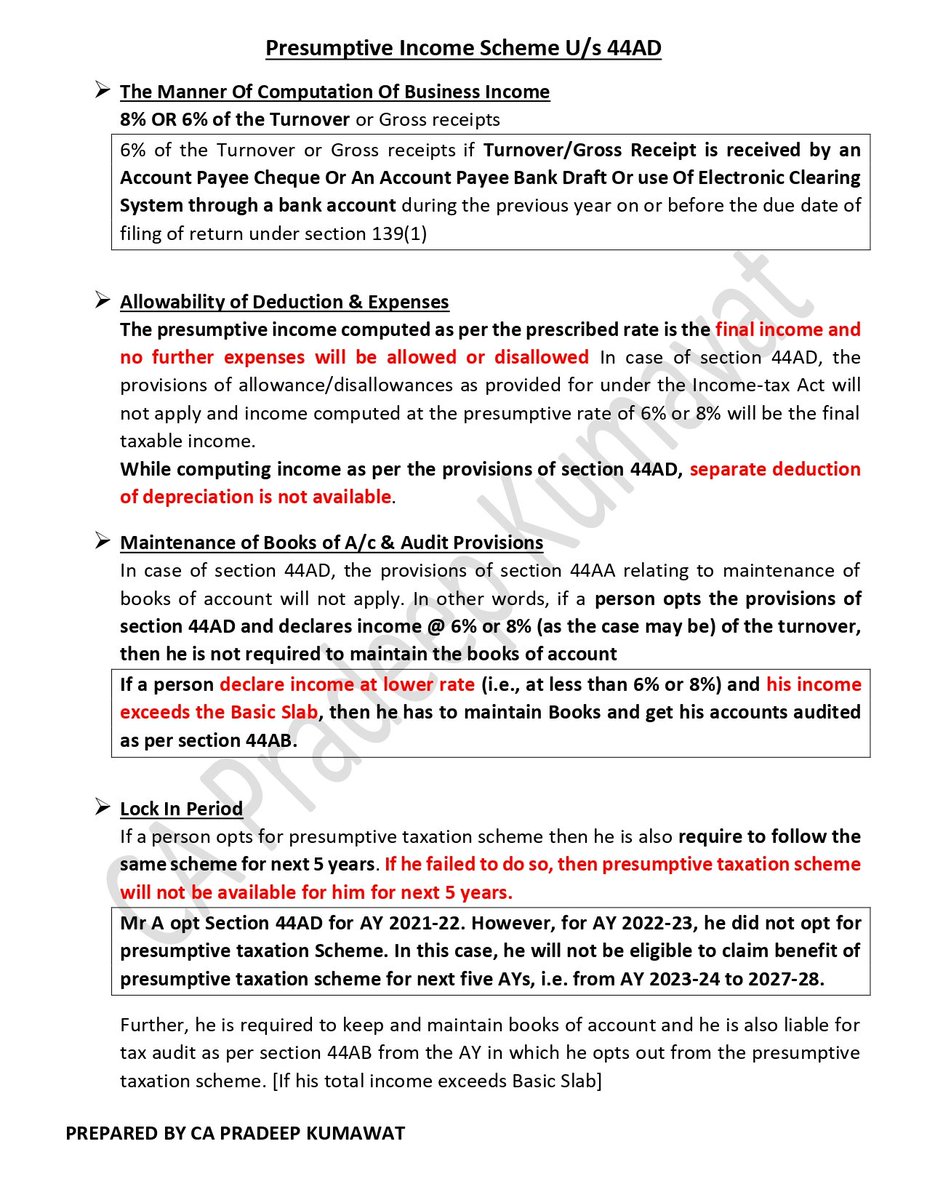

Presumptive Income U/s 44AD Condition, Eligibility, Limits and Changes for A.Y. 2025-26 Taxation Updates (CA Mayur J Sondagar) CAclubindia Tax Guru

Opt Old Regime > Form 10-IEA One of the most complicated issue in ITR Filing for this Year. Must read before filing Taxation Updates (CA Mayur J Sondagar) CAclubindia Tax Guru

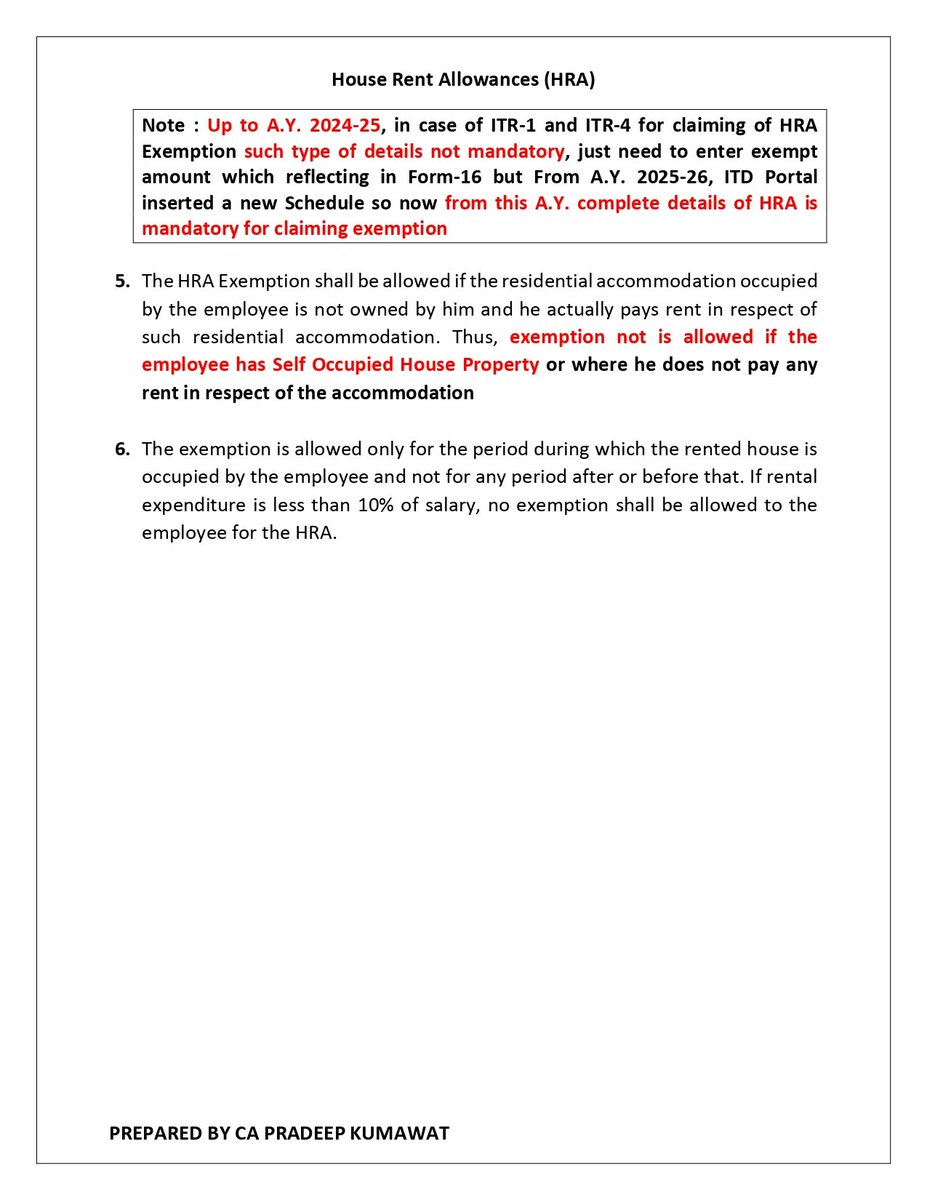

House Rent Allowance (HRA) Concept, Eligibility, Reporting in ITR Major changes in current year ITR Reporting Taxation Updates (CA Mayur J Sondagar) CAclubindia Tax Guru