CannaVestments

@cannavestments

Private Family Office- vginvests.com US Cannabis investor since 2014 #MSOgang

ID: 1379132789686206470

05-04-2021 18:04:25

3,3K Tweet

4,4K Followers

252 Following

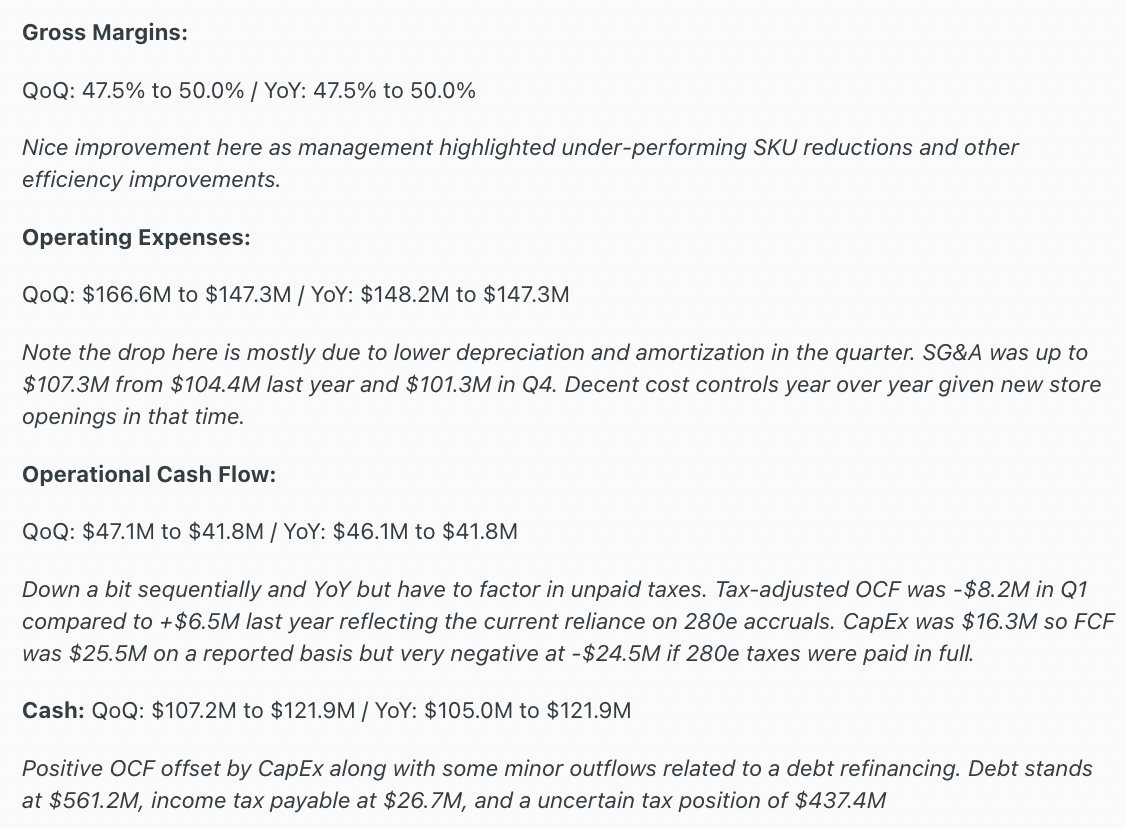

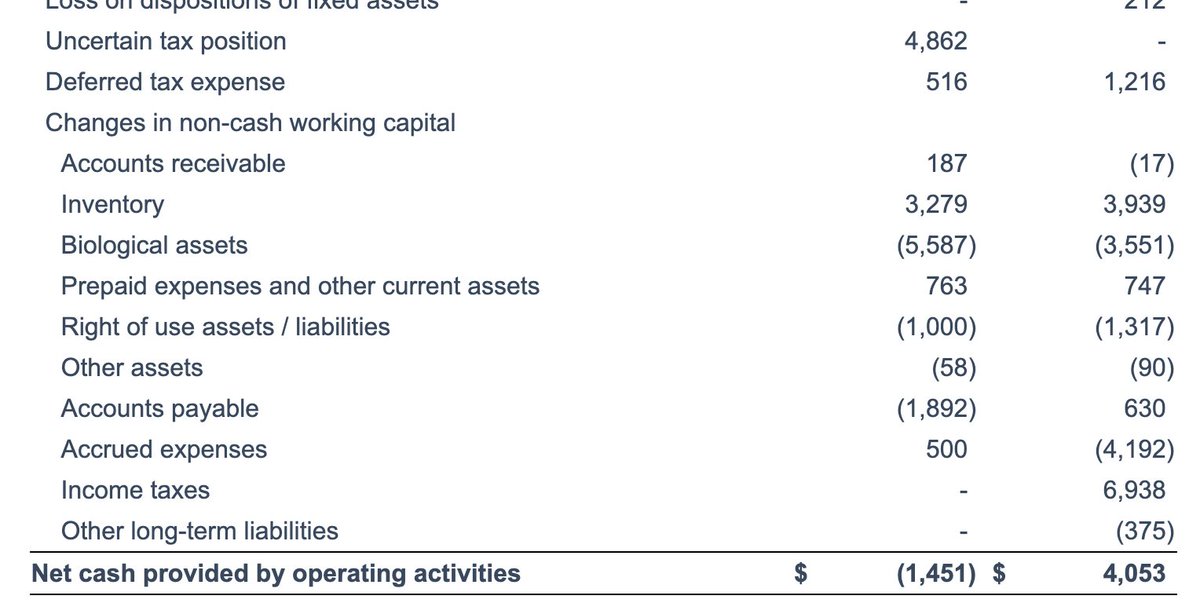

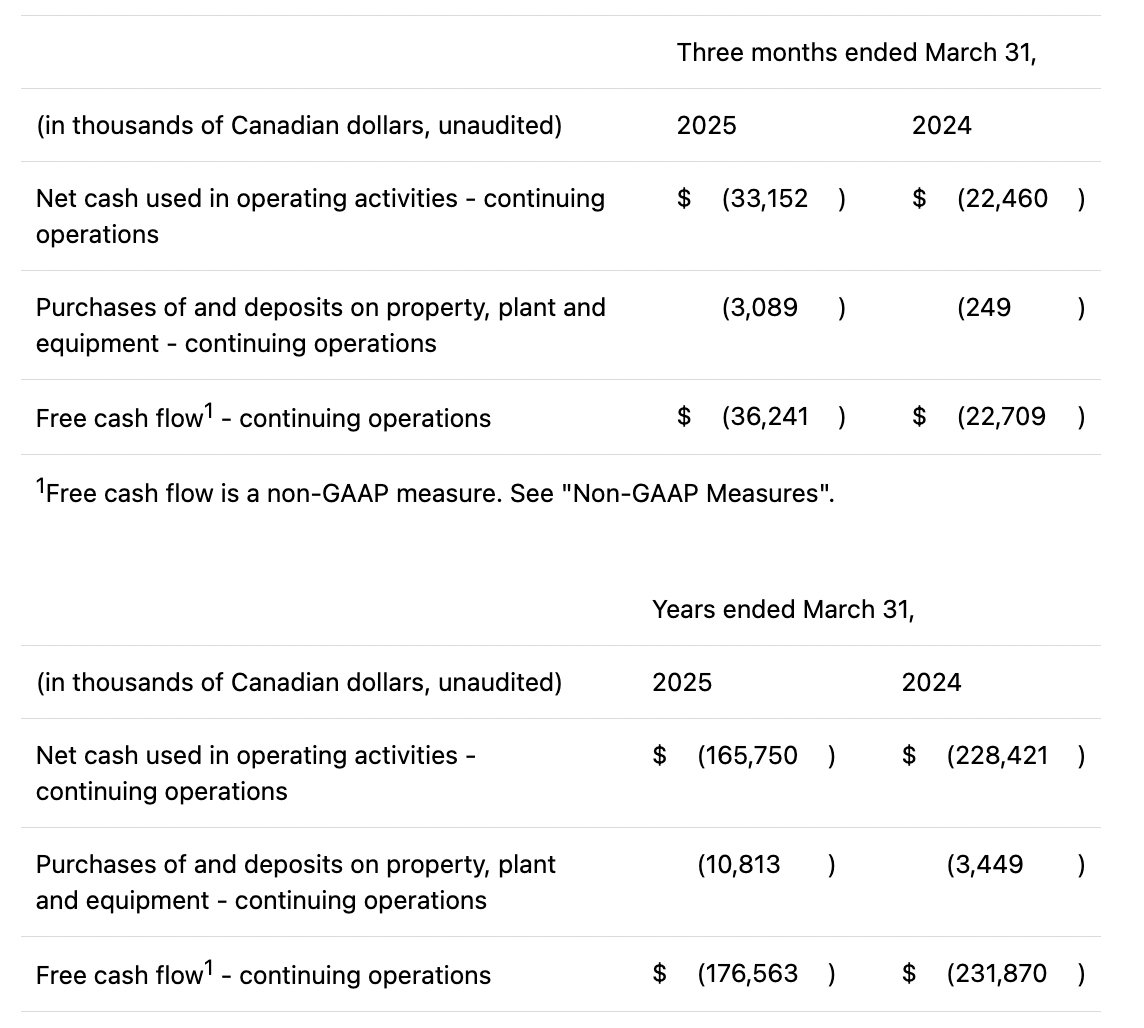

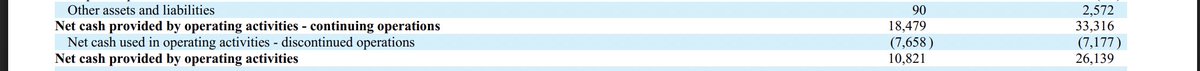

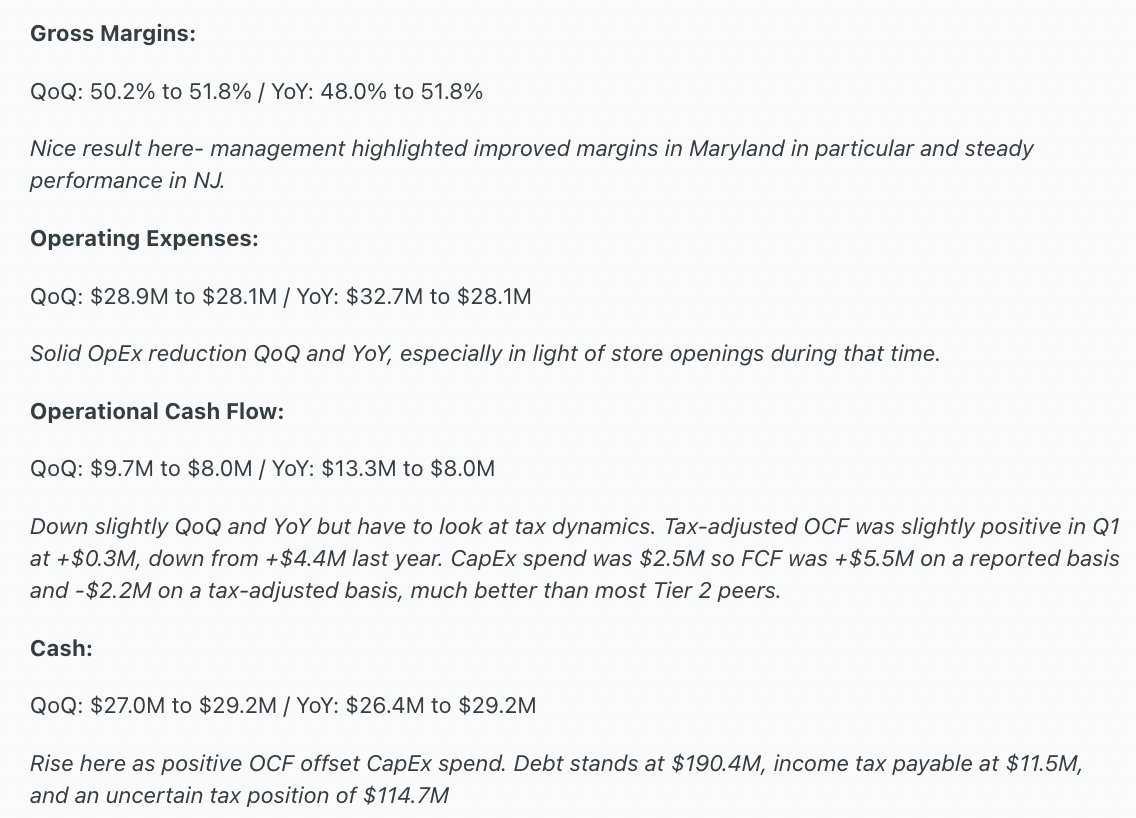

Stable Q1 showing from TerrAscend - results largely in-line, with solid margin improvement in a tough market. Top-line was down 12% YoY, although has stabilized in recent quarters. Like others, +CF reliant on 280e deferrals with tax-adjusted OCF just above breakeven in Q1

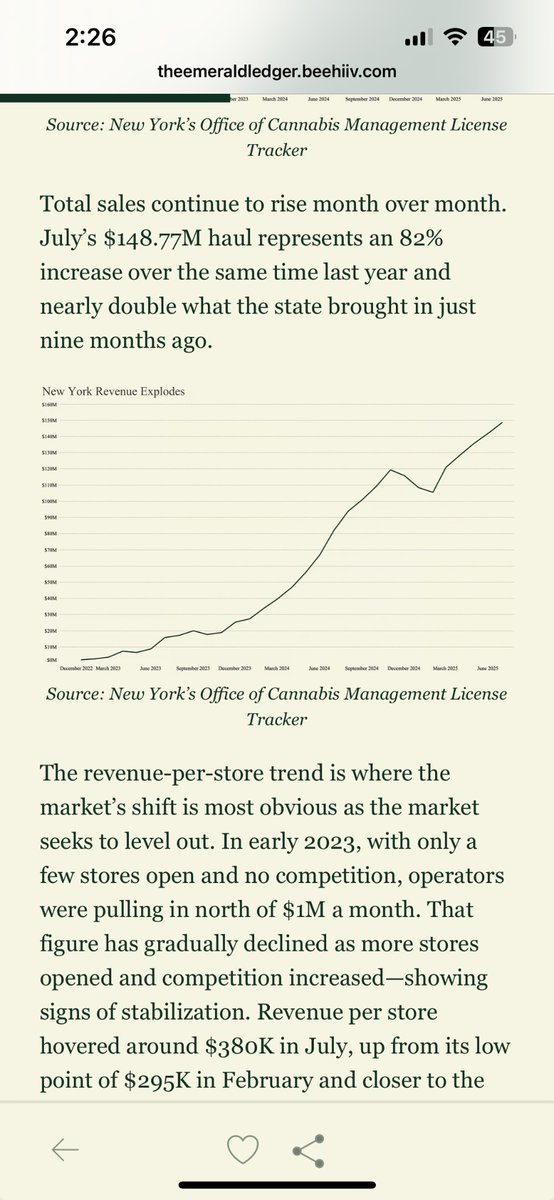

The Dales Report John Schroyer Crain's New York NY market continues to grow at a really healthy pace. $142M in June -> $1.7B run rate. Now the 6th biggest market in the US, just behind IL ($2B).

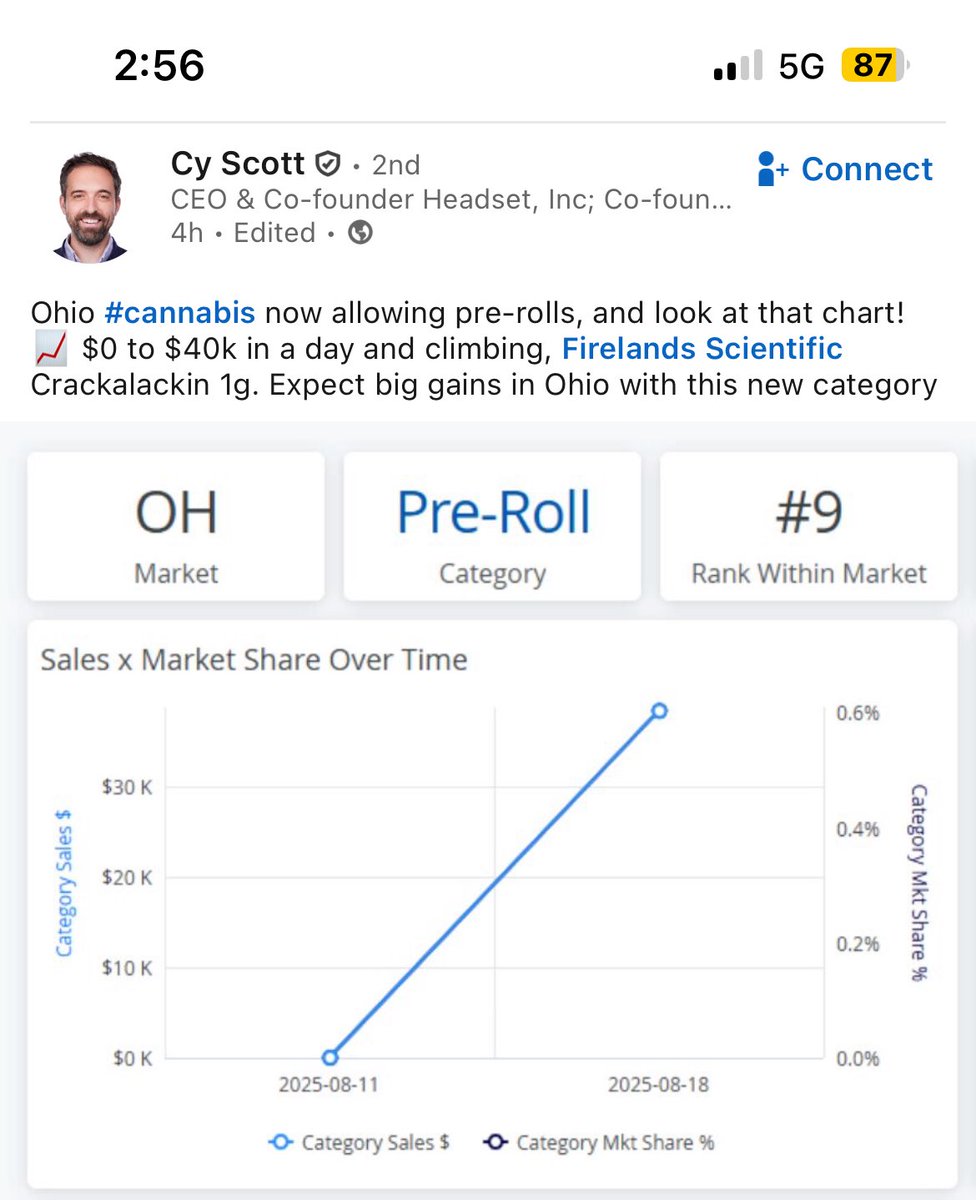

Medicate_oh LeafLink Dave Joyce Warren Davidson 🇺🇸 Bernie Moreno Vivek Ramaswamy linkedin.com/posts/cyscott_… Cy Scott Headset Firelands Scientific