bonesy.eth (🫵,😹)

@bonesycrypto

Nothing I say is financial advice. Professional mogger, webpage refresher, airdrop collector, meme dealer, and shitcoin trader.

ID: 1393396409542586373

15-05-2021 02:43:02

2,2K Tweet

7,7K Followers

4,4K Following

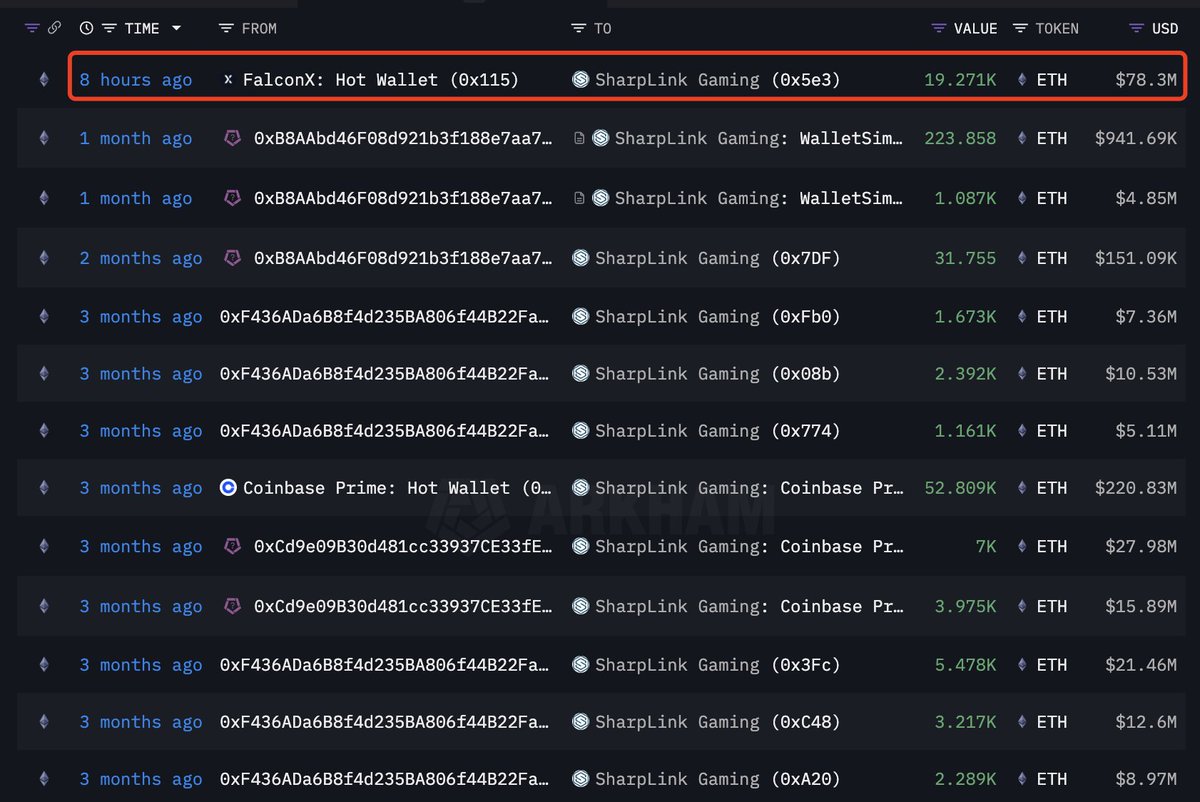

After a month of silence, SharpLink(SharpLink (SBET)) bought another 19,271 $ETH($78.3M). intel.arkm.com/explorer/entit…