stakeyour.eth 🦇🔊

@bogdanoffi

Ethereum home staker & @Evmavericks. Decentralization maxi therefore Eth maxi. #stakefromhome. Here to educate and fight ETH FUD with facts.

ID: 1587185785140260864

31-10-2022 20:52:45

748 Tweet

822 Followers

934 Following

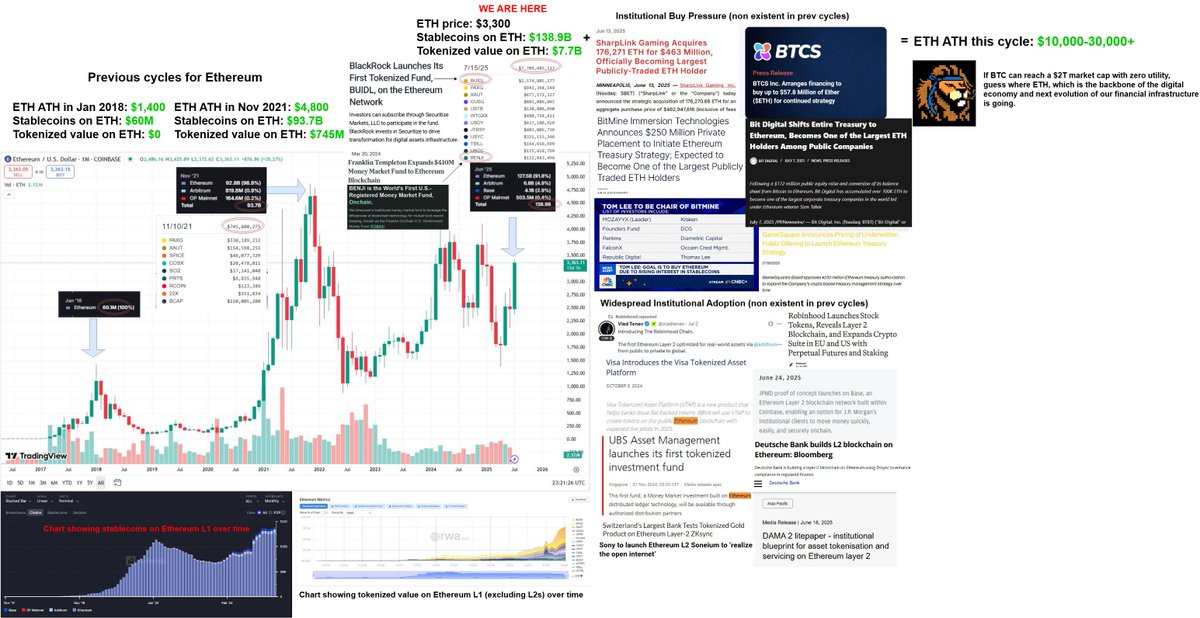

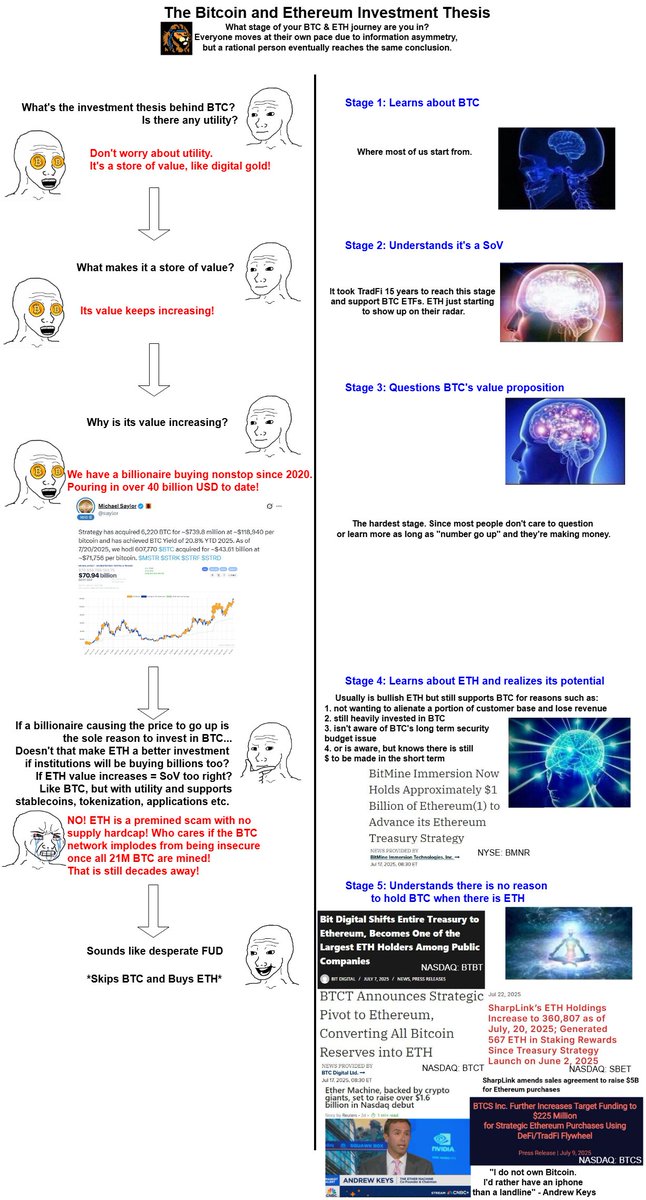

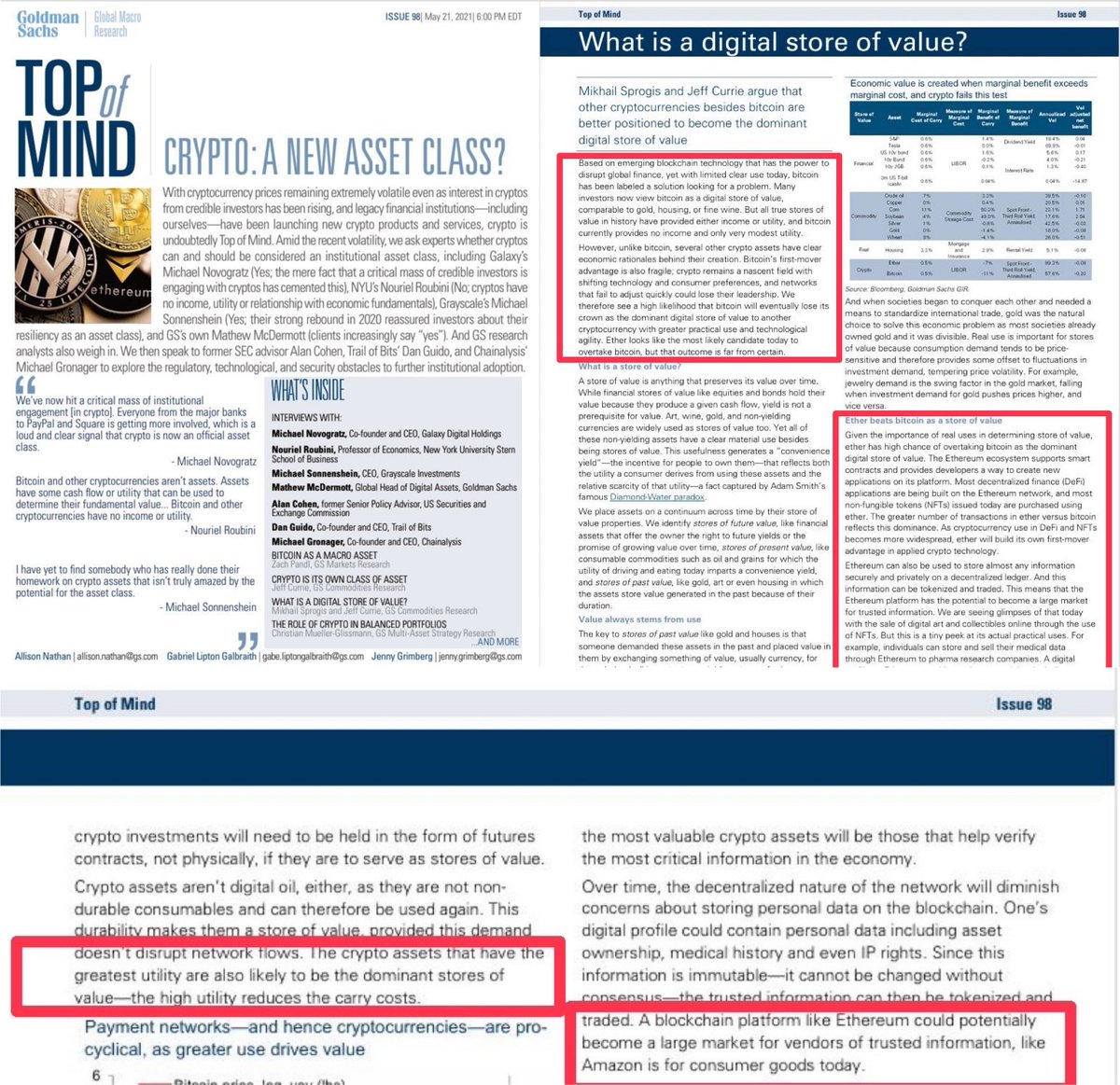

Reminder that in 2021 Goldman Sachs said "Ethereum could potentially become a large market for vendors of trusted information, like Amazon is for consumer goods today." & "Ether beats bitcoin as a store of value. Given the importance of real uses in determining store of value,

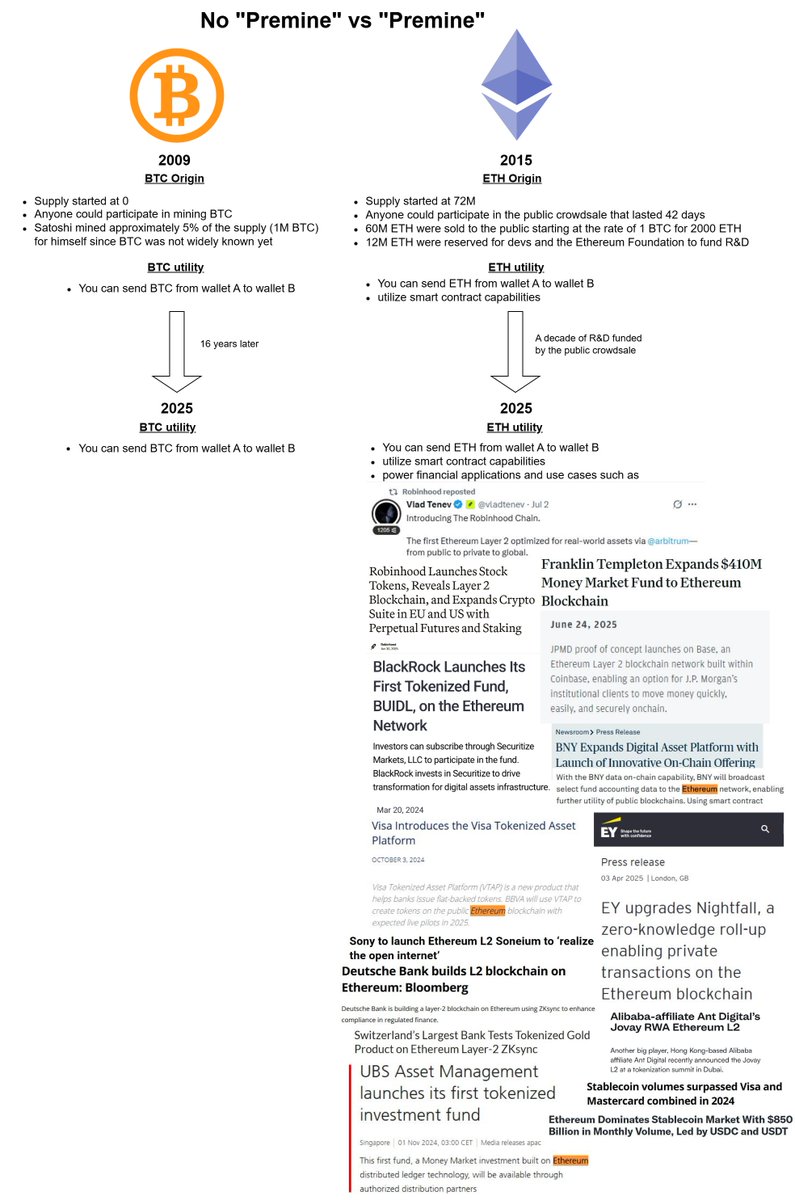

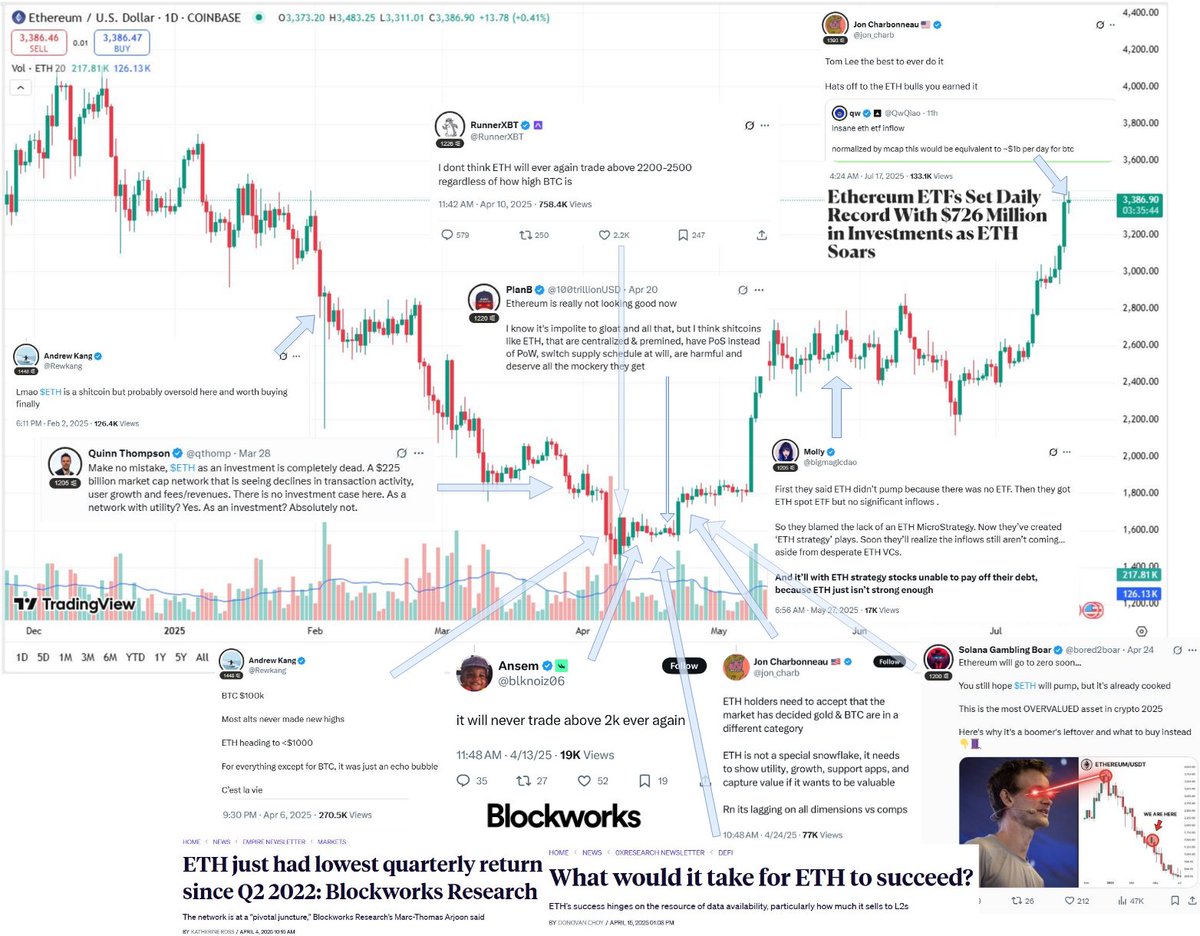

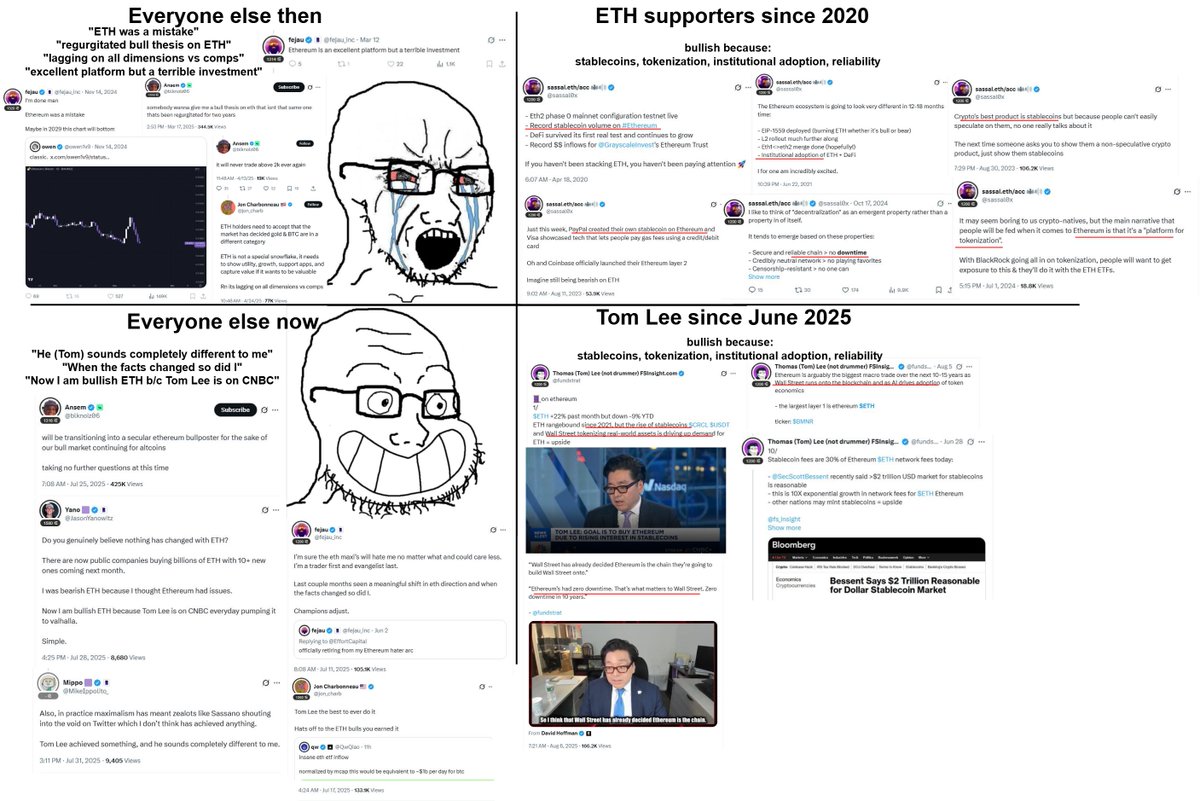

Imagine if people had this crazy idea that a decentralized and reliable blockchain (Ethereum) that provided utility via stablecoins, tokenization, and progressively gained institutional adoption would eventually be bullish for $ETH. I guess the key was Thomas (Tom) Lee (not drummer) FSInsight.com! He managed to

Since Alexander Leishman 🇺🇸 is kind enough to remind his followers every few months that $ETH has no value accrual narrative, I hope he reminds them that $BTC doesn't have one either. Unless of course he means "number go up" (since BTC has zero utility otherwise). So if BTC's sole

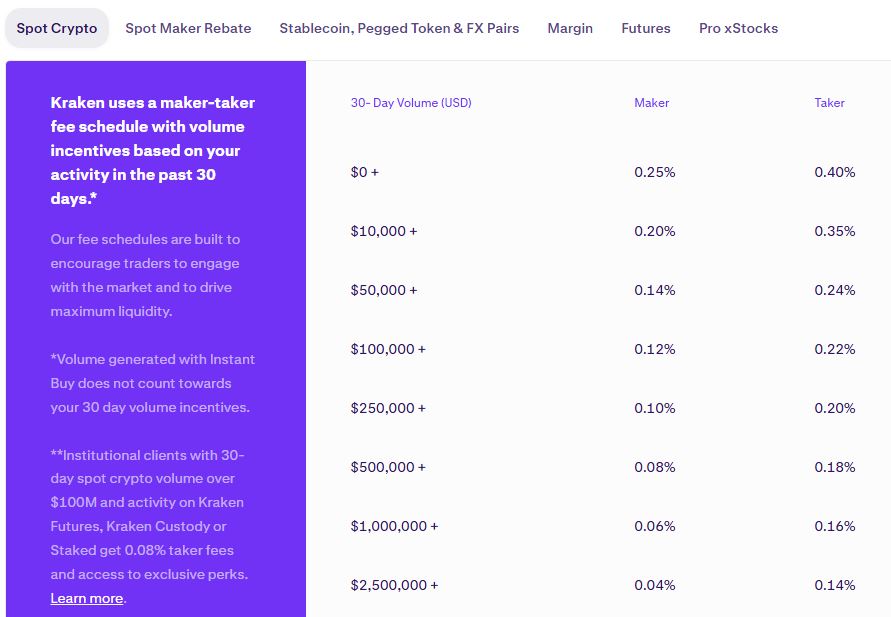

🚨To all Coinbase 🛡️ users: If you still trade on there please read this so you don't throw $ away in unnecessary fees. My post is NOT about CB Advanced vs Normal. It's about how the fees itself work, which many people don't know about unless they've actually read the fine print.

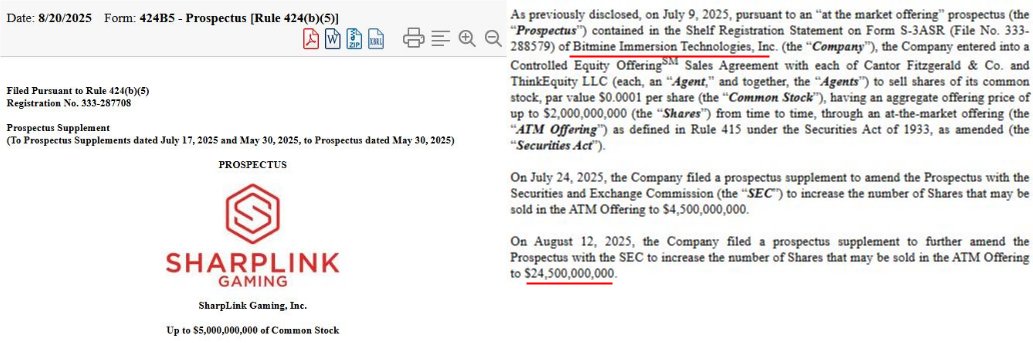

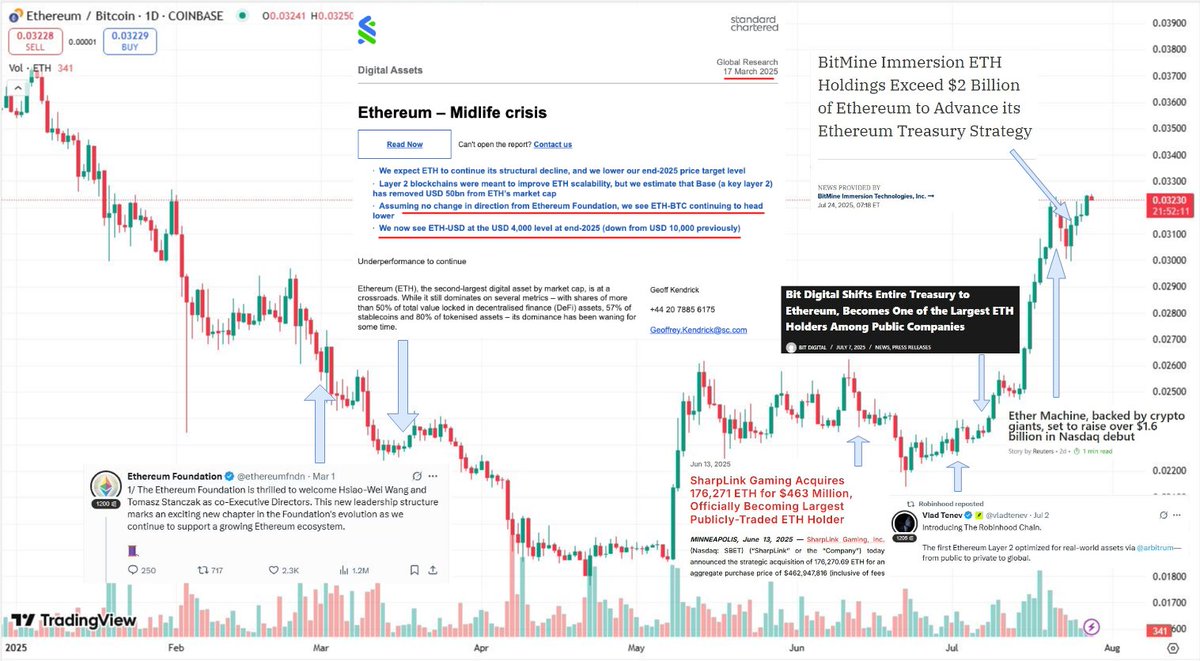

To put things into perspective, ETH DATs have provided less than 20% of the buy pressure Michael Saylor has done for BTC so far. Strategy: $46.15B into BTC since Sep 2020. ETH DATs: @SharpLinkGaming: $2.6B into ETH since June 2025. Acquired 740K ETH. Bitmine (NYSE-BMNR) $ETH: Cost basis unknown.