Guido Baltussen

@baltussenguido

Professor in behavioral finance and quant fund manager. I tweet about behavioral insights, research and investment findings.

ID: 1190368551896584192

01-11-2019 20:42:52

36 Tweet

531 Takipçi

33 Takip Edilen

FT on smart beta. Factor tilts should be significant to make up costs and added value of shorts is discussed Guido Baltussen on.ft.com/3o3JOPx

Big empirical asset pricing study coming up containing hand-collected market capitalizations for 1,488 major stocks for new 61-year sample. Send me Bart van Vliet Guido Baltussen a DM if you want to get a draft copy before publication.

.Pim van Vliet just sent me this. Have only read abstract and skimmed intro but it looks great! Back in time is as “out of sample” as forward if you haven’t looked yet. papers.ssrn.com/sol3/papers.cf…

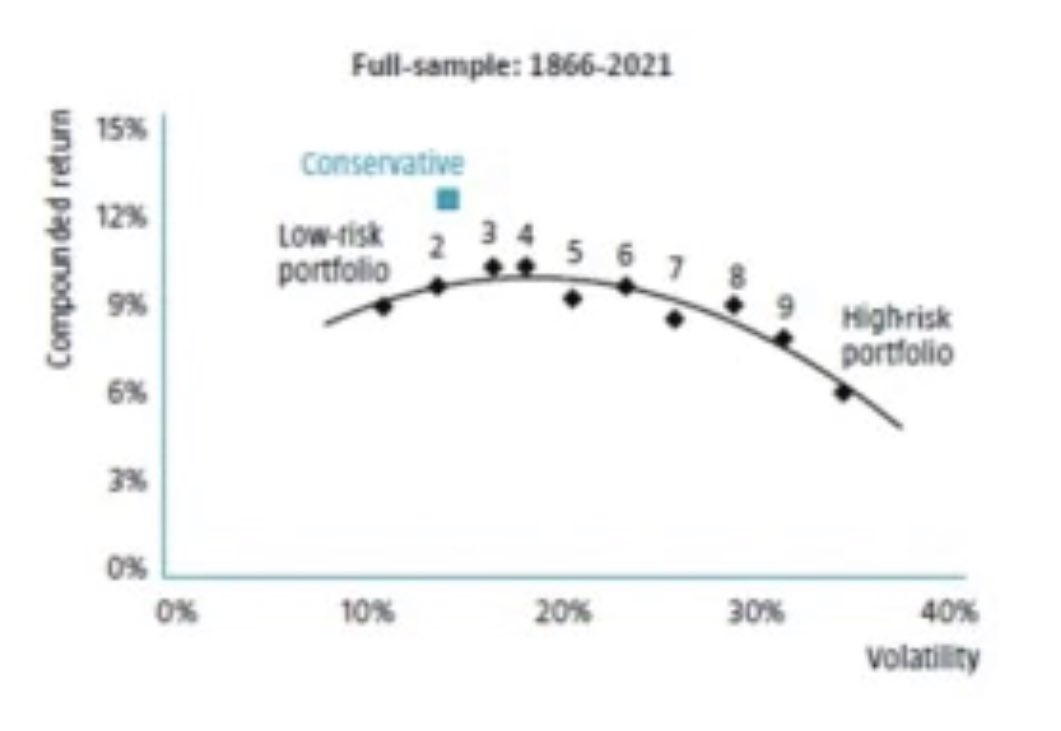

New white paper out! 150+ years of conservative investing. More evidence, pretty cool! Guido Baltussen Rowan Nijboer Lawrence Hamtil Wes Gray 🇺🇸 Clifford Asness 👇 bit.ly/3lxvhuf

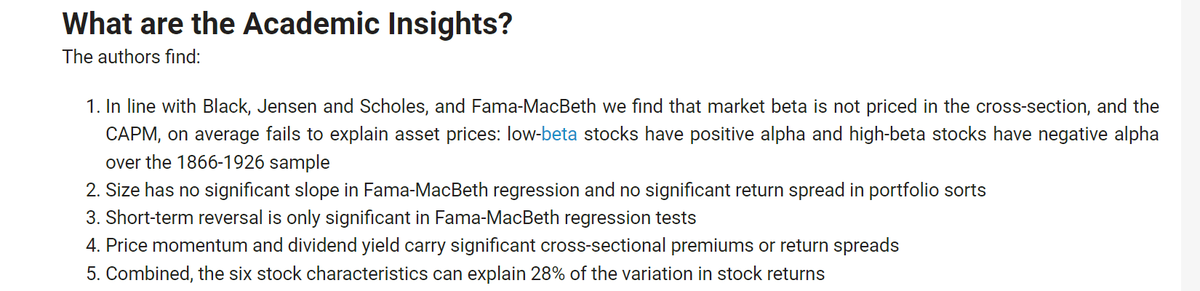

Nice summary by Wes Gray 🇺🇸 and Elisabetta Basilico, PhD, CFA on our pre-1926 test for equity factors: alphaarchitect.com/2022/11/cross-…

Taking ‘big data’ to another level 😉 we tied four(!) deep historical databases together to learn more about inflation and financial markets.Guido Baltussen Laurens Swinkels Bart van Vliet forthcoming in the Financial Analyst Journal 🚀👇papers.ssrn.com/sol3/papers.cf…

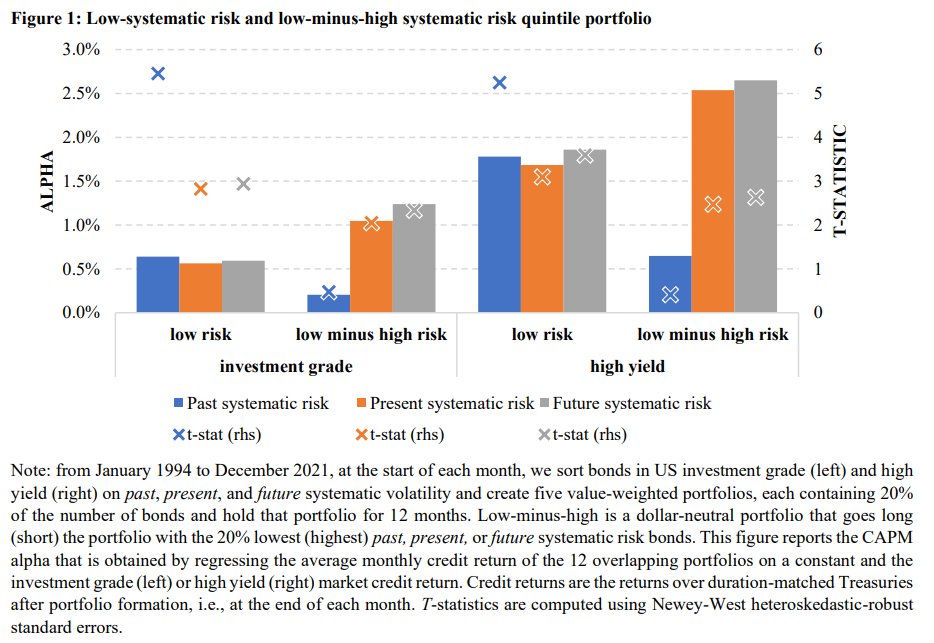

There is way too little empirical research on corporate bonds. This new study shows a significant Low-risk effect in corporate bonds. Very comprehensive study, using ~2 million observations 1994-2021. Patrick Houweling papers.ssrn.com/sol3/papers.cf…

A nice collection of thoughts by some of the many people who got to know Danny Kahneman over the years. Remembering Daniel Kahneman: A Mosaic of Memories and Lessons behavioralscientist.org/remembering-da… via Behavioral Scientist

We've significantly updated our paper "The Cross-Section of Stock Returns before CRSP." This research, with Guido Baltussen and Bart van Vliet, offers rigorous insights into factor premia using 60 years of pre-sample data, some hand-collected😵 Download here: