Aya Kantorovich

@aya_kantor

Co-Founder & Co-CEO @august_digital powering @upshift_fi | Fmr Founding Team @FalconXnetwork, prev @PanteraCapital opinions are my own | pfp @crypto_coven

ID: 1252142972

08-03-2013 16:18:53

913 Tweet

3,3K Takipçi

1,1K Takip Edilen

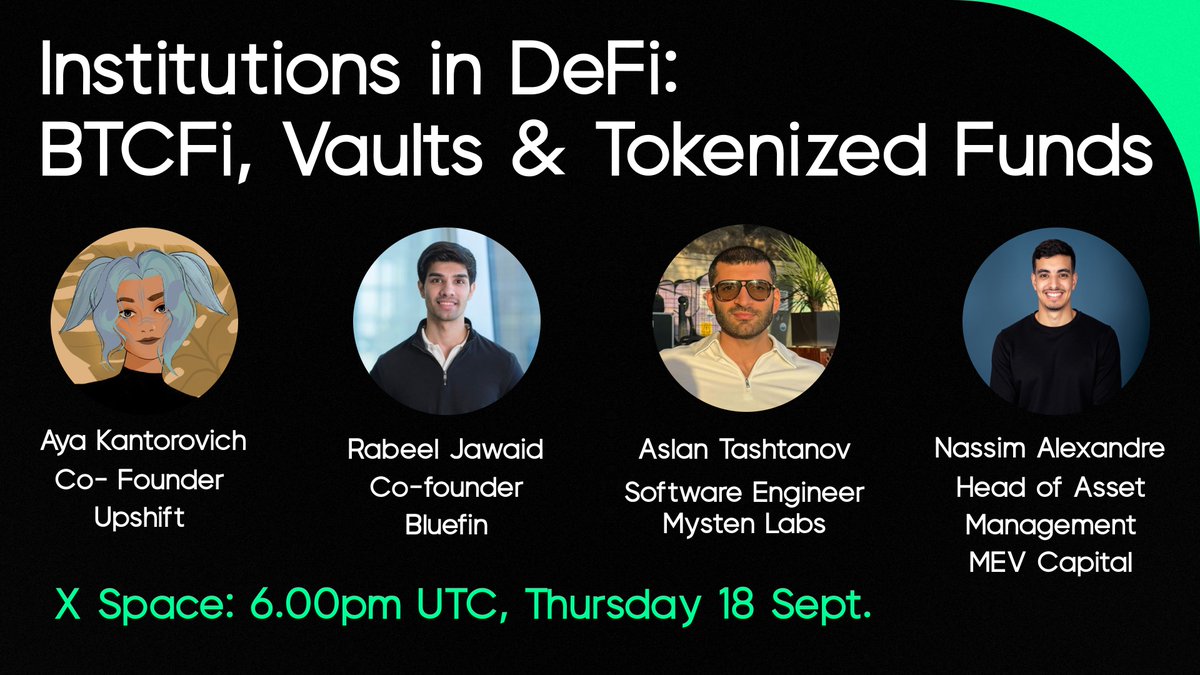

The third edition in our TradFi x DeFi series: Featuring speakers from August, MystenLabs.sui Bluefin and MEV Capital. Stablecoins are up 28x in the last year, Bitcoin is at all time highs - the institutions are here. Dive in this Thursday as we discuss the trends

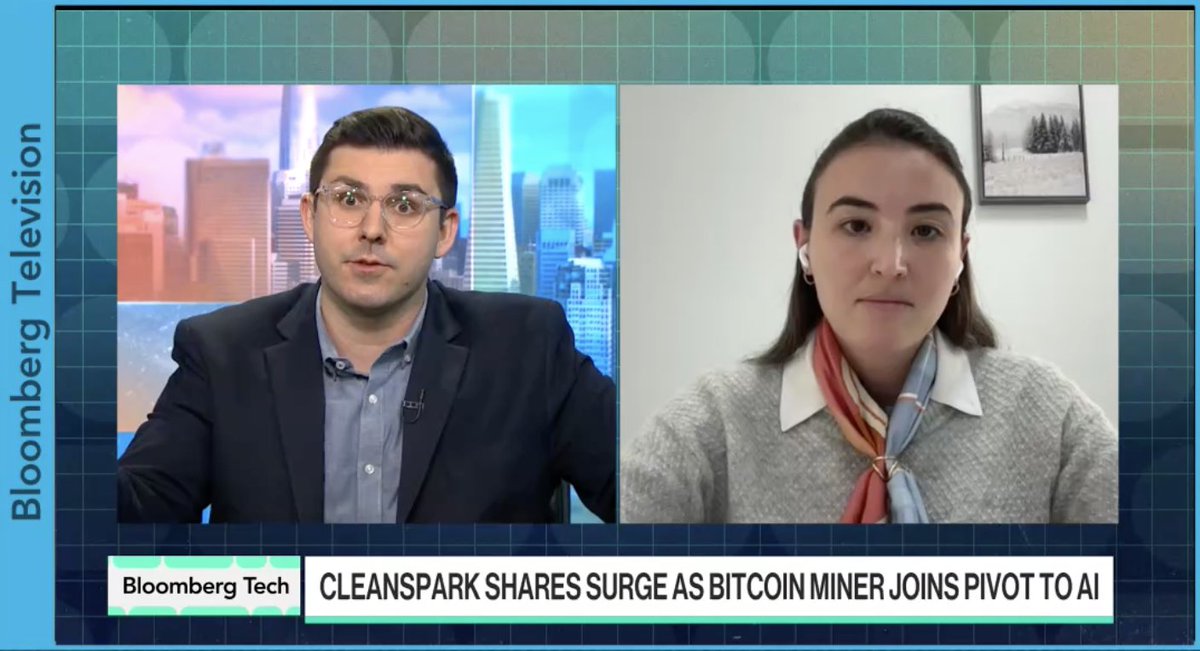

Great to speak today on Bloomberg Live about: - Bitcoin performance amid ETF inflows - dollarization through stablecoin legislation - the broader crypto regulatory environment in the US There is no better time to be building in DeFi, which has recovered well post Black

Stablecoin vaults continue to be DeFi's fastest growing vertical. Happy to be supporting Yuzu Money 🍋 with their new vault launch on Plasma!