Axel

@axeladller

FREE daily on-chain & macro #Bitcoin research from a Verified Author @CryptoQuant • . Get your weekly market report & original deep-dives • Subscribe now

ID: 700276256

http://adlerscryptoinsights.substack.com 17-07-2012 03:24:41

119 Tweet

14 Followers

517 Following

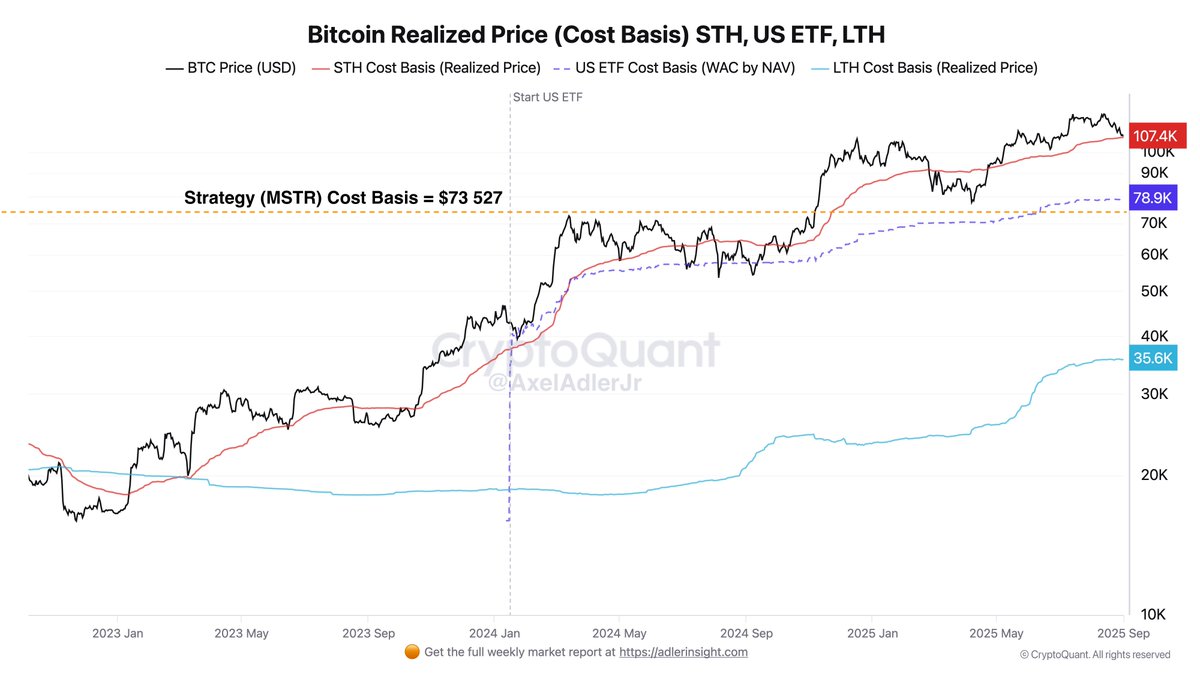

Volatility exiting compression, early expansion during price pullback via CryptoQuant.com cryptoquant.com/insights/quick…