Aura

@aurafinance

Boosting DeFi stakeholders' yield potential and governance power, starting with Balancer 💜 Join our community: discord.aura.finance

ID: 1488200731849015299

https://aura.finance 31-01-2022 17:21:23

2,2K Tweet

24,24K Followers

103 Following

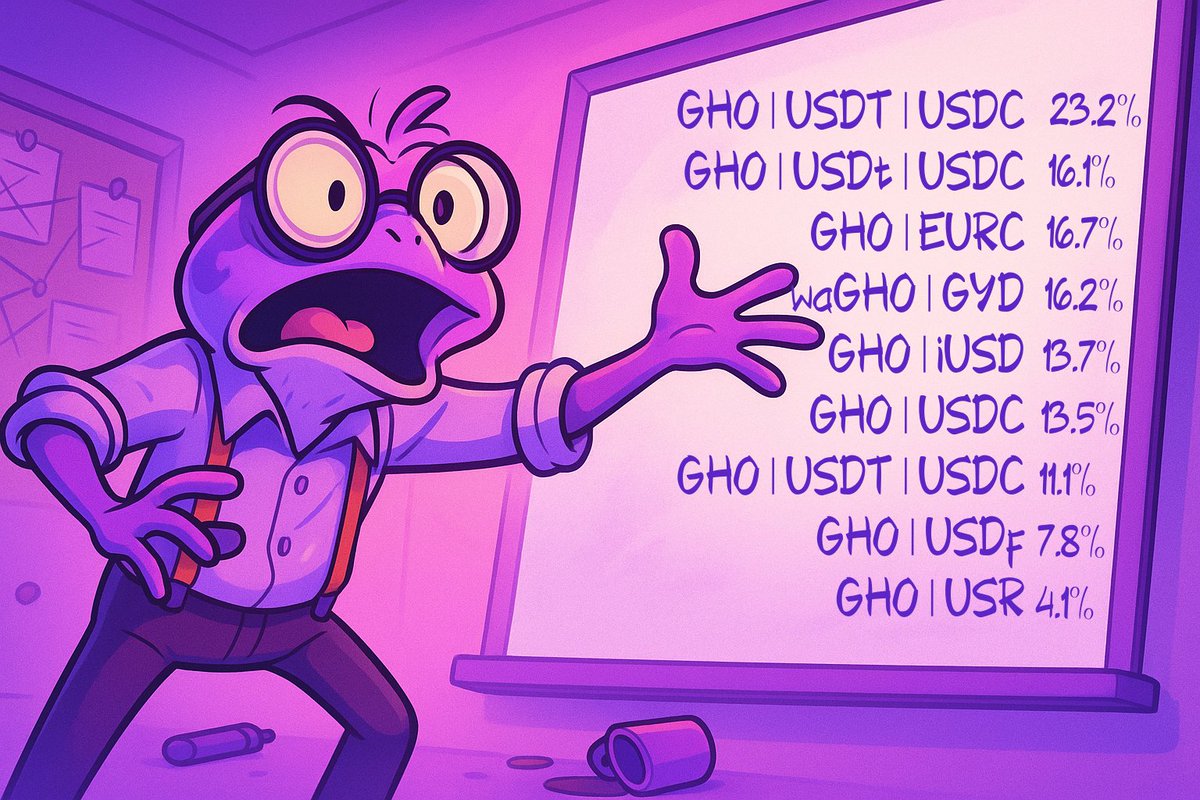

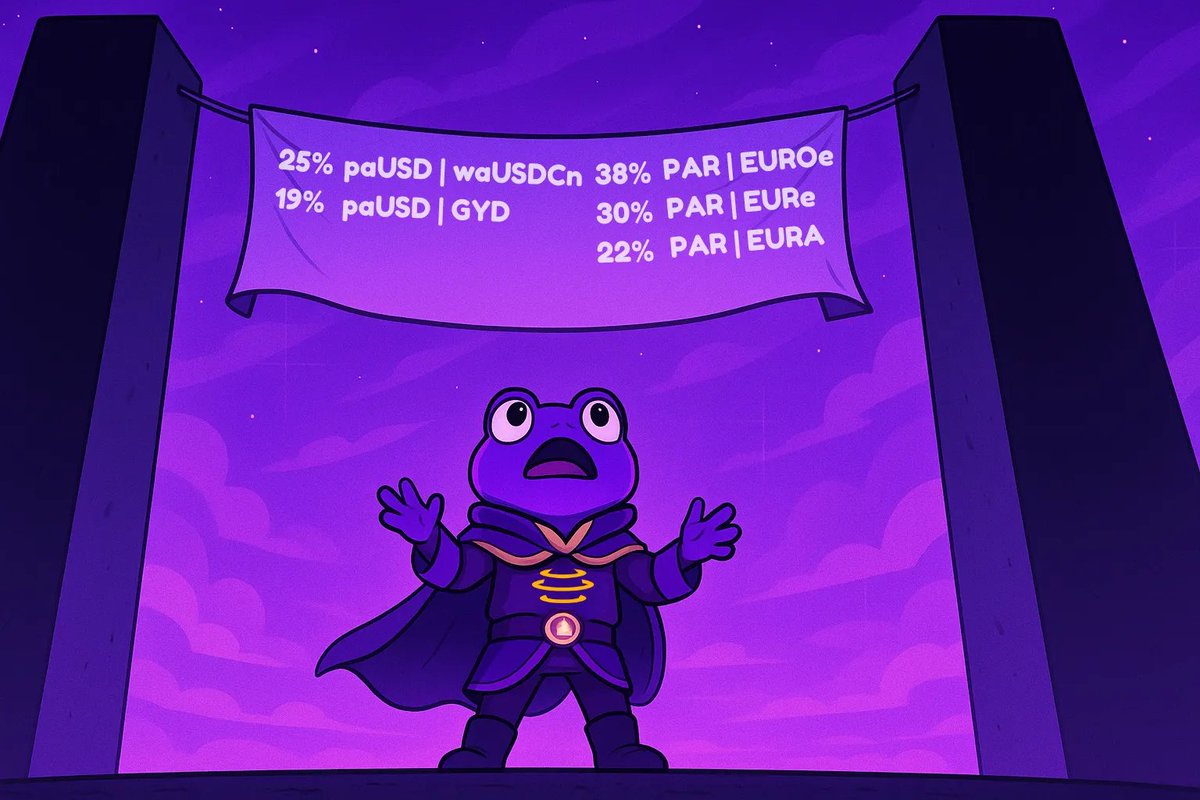

PAR and paUSD pools on Aura benefit from Parallel Protocol’s significant vlAURA holdings. By directing emissions to their own pools, they turn these Euro and USD stables into some of the most attractive LP pairs in DeFi. app.Aura.finance

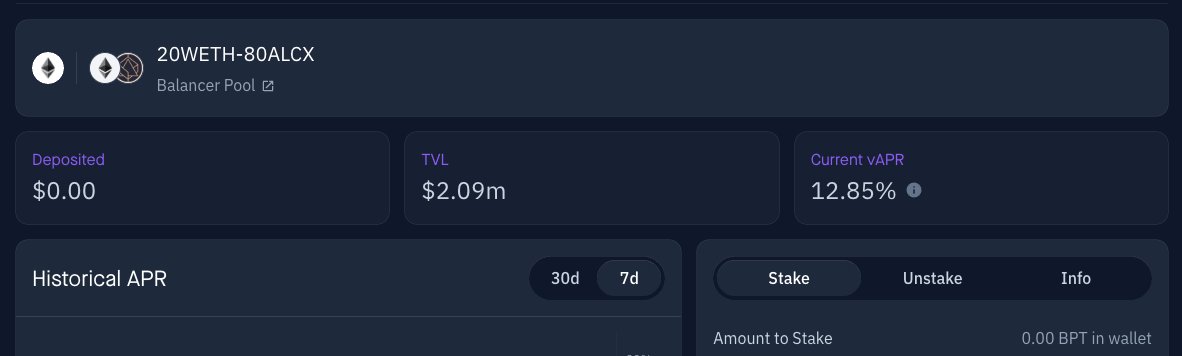

I am once again asking you to put your ETH to work on Aura. wstETH Lido rETH Rocket Pool sfrxETH Frax Finance ¤⛓️¤ Three top LSTs, one Mainnet pool, earning 11% vAPR. 🔗 app.aura.finance/#/1/pool/139

When it was clear Ethereum was the future, but gas was still 1 gwei… your father and I LP’d in the rETH | wstETH | sfrxETH pool on Aura at 12% vAPR. Lido x Rocket Pool x Frax Finance ¤⛓️¤ ETH: app.aura.finance/#/1/pool/139 Optimism: app.aura.finance/#/10/pool/30

What’s ahead for Balancer? 👀 We had a quick chat with Fábio Mendes right after his talk at Blockchain.Rio to hear his thoughts on the event, the LATAM DeFi ecosystem, and to get a sneak peek about the future 👀 Check out the interview 👇

Two Stables Labs pools are delivering double-digit yields on @Arbitrum: sUSDX | USDX — 21% vAPR sUSDX | USDX | USDT — 12% vAPR $USDX is a delta-neutral synthetic USD, while $sUSDX is the yield-bearing staked version. app.aura.finance/#/42161/pool/93 app.aura.finance/#/42161/pool/1…