Artur Sepp: Systematic Quant Trend/Vol/Rates/Macro

@artursepp

All views systematic artursepp.com/blog/. Quant of the Year by Risk Magazine: risk.net/awards/7958305…

ID: 2847947369

https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=1229200 28-10-2014 09:38:37

3,3K Tweet

9,9K Takipçi

366 Takip Edilen

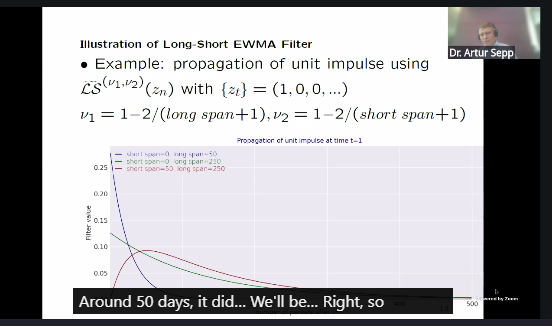

Join my online talk if interested to learn about "hard-quant" volatility modelling: Friday 18th Oct at 12.00 noon CT / 18.00 UK time cse.umn.edu/mcfam/mcfam-se… (just click the zoom link) I will focus on practical aspects of applying log-normal SV model worldscientific.com/doi/epdf/10.11…

Interview with CFM: In terms of alpha, with longer term signals, although you spend a lot of time trying to avoid the in-sample bias, it’s extremely difficult. We had models which we thought were well designed that we had to turn off because they were not globaltrading.net/powered-by-res…

Very interesting paper on problems with factor timing. Generally, these problems transfer to any timing strats including (dynamic) regime-conditioning. I do not find that any timing or regime models work well out-of-sample. Any thoughts? Rob Carver papers.ssrn.com/sol3/papers.cf…

A great book to turn your holiday into a self-study workshop! Gappy (Giuseppe Paleologo) would you have something like a Q&A forum, if possible to raise some follow-up questions and comments?

🏆 Honored to be a Quant Strats Hot 10 finalist! If my research work has resonated with you and added value to your work, I'd be grateful for your vote: docs.google.com/forms/d/e/1FAI… Looking forward to connecting at Quant Strats conference in London on 14-15 October!