Zee

@zli46

: )

ID: 2234093629

07-12-2013 06:45:21

167 Tweet

2 Takipçi

164 Takip Edilen

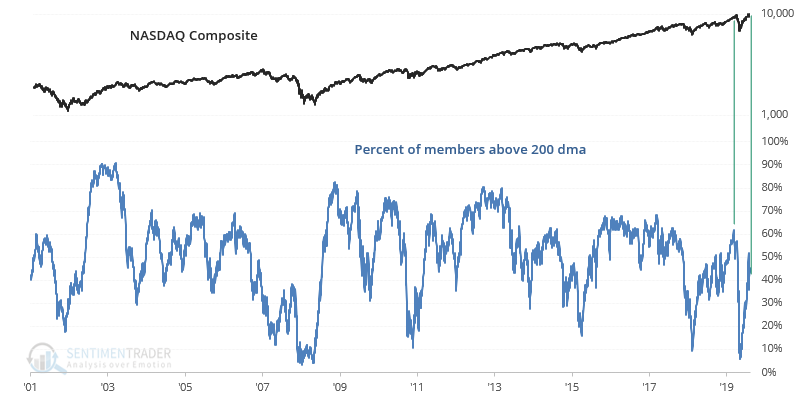

SentimenTrader Markets function has been hijacked by central banks and sense has long since left the building. None of the old rules work anymore. Dominated by negative real rates, relentless BS expansion, endless stimulus. MMT experiment and pre election manipulation

I like this blurb from Phil Galfond's latest newsletter. It is about poker but obviously applies to trading, too. You Will Eventually Run Worse Than You Ever Thought Possible This isn’t exactly advice, but more of a warning that has stuck with me. About 19 years ago, when I