Investor Relations Service

@theanalystng

News | Data | Analysis | Research | Analytics from the Nigerian Financial Markets. Subscribe via proshare.co/Home/Individua…

ID: 800819102

https://proshare.co 03-09-2012 17:15:54

22,22K Tweet

30,30K Takipçi

32 Takip Edilen

.Transcorp Power Plc maintains growth momentum in 9M 2025, with PAT jumping 17% to N68.4 billion and EPS improving to N9.12, supported by a 38% revenue expansion and reduced debt levels. However, outstanding receivables from power off-takers continue to strain cash flows in

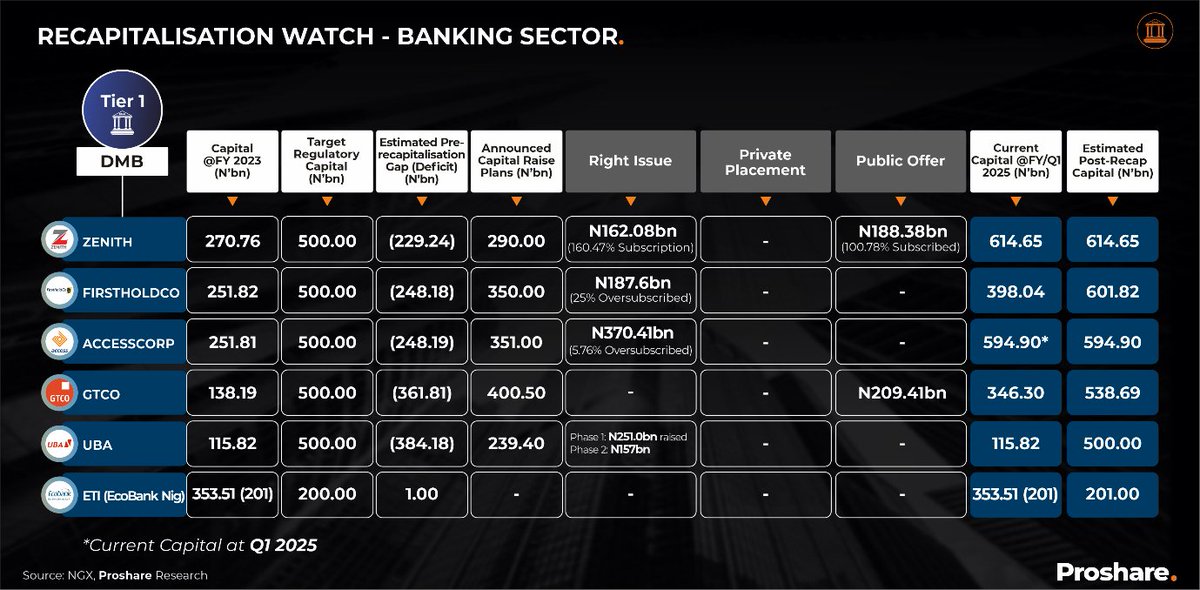

Banks Recapitalization Watch for the Week Ended October 16, 2025 The Central Bank of Nigeria’s (Central Bank of Nigeria) ongoing recapitalisation drive continues to reshape the banking landscape, with several banks yet to meet the minimum capital requirements, exploring various options to